Treasuries Break Down as Dollar Firms Near Key Retracement

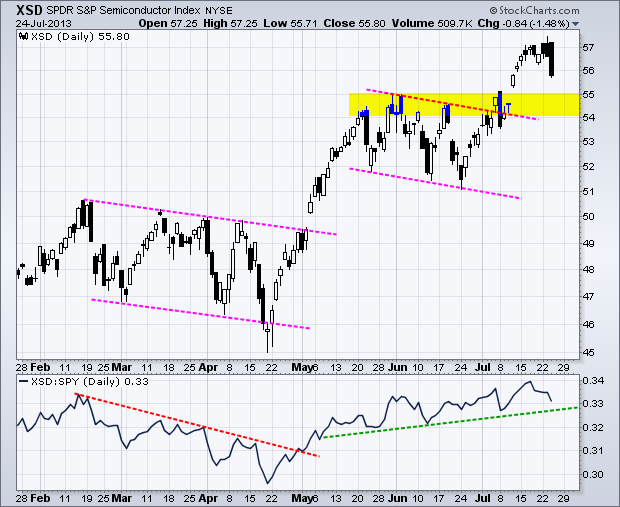

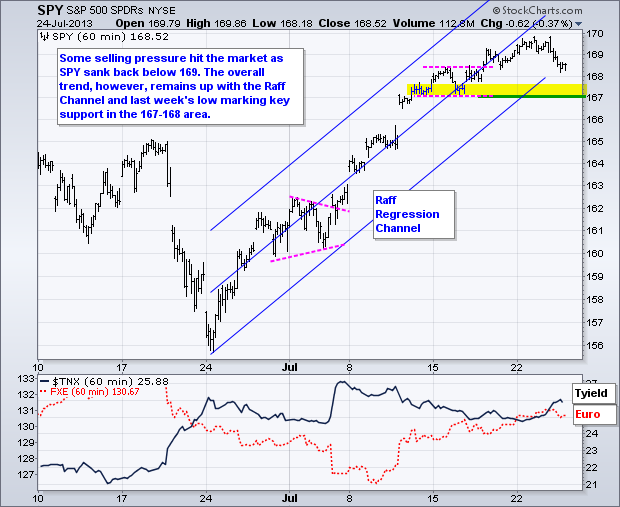

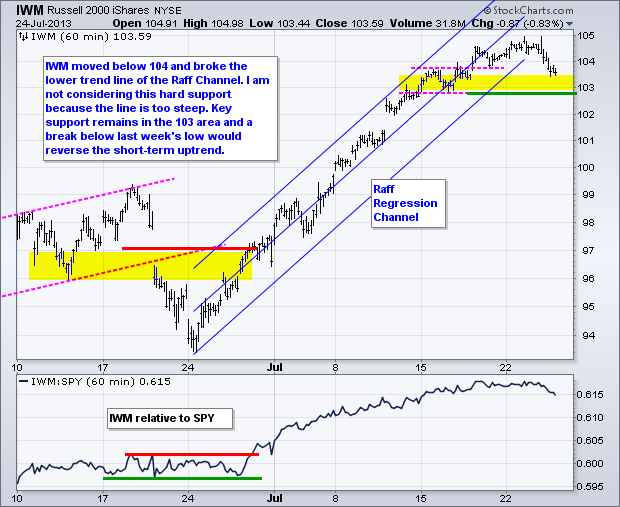

Stocks were mostly lower on Wednesday with small-caps leading the way. The Russell 2000 ETF (IWM) lost around .83% and the S&P 500 ETF (SPY) lost around .37%. Techs were mixed with the Nasdaq 100 ETF (QQQ) adding .32% and the Nasdaq 100 Equal-Weight ETF (QQEW) losing .63%. QQQ was, of course, helped by Apple, which surged after beating on earnings and revenues. Expectations could ramp for Apple as the company hints at a busy fall refresh. The energy, materials and utilities sectors led the market lower. Even though new homes sales beat expectations and hit a five year high, homebuilders were down with the Home Construction iShares (ITB) falling almost 3%. ITB may, however, bounce today because Ryland (RYL) reported strong results after the close. Semiconductor stocks got hit hard as the Semiconductor SPDR (XSD) fell 1.5% and formed a long black candlestick. As with most index, sector and industry group ETFs, the long-term and short-term trends are up for XSD, but the ETF got a little overextended after a 10+ percent surge (51 to 57). Broken resistance in the 54-55 area turns first support.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Thu - Jul 25 - 08:30 - Continuing Claims

Thu - Jul 25 - 08:30 - Durable Orders

Thu - Jul 25 - 10:30 - Natural Gas Inventories

Fri - Jul 26 - 09:55 - Michigan Sentiment - Final

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.