AI Fears Introduce a New Wave of Market Volatility: Here’s How To Combat It

The stock market is experiencing a fresh form of turbulence that's driven by technological disruption fears and rising input costs.

Investor anxiety around specific areas of artificial intelligence (AI) has intensified as concerns grow that AI innovations could render existing software products and services obsolete. This “disruption premium” has prompted selective selling in Real Estate, Financial Advisory, and Transportation Logistics companies.

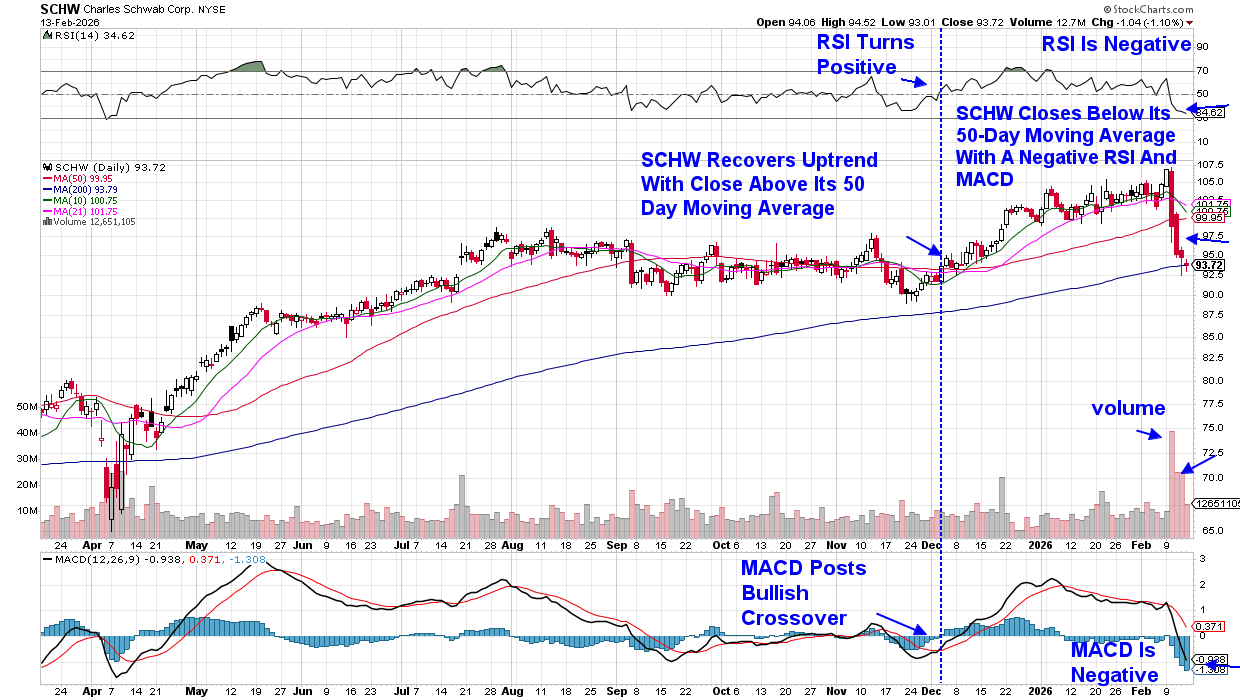

Below is a chart of Charles Schwab (SCHW), which sold off sharply on fears that AI will take over tasks that are currently being completed by advisors. As you’ll see, we’ve highlighted the needed characteristics to signal that the stock has regained its uptrend.

Other areas of AI that are being negatively impacted are memory and chip prices, which have surged 600% over the past several months. This has pressured profit margins for hardware manufacturers.

Investors navigating this environment should know when to exit their positions and look to strategies that go beyond conventional buy-and-hold approaches. Some ways to combat this new type of volatility include:

- Diversification Across Sectors. Spreading investments across defensive sectors, such as Consumer Staples and Utilities, can be a great way to buffer against tech-specific shocks. Both areas have stocks that provide growth as well as dividends after reporting strong earnings results.

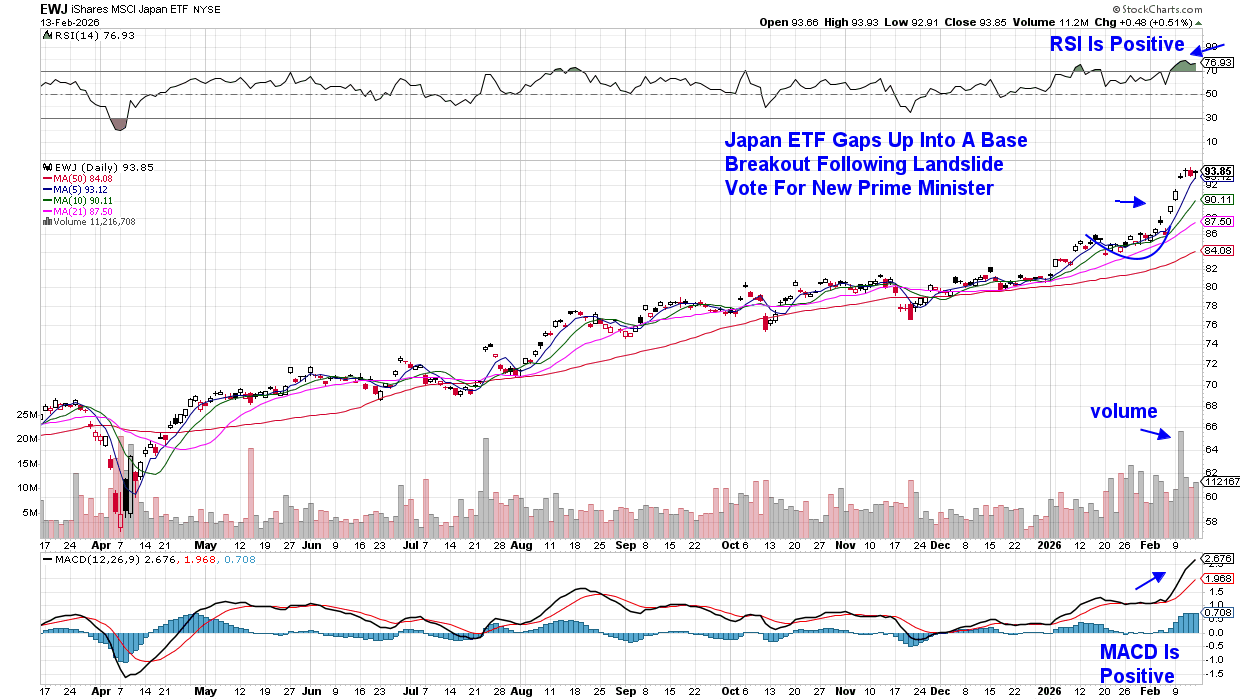

- Hedging with ETFs. Using tools like low-volatility ETFs can help mitigate sudden drawdowns in high-risk segments. It can also enable you to participate in the outperformance taking place in International markets.

Below is a daily chart of iShares MSCI Japan ETF (EWJ), which is in a confirmed uptrend on the heels of a landslide vote for their new Prime Minister's party as she tries to jumpstart the Japanese economy with a massive spending plan. The ETF also provides a 3.7% yield.

While disruption fears dominate headlines, certain firms stand to continue to gain from AI adoption. For those interested in immediate access to those names poised to trade higher, use this link here to access my twice-weekly MEM Edge Report at no cost. You’ll also be alerted to top defensive stocks as well as updates on current market conditions.

Warmly,

Mary Ellen McGonagle

MEM Investment Research