GLOBAL MARKETS ENHANCE PERSPECTIVE

(This is an excerpt from Friday's blog for Decision Point subscribers.)

If nature abhors a vacuum, technicians abhor "V" bottoms. Once prices bounced out of the March lows, the technical expectation was that, after a week or two of rally, prices would turn down again and the March lows would be retested. At this point, those expectations seem to be a fading dream.

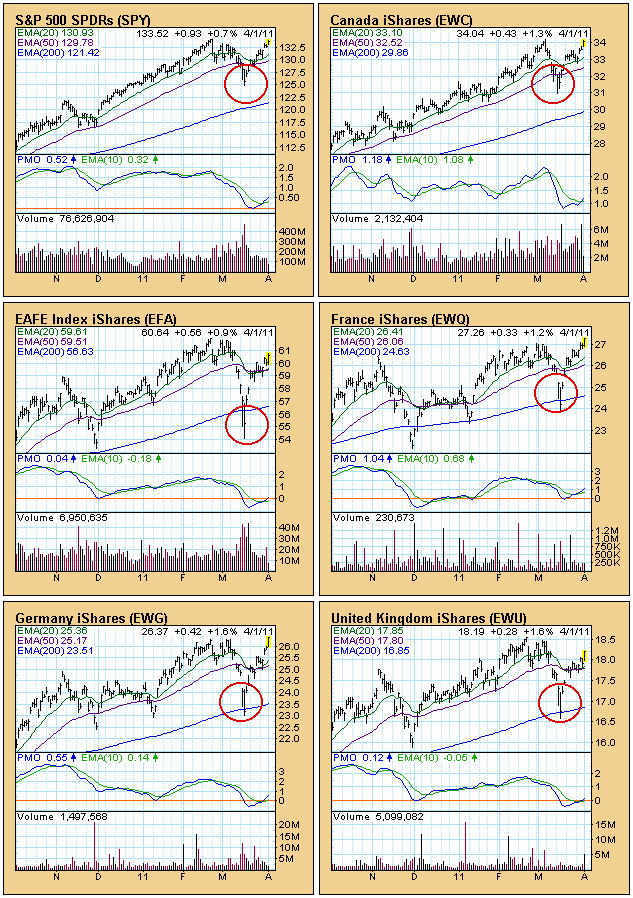

Looking at global markets we can see that "V" bottoms abound, and that in some cases the February highs have already been exceeded.

There could be some doubt that the rally can be sustained, and that, perhaps, a double top will form and that there will indeed be a retest, but I seriously doubt that will happen. Recently I conquered my tunnel vision with the S&P 500 Index and looked at global markets. What I discovered was that quite a few do not have "V" bottoms at all. Rather there is a large number of double bottoms (a solid technical bottom formation), which demonstrate broad-based strength in world markets. The graphic below is a bit daubting, but you only need to scan it briefly to see my point.

Bottom Line: Despite the precarious nature of "V" bottoms, the broader picture reveals a preponderance of solid double bottoms, which leads me to believe that the "V" bottoms will lead to higher prices without the benefit of retests.