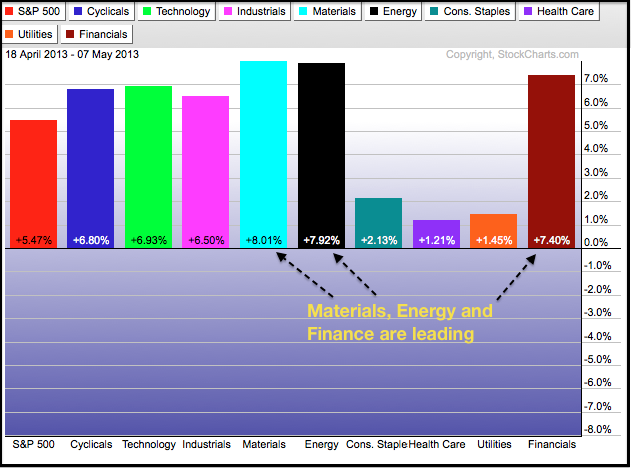

Offensive Sectors Turn Leaders as Defensive Sectors Turn Laggards

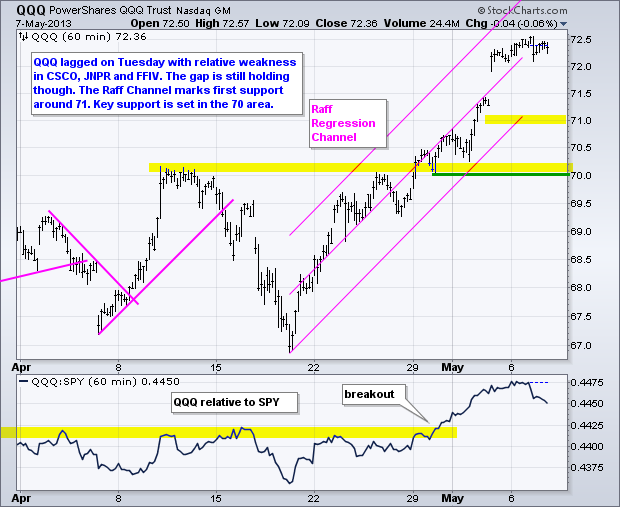

Stocks extended their gains on Tuesday with small-caps and mid-caps leading the way. The Nasdaq 100 ETF (QQQ) ended down and showed some relative weakness though. Techs were weighed down by networking and semis. The Networking iShares (IGN) fell 1.3% and the Semiconductor SPDR (XSD) was down .58% on the day. The broader market got help from the Industrials SPDR (XLI) and the Consumer Discretionary SPDR (XLY), both of which hit new highs. It is tempting to say the market is short-term overbought and ripe for a correction or pullback, but there is simply no evidence of selling pressure. Note that the S&P 500 is up over 5% in 13 trading days. Six of the nine sectors are up over 6%. The three defensive sectors are up the least and lagging the broader market. The shift to the offensive end of the market could put some legs in this rally.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Tue - May 07 - 15:00 - Consumer Credit

Wed - May 08 - 07:00 - MBA Mortgage Index

Wed - May 08 - 10:30 - Oil Inventories

Thu - May 09 - 08:30 - Jobless Claims

Thu - May 09 - 10:30 - Natural Gas Inventories

Fri - May 10 - 08:00 - TGIF

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.