Charts Worth Watching

- Charts Worth Watching: AMAT, BMY, BRK.A, CB, HOG, NBR, NSM, PII, PTEN

- Link to today's video.

- The next update will be Friday (July 17) by 7AM ET.

*****************************************************************

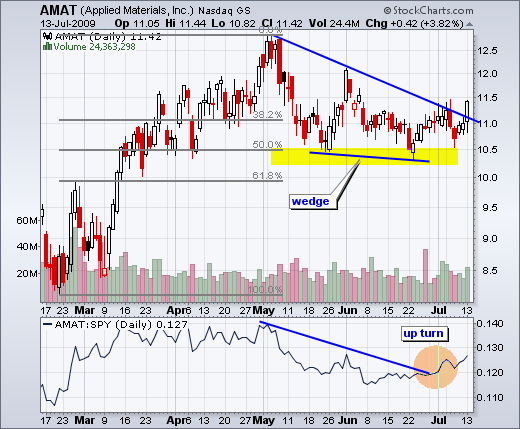

Applied Materials (AMAT) broke trendline resistance with good volume.

*****************************************************************

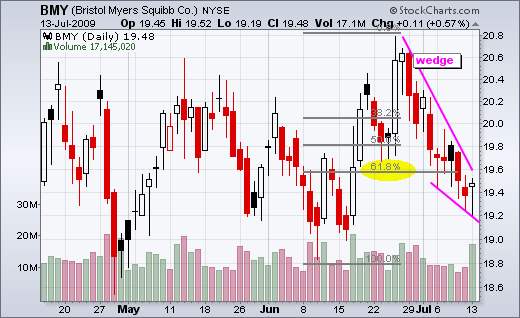

Bristol Meyers (BMY) firms near key retracement. Volume also surged as the stock recovered from early weakness to close strong. Look for follow through on good volume.

*****************************************************************

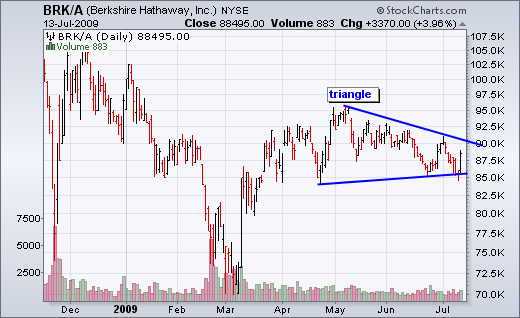

Berkshire Hathaway (BRK/A) surged off triangle support. Buffet's investment in Goldman Sachs appears to be paying off handsomely. Perhaps this will trigger a breakout in his stock.

*****************************************************************

The Cheesecake Factory (CAKE) edged higher over the last four days to stave off a support break.

*****************************************************************

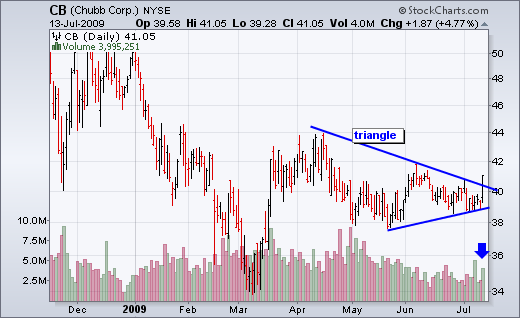

Chubb (CB) broke above triangle resistance with good volume.

*****************************************************************

Harley Davidson (HOG) is finding support in a familiar place.

*****************************************************************

Nabors Industries (NBR) is finding support near broken resistance. Also notice that the stock bounced on good volume in early July.

*****************************************************************

It's time for truth or consequences as National Semiconductor (NSM) tests support from broken resistance.

*****************************************************************

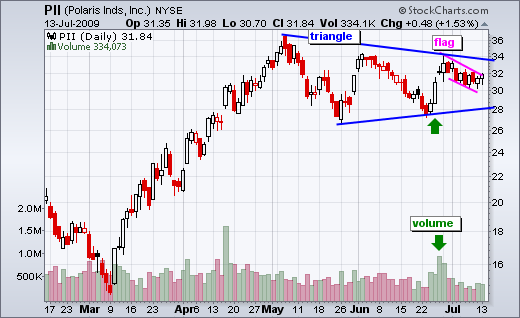

Polaris Industries (PII) surged with good volume in late June and then formed a bull flag in early July.

*****************************************************************

Patterson Energy (PTEN) is attracting lots of volume as it surges off support around 11.5.