MIXED SIGNALS

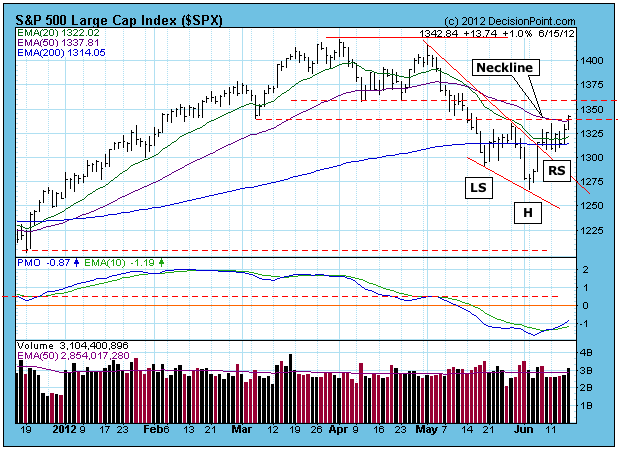

I have been expecting another short decline to finish out the right shoulders of a reverse head and shoulders pattern, but once again the Mr. Market said: "Expect whatever you like. I don't care."

My problem is that, being a person who likes things to be nice and neat, I wanted the right shoulder to be more even with the left shoulder. But no. What we have is a formation that is very lopsided, but I think it is close enough to be considered a completed reverse head and shoulders pattern. The neckline has been penetrated, so the minimum upside target is about 1430.

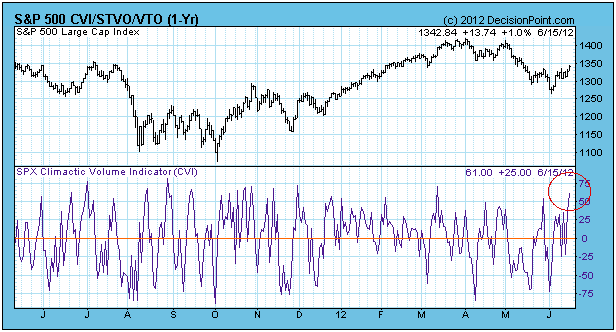

Unfortunately, the bullish breakout on the price chart is contradicted by the Climactic Volume Indicator (CVI) chart, which spiked to a level that usually signals a short-term top.

Conclusion: It is possible that Saturday's upcoming elections in Greece may have triggered some short-covering ahead of the weekend, resulting in a rally that may prove to have no legs. The breakout is far from decisive, and the CVI indicates a possible exhaustion climax, so I remain skeptical of the rally.