SPY and IWM Hold Uptrends - UUP Sinks Lower

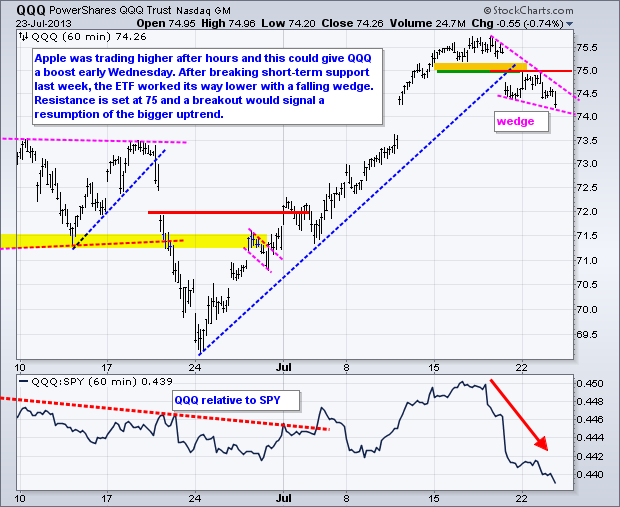

Stocks meandered again on Tuesday with the Dow Industrials SPDR (DIA) closing slightly higher and the S&P 500 ETF (SPY) edging lower. Large techs were under pressure ahead of Apple earnings as QQQ fell around 3/4 of a percent. Apple moved higher after hours and may provide a boost for QQQ. We are, however, still in the midst of a heavy earnings week with a few hundred reports scheduled over the next three days. The sectors were mixed with relatively insignificant moves. Industry groups within the materials sector were stand-out performers again. These industry group ETFs are prone to big swings and remain in downtrends overall. The chart below shows the Metals & Mining SPDR (XME) with eleven swings that were 8% or more over the past year. The pink like is the Zigzag indicator set at 8%. XME is currently up over 15% from its late June low, but still in a downtrend overall. XME has outperformed the broader market this month, but has underperformed the entire year.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Wed - Jul 24 - 07:00 - MBA Mortgage Index

Wed - Jul 24 - 10:00 - New Home Sales

Wed - Jul 24 - 10:30 - Crude Inventories

Thu - Jul 25 - 08:30 - Continuing Claims

Thu - Jul 25 - 08:30 - Durable Orders

Thu - Jul 25 - 10:30 - Natural Gas Inventories

Fri - Jul 26 - 09:55 - Michigan Sentiment - Final

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.