SPY, QQQ and IWM Challenge Short-Term Resistance

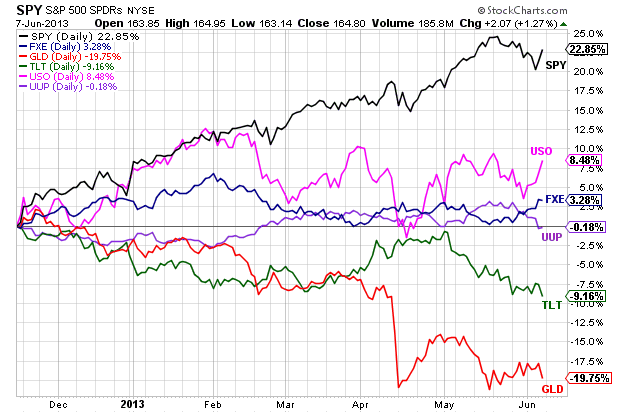

Stocks reacted positively to a rather routine employment report. The Labor department reported a 175,000 increase in non-farm payrolls for May. This is the not-to-hot and not-to-cold version of the jobs report. It is enough to suggest modest economic growth and keep the hopes alive for sustained quantitative easing. Stocks surged with the major index ETFs advancing over 1%. Treasuries plunged with the 20+ Year T-Bond ETF (TLT) falling 1.79% on the day. Overall, stocks fell Monday-Tuesday-Wednesday, and then surged on Thursday-Friday. The net result was positive as the major index ETFs closed with small gains for the week. On the price charts, the major index ETFs remain in 3-4 week consolidations. A little follow through to last week's reversal is needed to break consolidation resistance and signal a continuation higher. The PerfChart below shows stocks (SPY), oil (USO) and the Euro (FXE) leading the way since mid November. Conversely, the Dollar (UUP), Treasuries (TLT) and gold (GLD) are down. These relationships reflect a market that is embracing risk.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Wed - Jun 12 - 07:00 - MBA Mortgage Index

Wed - Jun 12 - 10:30 - Oil Inventories

Thu - Jun 13 - 08:30 - Jobless Claims

Thu - Jun 13 - 08:30 - Retail Sales

Thu - Jun 13 - 10:00 - Business Inventories

Thu - Jun 13 - 10:30 - Natural Gas Inventories

Fri - Jun 14 - 08:30 - Producer Price Index (PPI)

Fri - Jun 14 - 09:15 - Industrial Production

Fri - Jun 14 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.