SPY challenges January high

There was another challenge to the January high as the S&P 500 ETF (SPY) gained around 1/2% to close at 114.97. For all intents and purposes, SPY has reached the January high. However, it has yet to exceed the January high. As noted in Wednesday's market message, the Nasdaq, Nasdaq 100, Russell 2000, S&P 400 Midcap Index and Dow Transports have exceeded their January highs, but the S&P 500, Dow Industrials and NY Composite have not. So far, the majority (5 of 8) have exceeded their January highs, which makes this stat more bullish than bearish. However, there is a nagging concern with this "non-confirmation" from the S&P 500, Dow Industrials and NY Composite. With SPY trading at its January high and short-term overbought, top pickers are no doubt licking their chops. The reward-to-risk ratio for short positions is quite good with risk just above 115 and first reward potential to support around 112-113. Funny how the reward-to-risk ratio for short positions often looks good during an uptrend. It works as a bear trap of sorts. Sure, picking a top will work at some point, it is just a question of picking the right point. Be prepared for a few failures before getting it right.

Technically, there is not much change on the daily chart. Last week's gap above 113 is still holding as SPY has yet to buckle under pressure. The blue upswing line and last week's three day consolidation mark support at 112. RSI is near 70 and almost officially overbought. On the 60-minute chart, this week's advance looks like a rising channel. A break below 114 would be the first, and I do mean absolute first, sign of weakness.

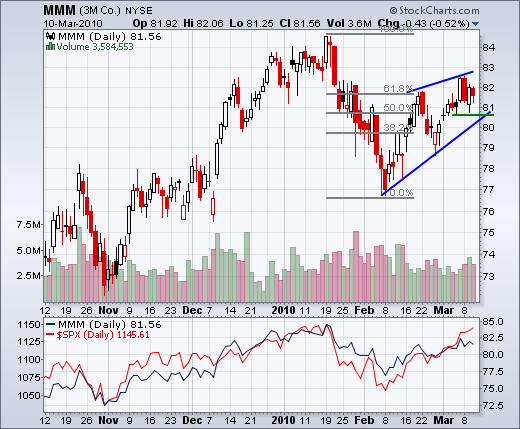

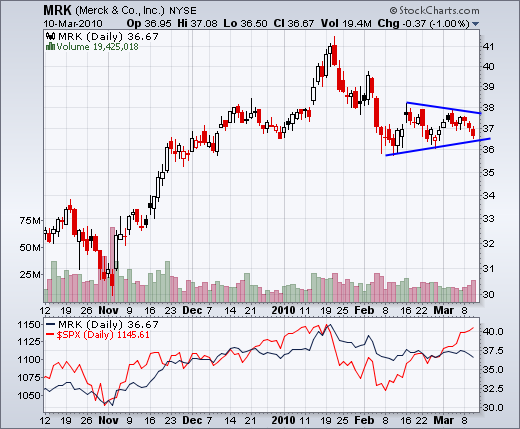

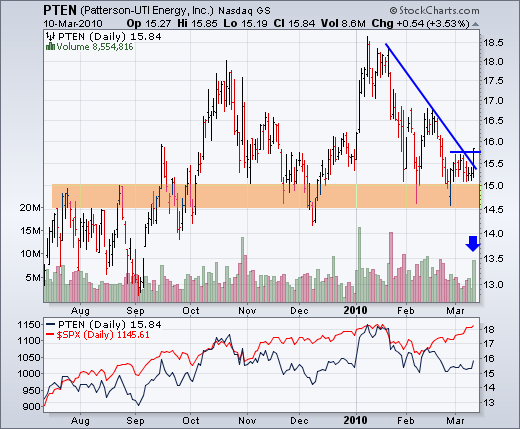

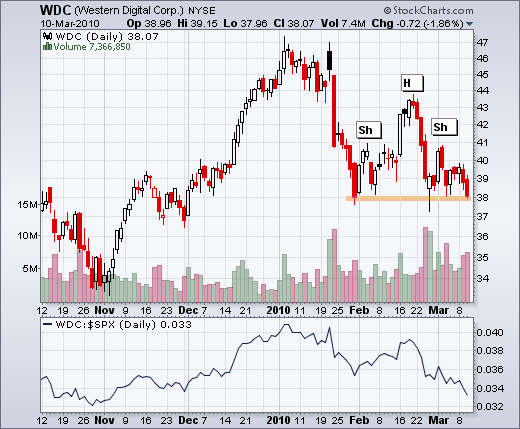

Charts of interest: DOW, FLEX, MHP, MMM, MRK, PTEN, WDC