The AI Revival: Why Investors Are Circling Back

After a period of volatility and doubt surrounding the AI theme, investors are rotating back into stocks that sold off sharply during the October to November pullback, particularly those that previously surged on expectations for next-generation AI infrastructure growth.

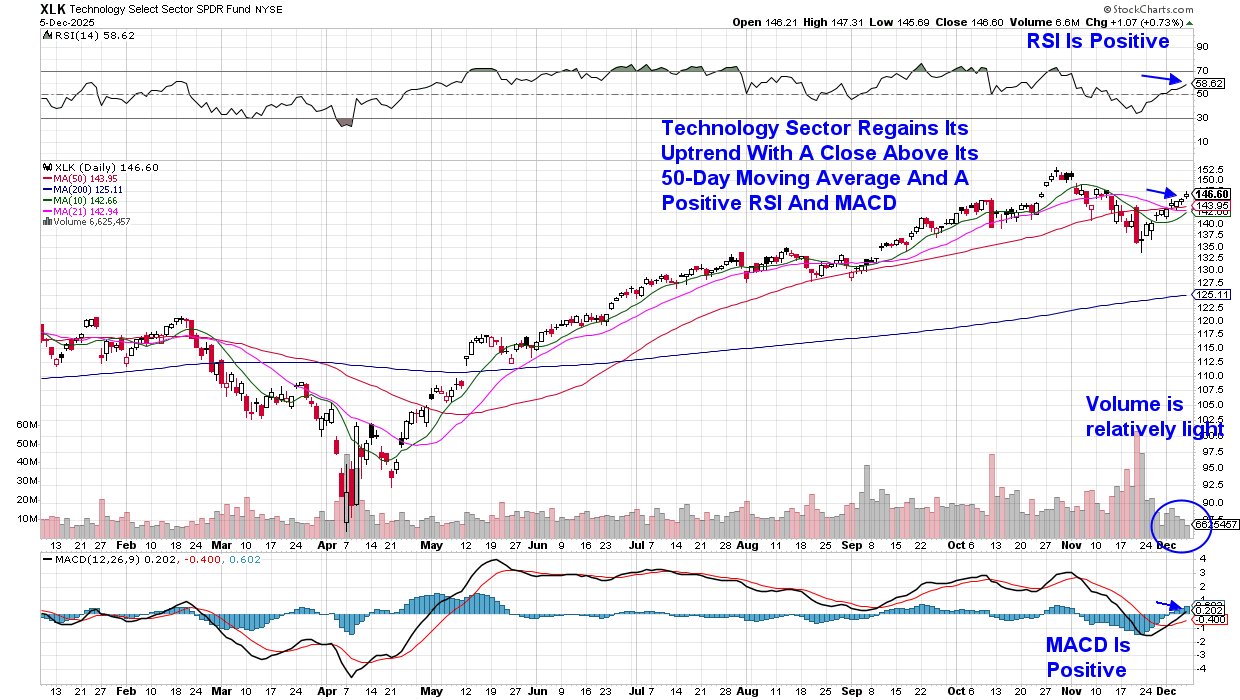

In turn, the Technology sector has regained its uptrend, which should continue to provide a tailwind for the broader markets. (The Tech sector accounts for 30%–35% of the S&P 500 Index.) Last week’s rally took place on relatively light volume, however, ahead of next week’s FOMC meeting.

The rotation back into AI stocks reflects renewed confidence following several large-scale commercial agreements and investments between technology companies. The recent announcements of new releases from major AI models also provided a boost, as competition heats up amid strong AI-related demand.

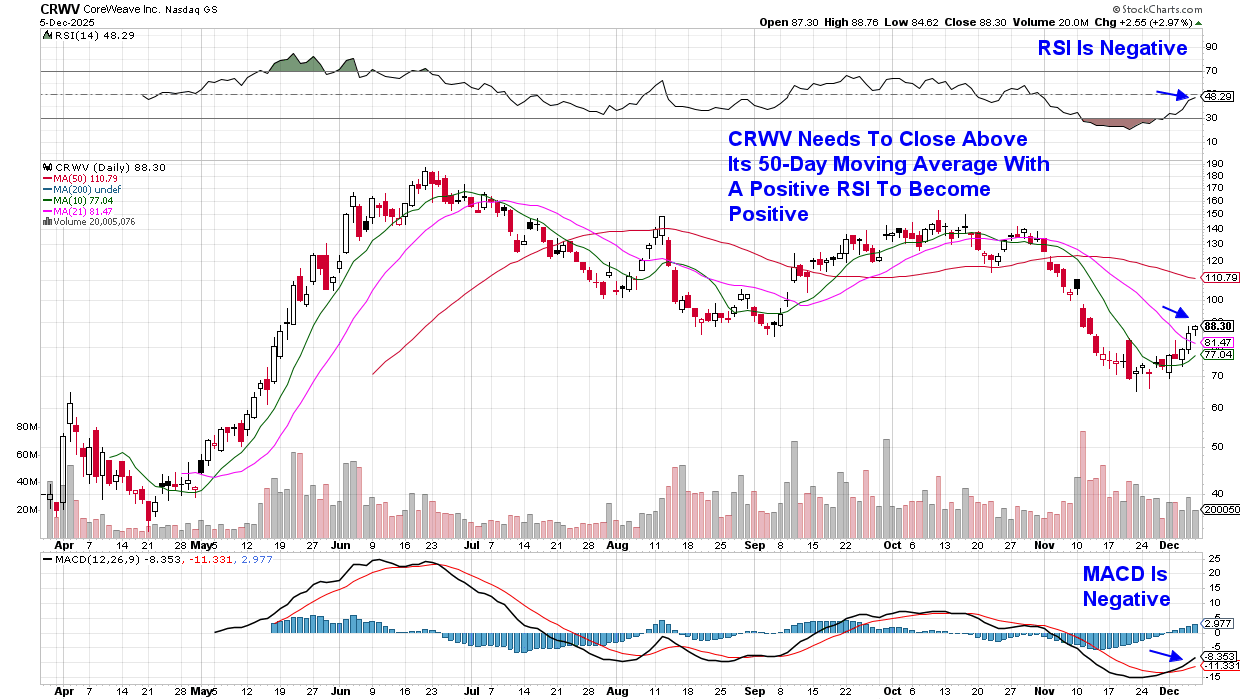

Let’s take a look at several stocks that saw renewed interest last week. Perhaps no stock better exemplifies the explosive growth and volatility of AI infrastructure than CoreWeave (CRWV). The GPU-focused cloud provider doubled from its March IPO price of $40.

The stock has experienced a tumultuous journey, soaring above $187 in summer 2025 before crashing nearly 50% in November, only to rebound strongly in recent days.

CRWV has become one of the year's most controversial AI plays. Simultaneously praised as "The Essential Cloud for AI" and criticized as an over-leveraged bet on uncertain demand, the company’s lack of earnings has kept performance volatile. While the stock posted a gain last week, it has not yet regained its prior uptrend.

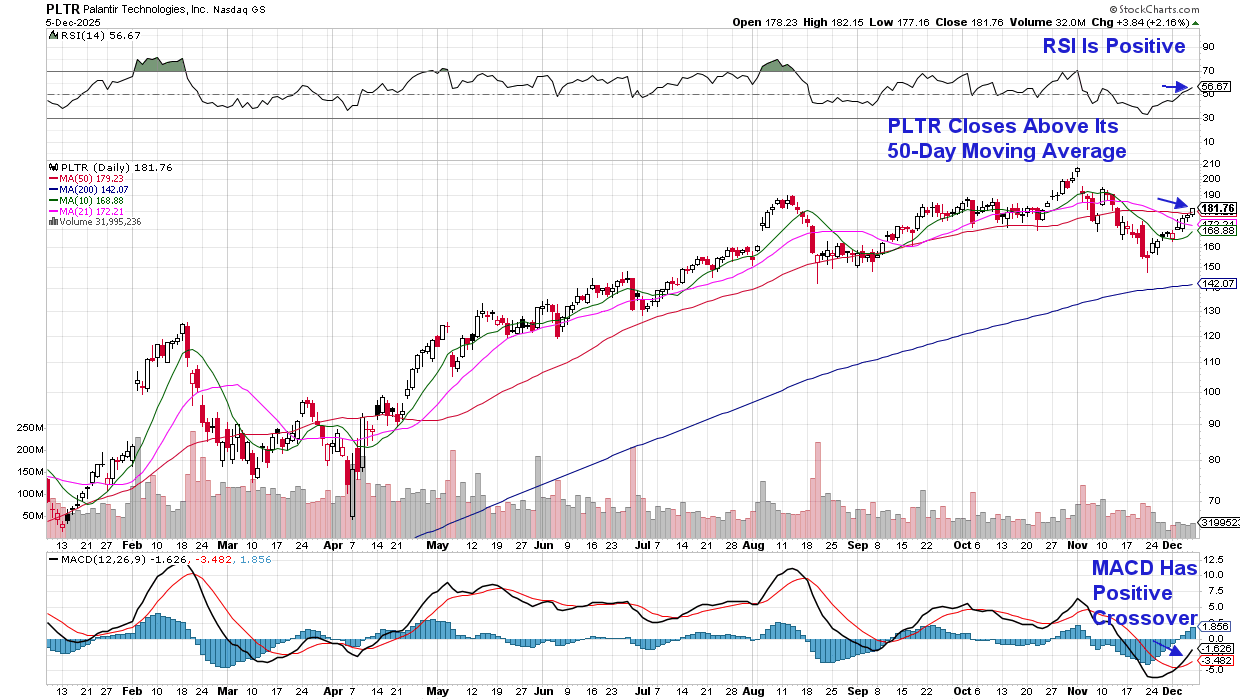

Palantir Technologies (PLTR) focuses on the software side of the AI revolution, and the valuation debate raging across the sector. The stock has been up over 100% year-to-date, driven by a combination of massive government contract wins and the company's Artificial Intelligence Platform (AIP) gaining traction across defense, healthcare, finance, and manufacturing sectors.

On Thursday, Palantir unveiled its partnership with CenterPoint Energy and NVIDIA, a new software platform designed to accelerate AI data center construction and address energy bottlenecks. This initiative puts Palantir at the center of AI infrastructure buildout, potentially opening massive new revenue opportunities.

Valuation concerns pushed PLTR down 16% in November, with last week’s rally putting the stock back into an uptrend. The volume was modest, however, and I’d like to see more conviction to confirm its new uptrend.

My twice weekly MEM Edge Report added Palantir to the Suggested Holdings List in January of 2024, and while it was removed during this year's bear market and again during its November pullback, it has remained on our Long Term Buy And Hold List for the past 2 years. You can use the link above for a no-cost 2-week trial!

NVIDIA (NVDA) continues to dominate the AI chip space. The company is also expanding beyond pure chip sales into networking, software, and services, creating a stickier ecosystem for customers.

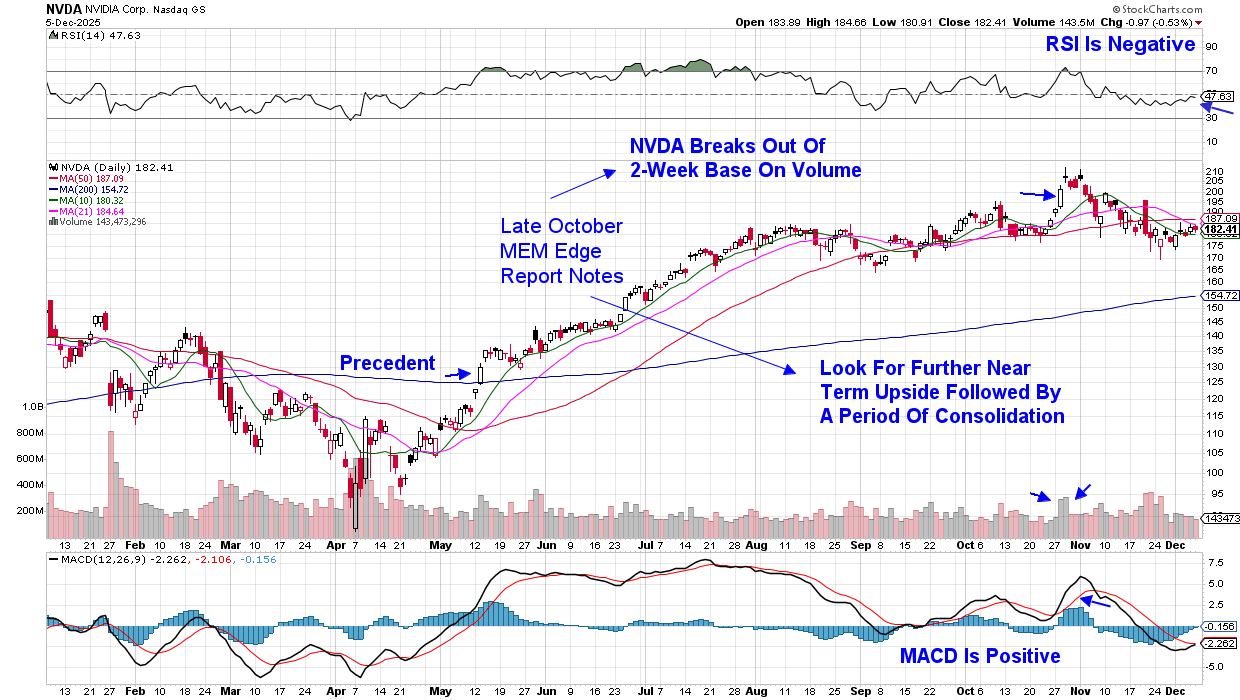

Nvidia’s November pullback of 12.5% masks continued fundamental strength. In the marked-up chart of NVDA below, I kept my late October notes from our MEM Edge Report. We were on the lookout for a period of consolidation similar to its May into June period; however, when the stock broke below its 50-day moving average, we removed it from our near-term buy-and-hold list.

We’re on the lookout for a downtrend reversal in NVDA, and to be kept up to date on our outlook, use this link here to access my twice-weekly report at no charge.

As 2025 draws to a close, the AI stock rally shows signs of maturation rather than exhaustion. The December "Santa Claus rally" period historically favors risk assets, and I urge you to use the links above to be alerted to stocks poised to outpace the broader markets.

Next week’s FOMC meeting will surely impact the markets, and you will need to keep that in mind before adding to any positions heavily.

Warmly,

Mary Ellen McGonagle

MEM Investment Research