FOREIGN STOCKS NEAR UPSIDE BREAKOUT

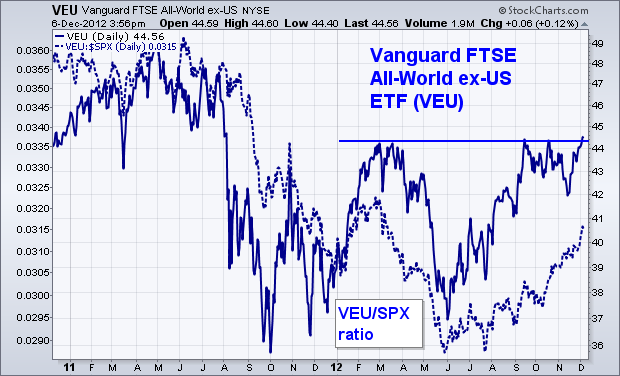

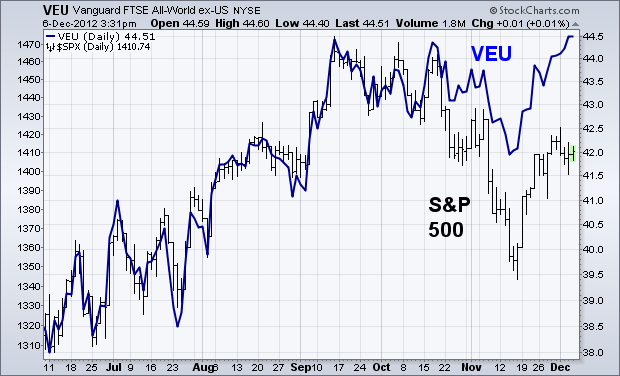

Foreign stocks look technically stronger than the U.S. at the moment. Tuesday's message showed EAFE iShares testing their spring high. Emerging markets are rising as well. A more comprehensive measure of foreign stocks that includes developed and emerging markets is shown below. Chart 1 shows the Vanguard FTSE All-World ex-US ETF (VEU) in the process of testing highs formed during the spring of this year. An upside breakout would give a boost to foreign stocks. The dotted line overlaid on the chart is a relative strength ratio of the VEU divided by the S&P 500. As I suggested on Tuesday, foreign stocks have been rising faster than the U.S. (rising ratio) since mid-year after lagging behind the U.S. during most of the past year (because of a falling dollar). After acting as a drag on the U.S. during the first half, foreign stocks are now leading the U.S. higher. Chart 2 shows foreign shares (VEU) in a stronger position than the S&P 500 (the VEU has risen 20% since June versus 10% for the S&P. Since global stocks are highly correlated, an upside breakout by foreign stocks would increase the odds for higher U.S. shares.