There go small-caps

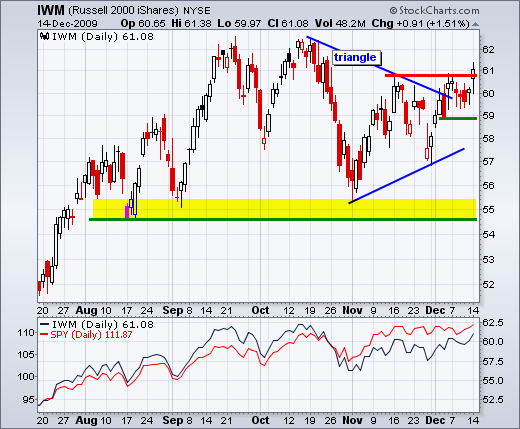

I first wrote about the Russell 2000 ETF (IWM) and the January effect on December 1st. To recap: the January effect is the historical tendency for small-caps to outperform large-caps from mid December to end January. IWM was firming in the 57-58 area on December 1st and I drew a tentative trendline extending up from the early November low. IWM subsequently surged in early December and broke above its mid November high yesterday. IWM appears headed for a resistance challenge around 62-63. A break below 58.9 would call for a reassessment.

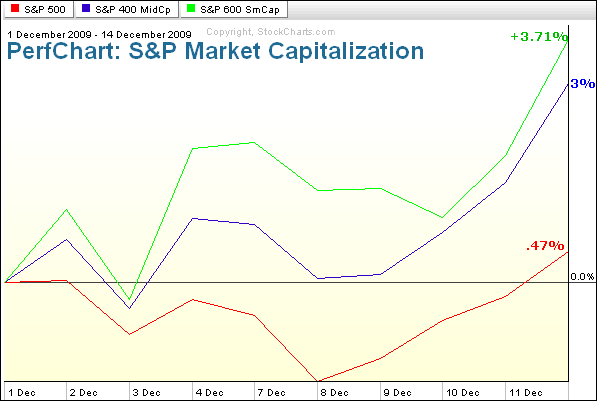

Even though IWM remains below its Sep-Oct highs, the ETF and small-caps are showing relative strength in December. The S&P Market Capitalization Perfchart shows the S&P 600 SmallCap Index ($SML) easily outperforming the S&P 500 since December 1st. Midcaps are also outperforming handily. It appears that the January effect started even earlier this year. This means it could end earlier too.

*****************************************************************