SPY stalls with indecisive candlestick

Technically, there is a case for a medium-term uptrend. SPY recorded a 52-week high in January and the February reaction low is above the early November reaction low. Also, consider that the Russell 2000 ETF (IWM) and S&P 400 MidCap ETF (MDY) are already back near their January highs. This is something to consider. Here is the big question? Was the January-February decline just a sharp pullback within a bigger uptrend or was this deep enough to signal the start of a medium-term downtrend? I thought it was deep enough to start a medium-term downtrend, which makes the current advance a counter-trend move that should peak at or below the January high. Relative strength in small-caps, mid-caps and some techs has me second guessing right now. We may, however, have our answer this week. A strong finish this week would be quite bullish. Conversely, a sharp decline in the next few days would forge a lower high in SPY and be quite negative. I am marking key support at last week's low (109) and a break below this level would reverse the four week advance. There are some charts of interest after the "continue reading" jump.

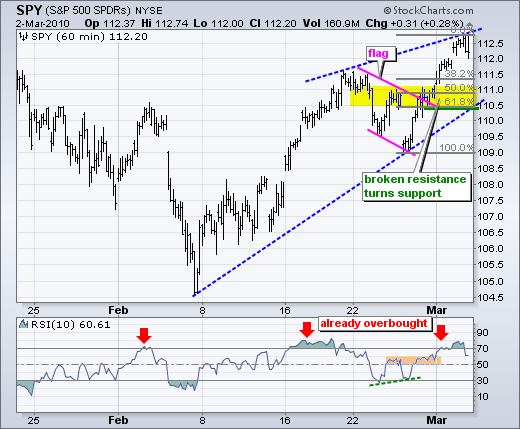

The 60-minute chart focuses on a shorter timeframe and tighter support level. SPY broke flag resistance and this resistance break turns into a support zone. Also notice that a 50-62% retracement of the 4-day surge would extend to the 110.5-111 area. Support at 110.5 is confirmed with the early February trendline. A break below 110.5 would be the first warning sign. Friday is the employment report, but Mr Market sometimes makes his big move a day or two before the actual report. This happened last month. Note that stocks fell sharply on Thursday, February 4th, and then rebounded with a selling climax on Friday, February 5th. Pre-emptive strikes could occur because we get ADP Employment today and Initial Claims on Thursday.

Wednesday-08:15 ADP Employment

Wednesday-10:00 ISM Services

Wednesday-10:30 Crude Inventories

Wednesday-14:00 Fed's Beige Book

Thursday-08:30 Initial Claims

Thursday-08:30 Continuing Claims

Thursday-10:00 Factory Orders

Thursday-10:00 Pending Home Sales

Friday-08:30 Employment Report

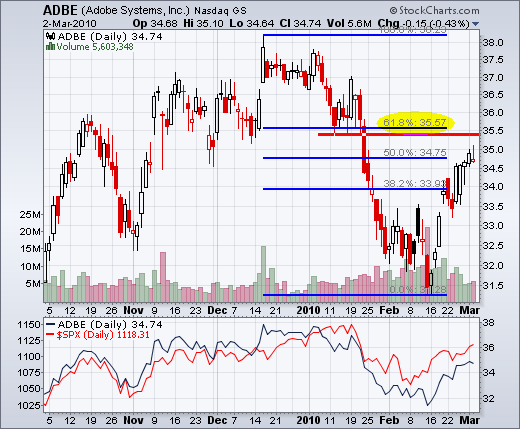

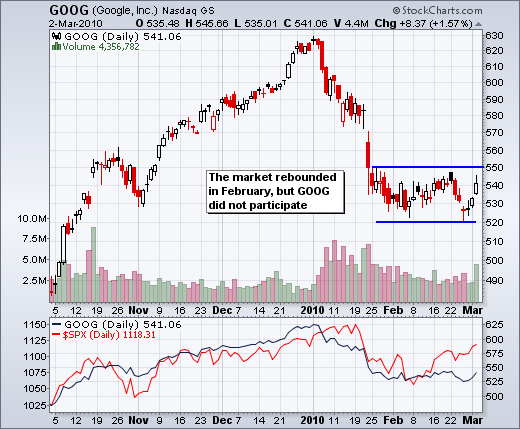

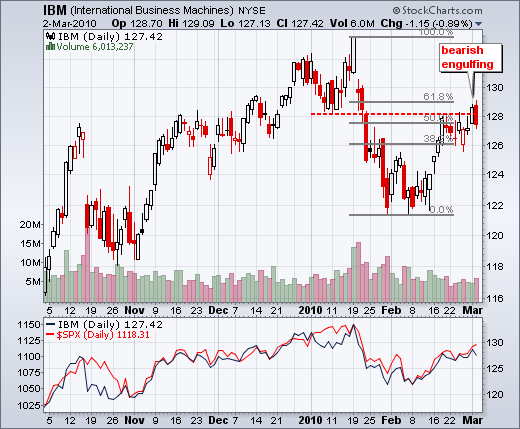

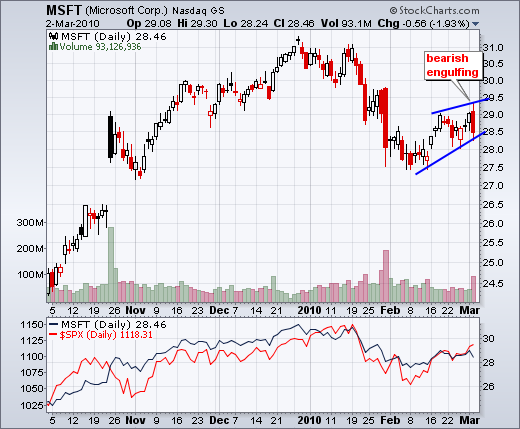

Charts of Interest: ADBE, GERN, GOOG, IBM, IP and MSFT