"Rel-to-52" Shows Fading Participation

When looking at a chart that shows new 52-week highs and lows, have you ever wondered what is happening with all the other stocks in the index? Where are they in relation to their 52-week high-low range? DecisionPoint.com's "Rel-to-52" index provides that answer.

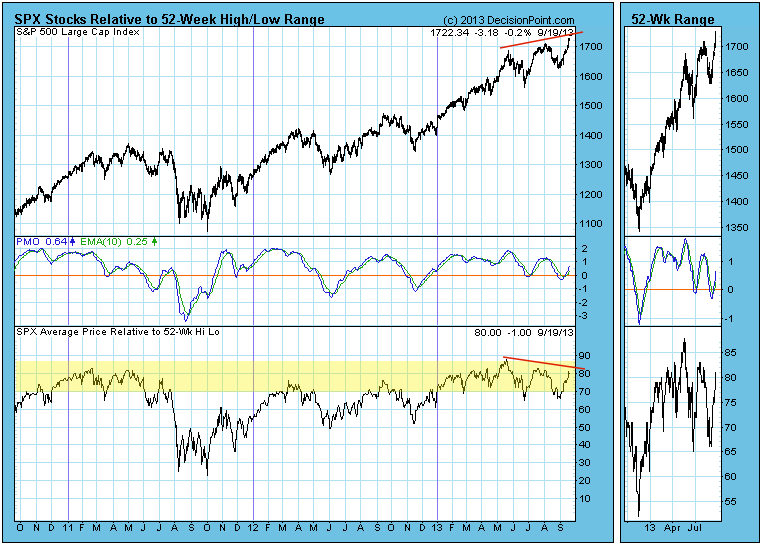

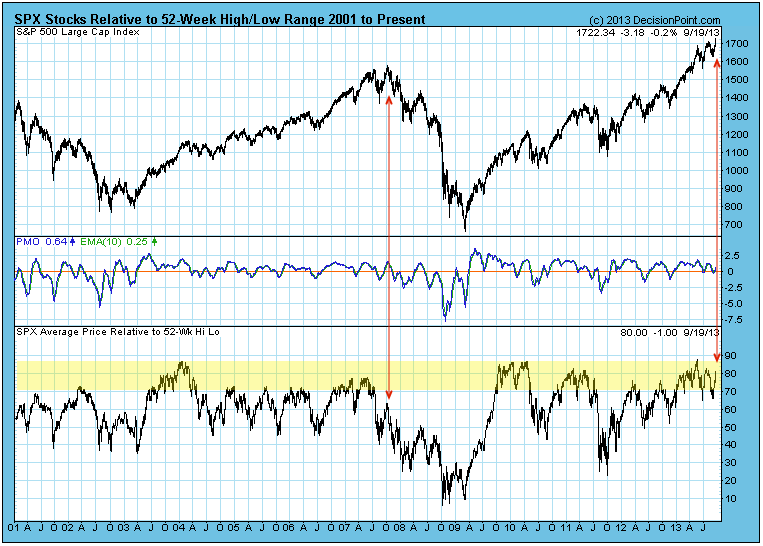

DecisionPoint.com tracks each stock in the S&P 500 Index and determines the location of its current price in relation to its 52-week high and 52-week low. We express this relationship using a scale of zero (at the 52-week low) to 100 (at the 52-week high). For example, a stock in the middle of its 52-week range would get a "Rel-to-52" value of 50. The charts below show the average "Rel-to-52" for all the stocks in the S&P 500 Index.

The most recent Rel-to-52 reading is 80, which means that on average S&P 500 stocks are within 20% of their 52-week high. This shows a lot of strength behind the recent rally; however, in the last four months the Rel-to-52 index has made a series of lower tops (a negative divergence), giving evidence that support for the rally is fading.

The current negative divergence is not nearly as profound as the one that formed at the 2007 bull market top, but it is a problem nevertheless. Another problem is that the Rel-to-52 index is currently in the zone where we would consider it to be overbought, and because of this we will typically see Rel-to-52 tops corresponding with price tops. It is simply a matter of cyclical behavior where things get as good as they are going to get, then they swing back in the other direction.

Conclusion: DecisionPoint.com's Rel-to-52 index provides a unique, precise analysis of 52-week high and low status of all stocks in the S&P 500 index. It is currently overbought and presenting a negative divergence, so it is likely that the market will soon roll over into a correction. We have no reason to believe it will be a particularly severe correction, but we certainly think one is due.