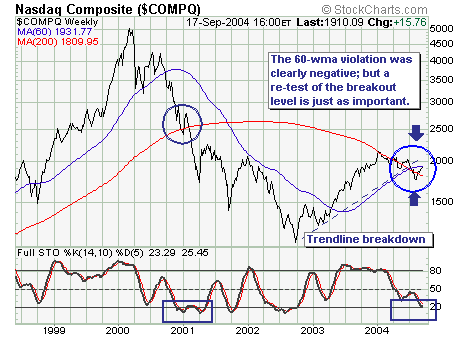

TIME TO SHORT TECH SHARES?

The current Nasdaq Composite rally is at an inflection point much in the same manner it was during the week of July 14th as prices slid to new yearly lows. The simple indicator we are looking at is the 60-week moving average, which in the past has an enviable record as an inflection point. If prices breakout above this level, then higher prices will develop; however, if the 60-wma acts as resistance as we believe it shall given the declining 200-wmathen a larger decline will be underway. Thus, if one is inclined to be short technology sharesthis is certainly the best risk-adjusted time in which to do so.