MEMBERS ONLY

Stock Market Is Sending Mixed Signals; Here’s What to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market is sending mixed signals. See what the charts reveal about current trends and why semiconductors may lead the next move....

READ MORE

MEMBERS ONLY

These Tech Stocks Are Close to Triggering Upside Breakouts

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil highlights several tech stocks forming constructive pullbacks that could soon trigger upside breakouts. He also reviews S&P 500 market conditions, key support levels, and how relative strength helps confirm emerging setups....

READ MORE

MEMBERS ONLY

Pullback Playbook: Buy the Dip When Everyone Else Panics

by Tony Zhang,

Chief Strategist, OptionsPlay

Tony Zhang explains how to identify real dip-buying opportunities during market panic using a data-driven pullback filter. Learn a structured framework for recognizing when volatility may be creating a reversal setup....

READ MORE

MEMBERS ONLY

S&P 500 Pullbacks Keep Getting Bought. Why?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

S&P 500 pullbacks keep attracting buyers, even as momentum signals weaken. Join Frank Cappelleri as he explains why dip-buying continues to support the market in spite of rising volatility and mixed technical signals....

READ MORE

MEMBERS ONLY

Tech May Be About to Regain Part of Its Old Leadership Role

by Martin Pring,

President, Pring Research

Though Technology has been among the weakest performers of late, recent action in XLK suggests that the sector has the potential to reclaim a leadership role....

READ MORE

MEMBERS ONLY

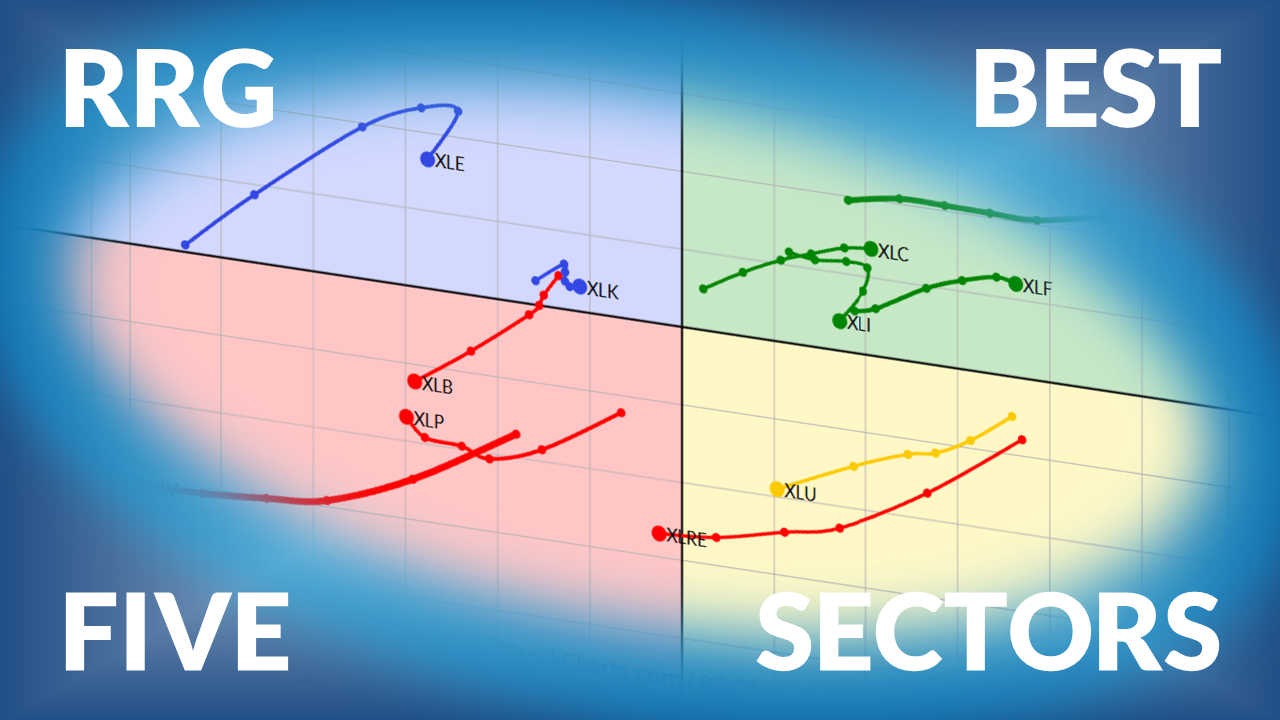

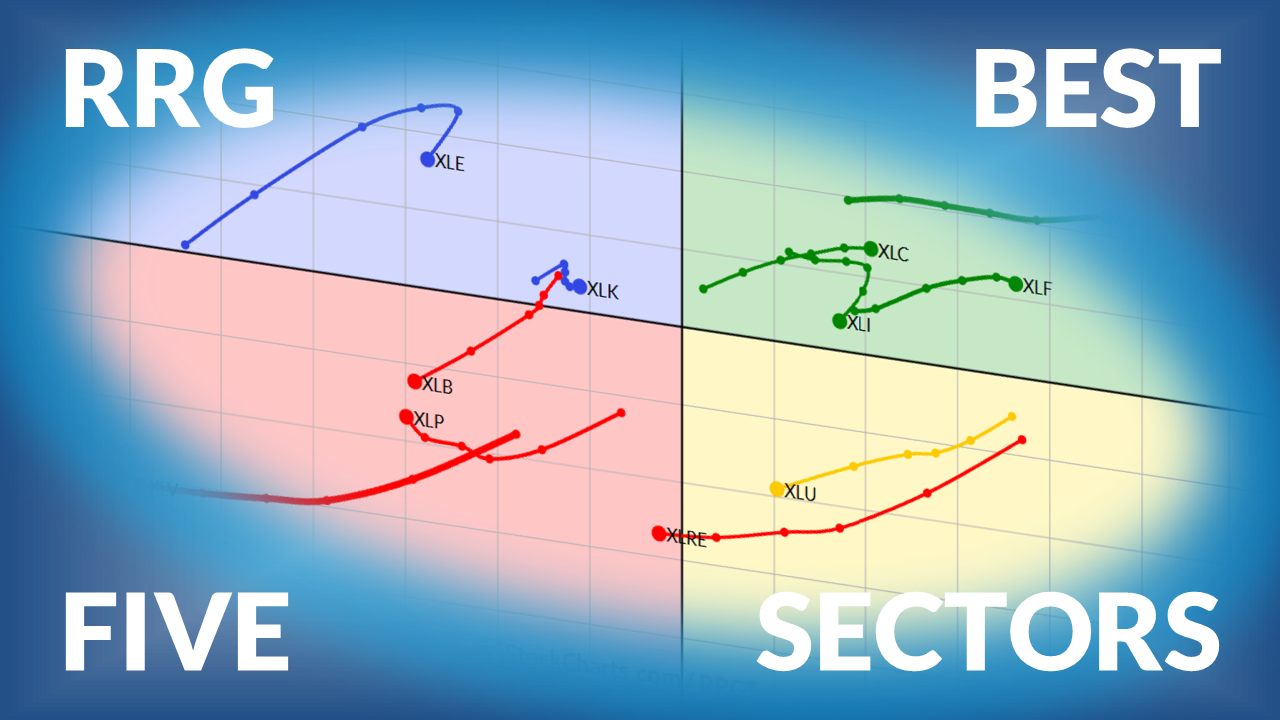

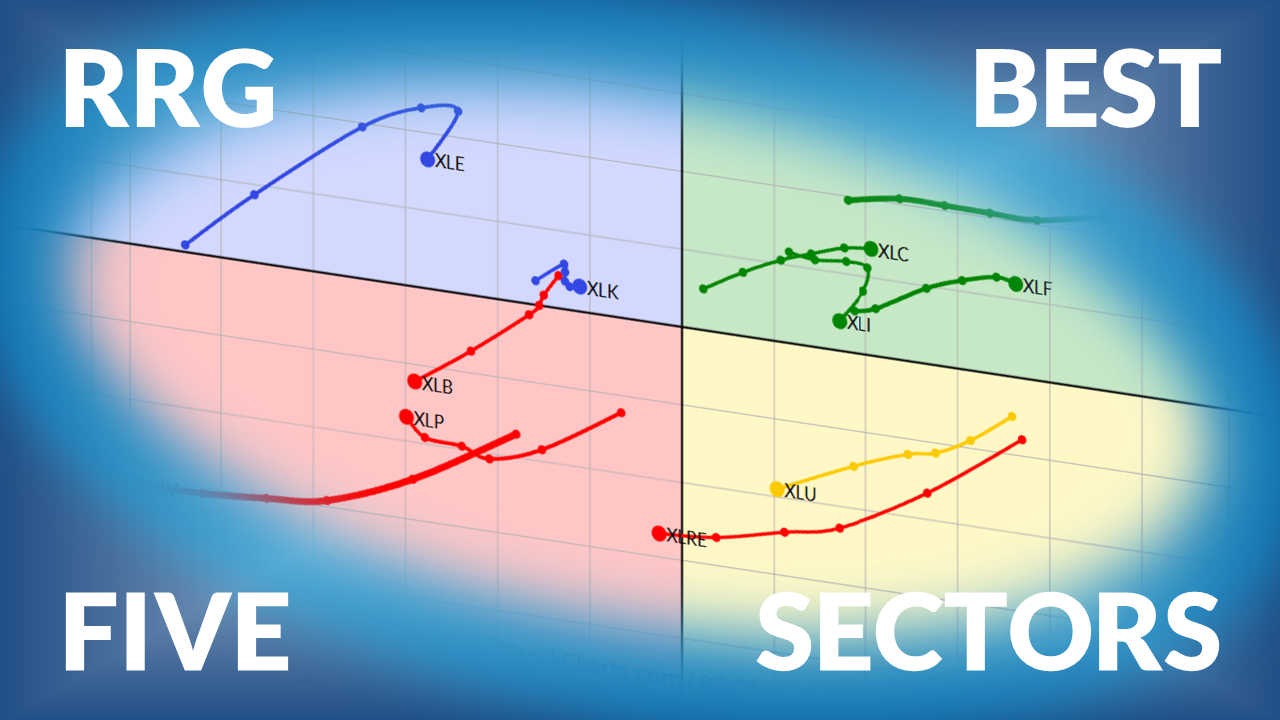

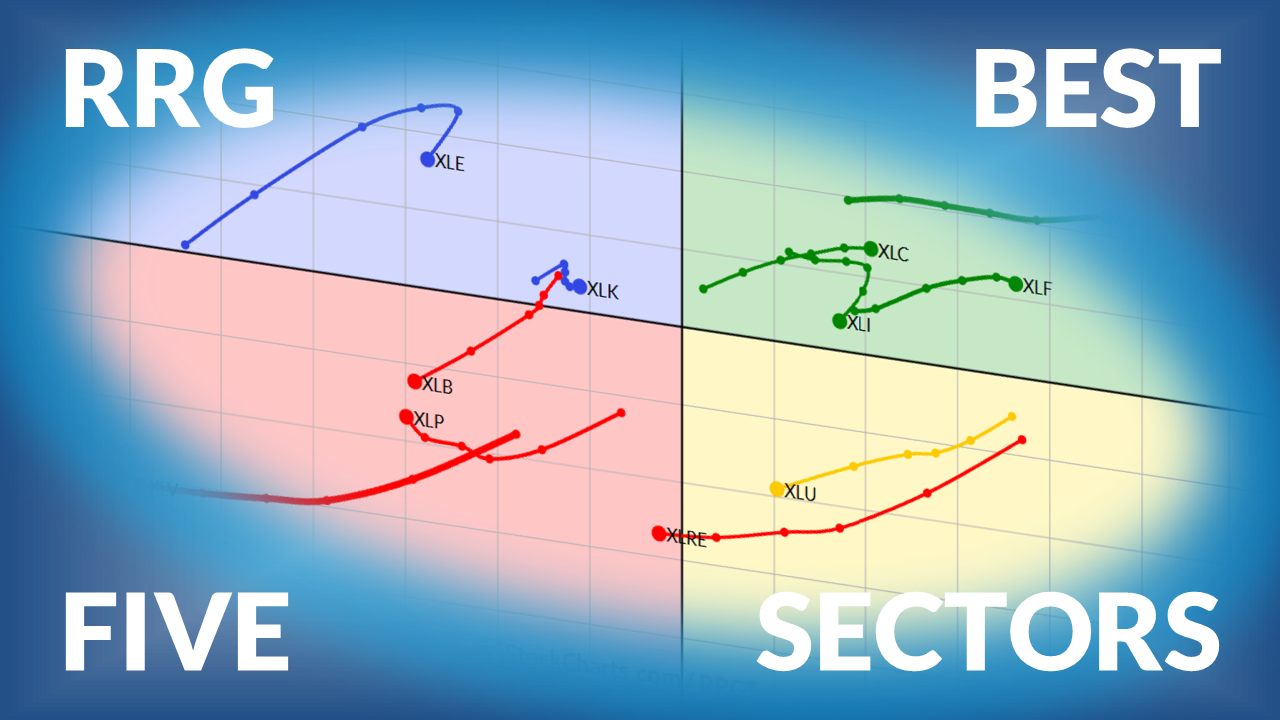

The Best Five Sectors This Week #56

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly sector rotation update based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

$4 Gasoline Ahead? What RBOB Futures and Oil Charts Signal About Pain at the Pump

Oil prices have surged and hit close to $120 per barrel. While gasoline futures indicate a $4 national average, technical signals suggest gasoline prices may be close to a short-term peak....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Rests At Crucial Support; Any Close Below This Level May Invite Incremental Weakness

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty has slipped back and closed exactly at its 100-week moving average, which has historically been a support level. Is it at risk for more downside?...

READ MORE

MEMBERS ONLY

What John Murphy’s Principles Say About Today’s Market

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

It was a challenging week.

Yes, the stock market had to cope with rising geopolitical tensions in the Middle East. But for many in the technical analysis community, the week carried a heavier weight. We learned of the passing of John Murphy, one of the most respected and influential teachers...

READ MORE

MEMBERS ONLY

A Tribute To John Murphy (1942-2026)

As you may have already heard, StockCharts' former Chief Technical Analyst, and a personal friend, passed away last month. It’s hard to put into words what John J. Murphy meant to me, to StockCharts, and to the entire technical analysis community.

John was one of the most influential...

READ MORE

MEMBERS ONLY

Rising Oil Prices, Rising Fear — What the Charts Are Showing Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Rising oil prices and geopolitical tensions pushed volatility higher as the S&P 500 tested key support levels. Mary Ellen McGonagle analyzes what the charts reveal about inflation fears, sector weakness, and the few pockets of strength emerging in this volatile market....

READ MORE

MEMBERS ONLY

A Market in Transition: Navigating Volatility and Rising Macro Risk

by Mary Ellen McGonagle,

President, MEM Investment Research

Rising oil prices are increasing investor fear. We're seeing a broad risk-off shift across institutional portfolios. Here's what you can expect, going forward. ...

READ MORE

MEMBERS ONLY

Market Breadth Breaks Down, but These Stocks Still Look Strong

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Even as market breadth deteriorates and the S&P 500 slips below key support, strong setups still exist. Dave Keller, CMT, highlights Marathon Petroleum, Target, and Palantir — three charts showing breakouts, trend strength, and improving momentum into March....

READ MORE

MEMBERS ONLY

Trend Signals in Agriculture ETF; Wheat and Soybeans Turn Up; A Tribute to John Murphy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Money has moved into agricultural commodities, which offer true diversification in a portfolio. Arthur Hills analyzes the chart of DBA and zeroes in in soybeans, wheat, and livestock....

READ MORE

MEMBERS ONLY

Stocks Wobble as Oil Spikes: What the Charts Are Telling Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market turned volatile as oil prices surged. Here's what the charts are telling investors about the market's next move....

READ MORE

MEMBERS ONLY

Headlines Hit the Market But Buyers Keep Stepping In

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stock market has been rattled by geopolitical headlines, which have driven up crude oil prices. In this video, Tom Bowley shares his observations on what's happening beneath the surface....

READ MORE

MEMBERS ONLY

Two Bullish Inter-Asset Relationships that Could Signal the Next Bear Market

by Martin Pring,

President, Pring Research

Martin Pring analyzes the behavior of two inter-asset relationships, namely Stocks vs. Commodities and Stocks vs. Bonds. Read about his insights and know how to uncover the clues going forward....

READ MORE

MEMBERS ONLY

This RSI Setup Could Be Your First Entry After the Breakout

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil shows how a specific RSI setup can help traders identify the first pullback entry after a breakout. He also reviews S&P 500 volatility, sentiment, QQQ, IWM, and several stock setups....

READ MORE

MEMBERS ONLY

Is Distribution Hitting the S&P 500? What Traders Should Watch Now

As large-cap stocks dip to multi-month lows, some shifts are taking place that investors shouldn't ignore. Two indicators to watch are SPY distribution risk and the U.S. dollar's consolidation. Watch these charts closely....

READ MORE

MEMBERS ONLY

Navigating Global Uncertainty with Coinbase (COIN)

by Tony Zhang,

Chief Strategist, OptionsPlay

Cryptocurrency prices have been under pressure. Here's a bear put spread options setup for a short-term bearish trade in COIN....

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch | March 2026 Breakouts & Inflection Points

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With corporate earnings now behind us, investors can shift their focus to the trends taking shape in Q1.

In this video, David Keller, CMT, shares the top 10 charts he's watching for March 2026, and more importantly, why they matter right now. Dave organizes his charts into three...

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week #55

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on sector rotation for US sectors using Relative Rotation Graphs®....

READ MORE

MEMBERS ONLY

Oil Soars After Iran Strikes: Are More Gains to Come in Energy?

Geopolitical tensions resulted in a surge in oil prices. Here's a technical look at the charts and potential target prices....

READ MORE

MEMBERS ONLY

Has the Bull Run Its Course?

by Bruce Fraser,

Industry-leading "Wyckoffian"

Faced with an extended range-bound structure for QQQ, Bruce Fraser presents a PnF case study as he considers the progress of the bull market uptrend....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Drags Its Resistance Lower, Need To Move Past These Levels To Rise Again

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With Nifty hovering about its 50-week moving average but trading below the 20-week, price action suggests a loss of upside momentum. What could it take to open the door for an up move?...

READ MORE

MEMBERS ONLY

AI Trade Cools — Defensive Rotation Heats Up!

by Mary Ellen McGonagle,

President, MEM Investment Research

In spite of strong Nvidia earnings, the broader AI trade showed fatigue. Mary Ellen McGonagle highlights rotation into healthcare leaders and selective consumer discretionary stocks, but highlights where this market demands careful positioning going forward....

READ MORE

MEMBERS ONLY

Professional Money Managers Are Reducing Risk — Should You?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Beneath this week's market jitters, a subtle but meaningful shift is taking place.

It was another week where headlines, above all, drove the stock market. We had stories about AI disrupting software jobs, rising geopolitical tensions, and whispers of credit problems in the private credit space. Put all...

READ MORE

MEMBERS ONLY

The Stock Market’s Tone Is Changing: Are You Prepared?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market is consolidating, not collapsing. Here's what sector rotation, moving averages, and the VIX reveal about what may come next....

READ MORE

MEMBERS ONLY

When the Rally Stops Working: How to Know If Your AI Stock Is Rolling Over

by Mary Ellen McGonagle,

President, MEM Investment Research

When strong earnings stop driving higher prices, leadership may be shifting. Learn the chart signals that tell you when an AI stock is rolling over....

READ MORE

MEMBERS ONLY

Nervous Investors Should Look Here in March

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Utilities sector is approaching a seasonally strong month. Tom Bowley analyzes this sector and makes a case for why utility stocks may soar in March....

READ MORE

MEMBERS ONLY

Mag 7 Leaders and Laggards; 3 Trend Reversals; Analysis and Key Levels for Apple

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Mag 7 stocks have lost steam since November. However, four of the seven are showing long-term uptrends. Arthur Hill analyzes each of these charts and identifies potential reversal or continuation levels....

READ MORE

MEMBERS ONLY

Tariff Ruling Sparks Rotation — Here’s Where Money Is Moving

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A major Supreme Court tariff ruling has left the S&P 500 pinned, but the bigger story may be where money is moving. Tom Bowley breaks down the rotation into utilities, energy, and materials as Treasury yields fall, explaining why that shift matters....

READ MORE

MEMBERS ONLY

Bitcoin at Key Support — Is an Interim Low Forming?

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil explains why Bitcoin is sitting at key support near a major retracement level and what would confirm an interim low. He also reviews SPY volatility, sentiment, ADX conditions, and several stock setups....

READ MORE

MEMBERS ONLY

March Volatility Ahead? Watching Yields, the Dollar, and the S&P 500

The 10-Year Treasury yield is close to a key support level, the S&P 500 is showing signs of weakening momentum, and the US dollar could see some upside movement. Add these charts to your StockCharts ChartLists as we enter a volatile period....

READ MORE

MEMBERS ONLY

2026 Starts With a Big Rotational Change

by Martin Pring,

President, Pring Research

There has been a shift in market leadership, suggesting that we may be in the later stages of a business cycle. Martin Pring's analysis of these rotations uncovers the scenarios we can expect during this stage....

READ MORE

MEMBERS ONLY

NVDA Earnings Preview: 5 Charts That Could Define the Next Major Move

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With NVIDIA earnings having the potential to trigger a major move, Dave Keller takes a close look at it’s chart across multiple timeframes. From long-term PPO signals to key support and resistance, he explains the critical features that could confirm a breakout or breakdown....

READ MORE

MEMBERS ONLY

JPMorgan Crumbles as AI Disruption Hit Wall Street's Fortress

by Tony Zhang,

Chief Strategist, OptionsPlay

JPM's stock price is showing technical weakness. Here's a bearish options strategy setup with a compelling risk/reward structure. Explore how you can take advantage of it....

READ MORE