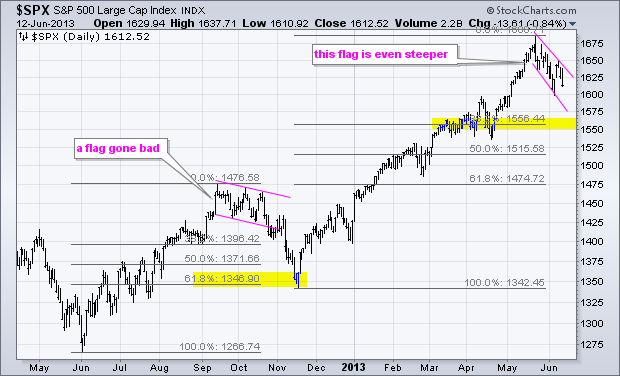

Setting a Fibonacci and Support Target for the S&P 500 $SPX

The Asian rout continues as the Shanghai Composite ($SSEC) caught up with a 2.83% decline on Thursday. The Hang Seng Index ($HSI) fell another 2.3% and the Nikkei 225 ($NIKK) plunged over 6%. European stocks are also down with the major indices falling around 1% in early trading (4AM ET). The German DAX Index ($DAX) was down over 1.5%. Perhaps European stocks, and German exporters, are smarting from a rising Euro, which is up almost 4% since mid May. In any case, US stocks are in short-term downtrends and look vulnerable to further weakness. Even though this is still just a correction within a bigger uptrend, the current decline is the deepest since October. The October decline started as a falling flag and evolved into more as the S&P 500 fell over 8%. An 8% decline from recent highs would extend to the 1555 area. Notice that the 38.2% retracement and March-April lows mark support in this area. The second chart below shows the 7-10 year T-Bond ETF (IEF) stalling on Monday, forming a bullish engulfing on Tuesday and an inverted hammer on Wednesday. Treasuries are setting up for a bounce and this would be negative for stocks. A breakout at 105 in IEF and CCI move into positive territory would be short-term bullish here. Retail sales will be reported before the open and a disappointment would likely exacerbate selling pressure.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Thu - Jun 13 - 08:30 - Jobless Claims

Thu - Jun 13 - 08:30 - Retail Sales

Thu - Jun 13 - 10:00 - Business Inventories

Thu - Jun 13 - 10:30 - Natural Gas Inventories

Fri - Jun 14 - 08:30 - Producer Price Index (PPI)

Fri - Jun 14 - 09:15 - Industrial Production

Fri - Jun 14 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.