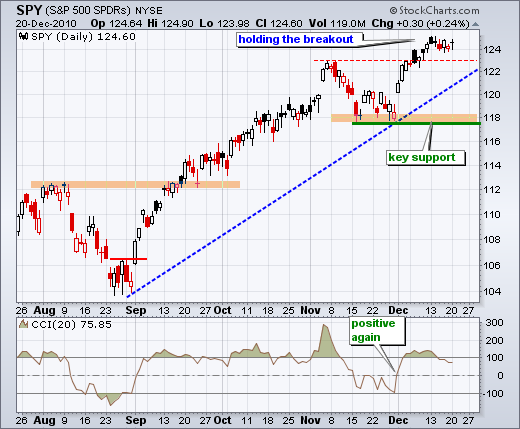

SPY Continues Consolidation Above Resistance

The song remains the same. Despite overly bullish sentiment and waning breadth, SPY continues to hold its gains and consolidate above the resistance break. Once again, price action or "the tape" rules the roost here. Chartists use all kinds of tools including momentum indicators, sentiment measures, breadth readings and volume. However, only one thing really counts when all is said and done: price action. This is also known as the trend or the tape. A simple look at the daily chart shows SPY breaking its November high and holding this breakout. SPY may be overbought and ripe for a pullback, but there is simply no evidence of price weakness or selling pressure.

There is no change on the 60-minute chart, SPY appears to have gapped down on Friday, but this is due to a distribution (ex-dividend). The ETF opened around 124 and then bounced to form a higher low. Overall, a pennant consolidation is taking shape with support around 123.5 and resistance around 125. A break of these levels will provide the next short-term signal. While a support break would be negative, I still see a bigger support zone around 122-123. This, combined with bullish seasonals, could limit the downside.

Key Economic Reports:

Wed - Dec 22 - 07:00 - MBA Mortgage Applications

Wed - Dec 22 - 08:30 - GDP Estimate

Wed - Dec 22 - 10:00 - Existing Home Sales

Wed - Dec 22 - 10:30 - Crude Inventories

Thu - Dec 23 - 08:30 - Personal Income & Spending

Thu - Dec 23 - 08:30 - Durable Orders

Thu - Dec 23 - 08:30 - Initial Claims

Thu - Dec 23 - 09:55 - Michigan Sentiment

Thu - Dec 23 - 10:00 - New Home Sales

Charts of Interest: Tuesday and Thursday in separate post.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.