Bigger Uptrend Continues to Trump Short-Term Negatives

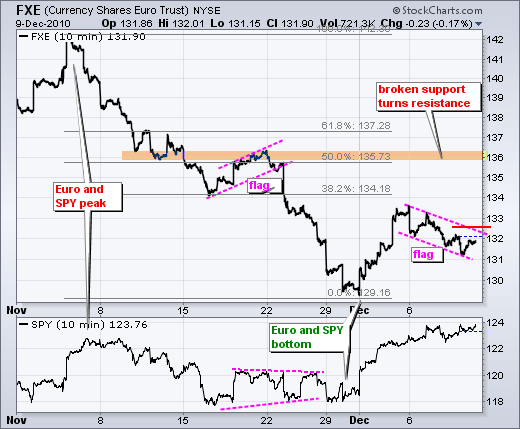

I am still watching the falling flag in the Euro. A falling Euro is potentially negative for stocks and the short-term trend is clearly down as long as the flag falls. On the Euro Currency Trust (FXE) chart, a move above 132.5 would break flag resistance and provide the first signal that last week's advance is continuing. Such a breakout could be positive for stocks.

There is not much change on the daily chart. It looks like the bigger uptrend is trumping the short-term negatives. SPY began the week short-term overbought and near resistance from the November high. The ETF also formed a narrow range day on Monday and moved lower after Tuesday's big gap. Despite these negatives, the ETF managed to close higher the last three days, hence three black candlesticks. The finance sector and banking group continue to lead and this is positive too.

On the 60-minute chart, SPY filled the gap with a decline after Tuesday's strong open, but held support in the 122-122.5 zone. I will mark first support at 122. The bulls are in good shape as long as this level holds. Also watch RSI support in the 40-50 zone.

Key Economic Reports:

Fri - Dec 10 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday in separate post.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.