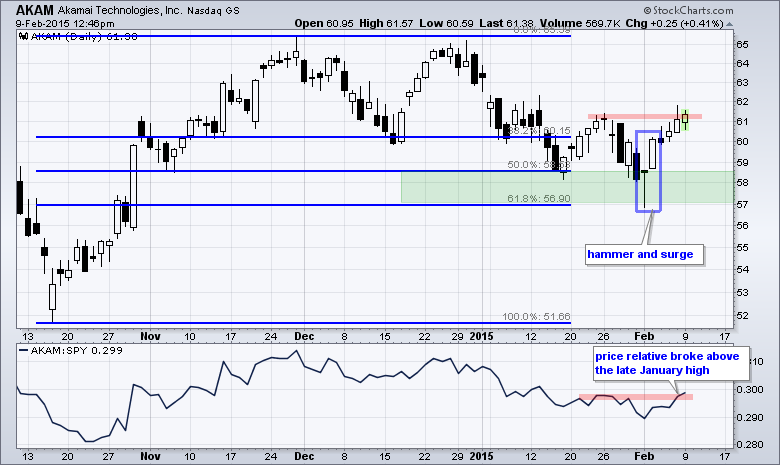

Akamai Forges Candlestick Reversal at Key Retracement

It has been a rough year for Akamai (AKAM), but the decline over the last few months looks like a classic correction. After hitting a new high in late November, the stock retraced 50-62% with a decline to the 57-58 area. This retracement amount is typical for a correction within a bigger uptrend. The stock affirmed support here by forming a hammer on February 2nd and surging the very next day. This surge confirmed the hammer and the short-term trend is up. AKAM is now challenging the late January high and a breakout here would suggest that the correction is ending and the bigger uptrend is resuming.

Click this image for a live chart