Broad Based Decline Produces 90% Down Day

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

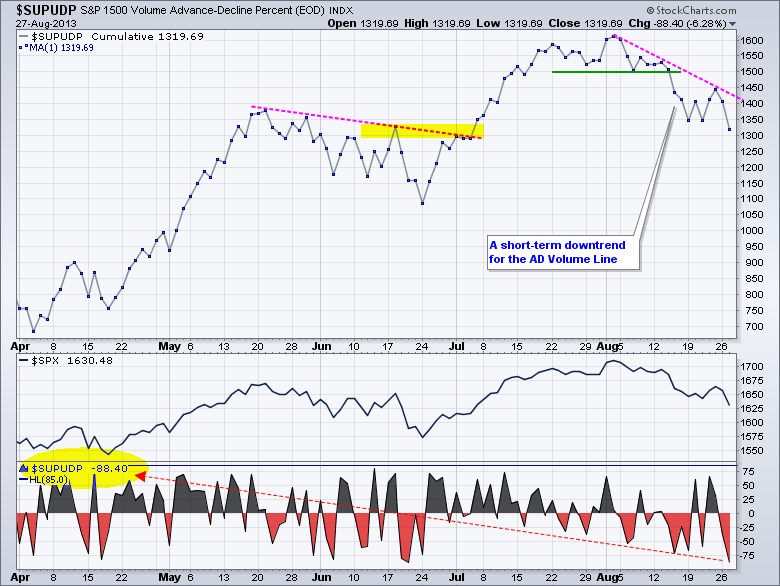

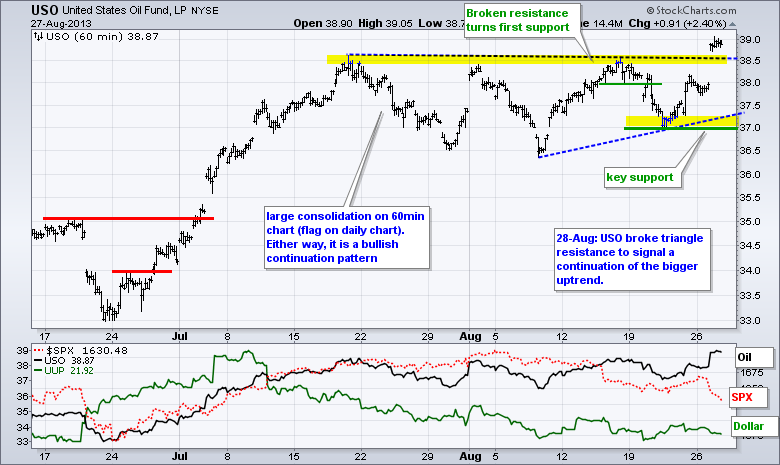

It was a good old fashion flight to safety on Tuesday. Stocks moved broadly lower, while the safe havens moved higher. The 20+ Year T-Bond ETF (TLT) moved higher, the Yen Index ($XJY) surged and Spot Gold ($GOLD) advanced around 1%. Oil moved higher as the market priced in a bigger risk premium. The rise in oil hurt the Dow Transports as it fell over 2.5%. The DJ US Airline Index ($DJUSAR) and the DJ US Trucking Index ($DJUSTK) also got hammered. Stocks were basically hit with a broad-based sell off. S&P 1500 AD Percent ($SUPADP) dipped below 90% and S&P 1500 AD Volume Percent ($SUPUDP) reached -88%. These are the lowest readings since late June. The AD Line and the AD Volume Line remain in clear downtrends with last week's high marking key resistance.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Wed - Aug 28 - 07:00 - MBA Mortgage Index

Wed - Aug 28 - 10:00 - Pending Home Sales

Wed - Aug 28 - 10:30 - Crude Oil Inventories

Thu - Aug 29 - 08:30 - Initial Jobless Claims

Thu - Aug 29 - 08:30 - GDP

Thu - Aug 29 - 10:30 - Natural Gas Inventories

Fri - Aug 30 - 08:30 - Personal Income & Spending

Fri - Aug 30 - 09:45 - Chicago PMI

Fri - Aug 30 - 09:55 - Michigan Sentiment

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.