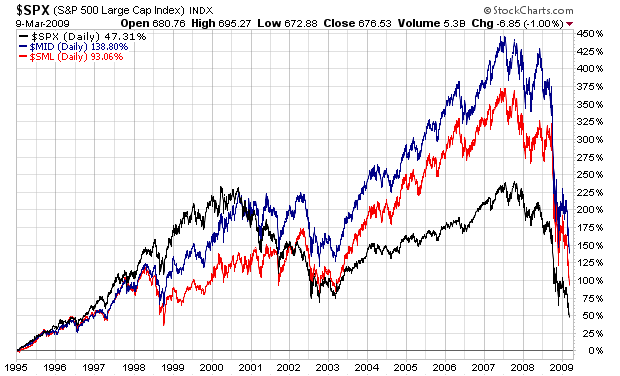

Large Caps, Mid Caps or Small Caps?

Click here for a live version of this chart.

Long term answer: Mid caps. Next question?

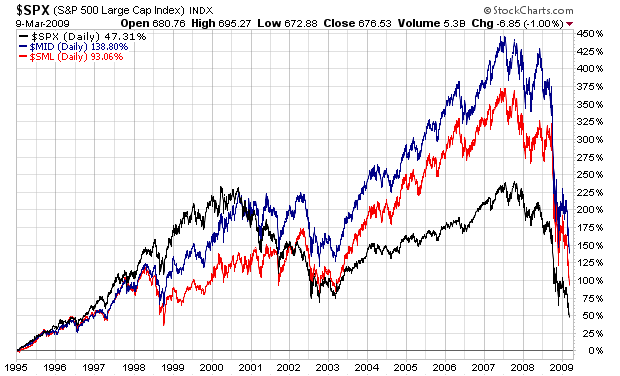

Click here for a live version of this chart.

Long term answer: Mid caps. Next question?

After a week of heightened volatility, the Nifty ended the week with gains and a positive broader trend. What will it take to reassert upside momentum -- or a correction?... READ MORE

This week’s market action is a reminder of why it’s important to tune out the noise and tune into the charts. Three straight down days are enough to make any investor a little uneasy. Headlines clog up your inbox, opinions pile up, and it feels like something terrible... READ MORE

Mary Ellen McGonagle breaks down why AI infrastructure continues to lead even as headline tech stocks struggle with earnings volatility. She highlights where capital is flowing under the surface and why long-term demand themes are holding up against short-term noise.... READ MORE

The Dow Jones Industrial Average and Dow Jones Transportation Average notched record closes, indicating that economic conditions are strong. Even the S&P 500 and XLK bounced off key support levels. Does this mean we're out of the woods? Find out here.... READ MORE

As volatility picks up, the S&P 500 sits in a crucial neutral zone. Dave Keller, CMT, uses probabilistic analysis to outline four possible paths for the index into late March—from a renewed bull run to a deeper correction—helping investors prepare for multiple outcomes.... READ MORE

Money is moving into stocks with relatively low volatility, most equal-weight sectors are up, and QQEW reversed its long-term uptrend. What does Arthur Hill make of this? Find out here.... READ MORE