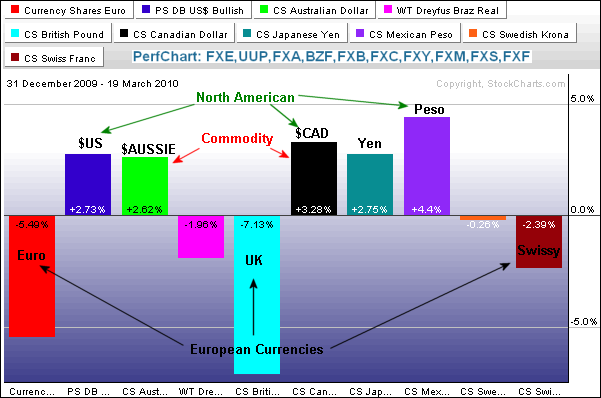

North American Currencies show strength in 2010

The Perfchart below shows the performance trends for 10 currency ETFs in 2010. The North American and commodity currencies are strong, while the European currencies are weak. First, notice that the DB Dollar Bullish ETF (UUP), Mexican Peso ETF (FXM) and the Canadian Dollar ETF (FXC) are up. Strength in all three North American currencies bodes well for a recovery throughout the continent. In particular, Mexico and Canada benefit from a recovery in their big neighbor. The Peso is the strongest of the 10 currency ETFs this year (ole!). The Canadian Dollar and Australian Dollar ETF (FXA) represent two of the so-called "commodity currencies" because both countries are rich in natural resources. In contrast to the North American and the Commodity Currencies, the Euro ETF (FXE), British Pound ETF (FXB) and Swiss Franc ETF (FCF) are weak this year. The Euro and Pound each have their own set of problems, but these are compounded by their proximity to each other. These are the currency trends so far in 2010 and they show no signs of changing.

Click this image for a live PerfChart.