The Best Five Sectors, #29

Key Takeaways

- Technology, Industrials, and Communication Services maintain top 3 positions

- Utilities and Consumer Discretionary enter the top 5, pushing out Financials and Materials

- Mixed signals as defensive Utilities and offensive Consumer Discretionary both rise

- Technology and Industrials show continued strength, while Communication Services faces challenges

Sector Rankings Shake-Up

Despite a backdrop of conflicting market signals, this week's sector rotation analysis reveals some intriguing shifts. The top three sectors remain unchanged, but we're seeing movement in the ranks below that could indicate evolving market dynamics.

The weekly sector rankings have seen some interesting changes. While Technology, Industrials, and Communication Services hold steady in the top three spots, we're witnessing a notable shift just below. Utilities and Consumer Discretionary have moved into the fourth and fifth positions, respectively, displacing Financials and Materials.

This rotation presents us with a bit of a conundrum. On one hand, we have Utilities, a classically defensive sector, moving up. On the other hand, we see Consumer Discretionary, typically an offensive, cyclical play, also gaining ground. It's a mixed picture that reflects the ongoing rotation beneath the surface of the broader market.

From my perspective, the ascent of Consumer Discretionary into the top five is a positive sign. Its growth orientation, combined with the continued strength in Technology and Industrials, suggests a tilt towards cyclical growth stocks. However, the presence of Utilities in the top five gives me pause. I'm still working to understand the full implications of this move; it could simply be outperforming the lower-ranked sectors rather than signaling a broader defensive shift.

- (1) Technology - (XLK)

- (2) Industrials - (XLI)

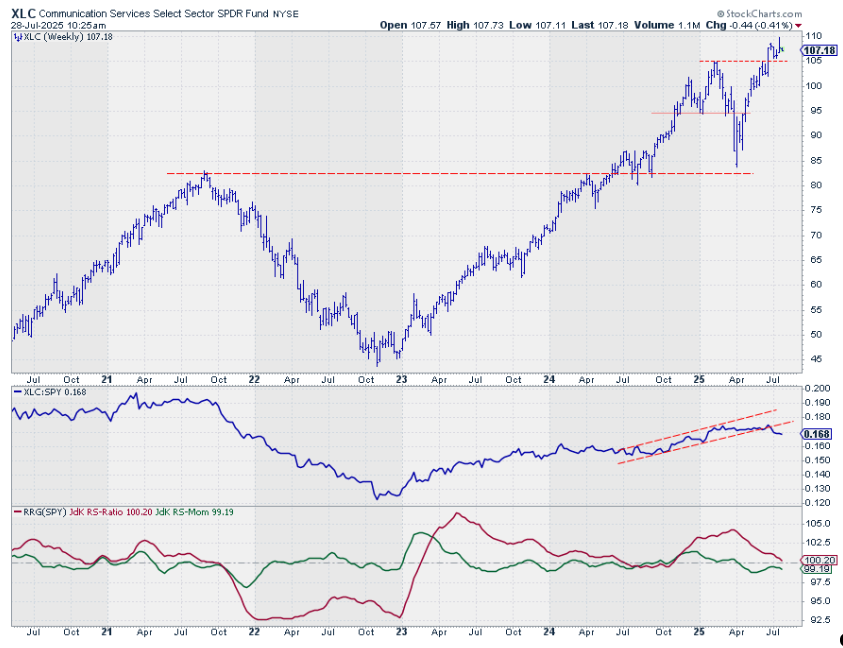

- (3) Communication Services - (XLC)

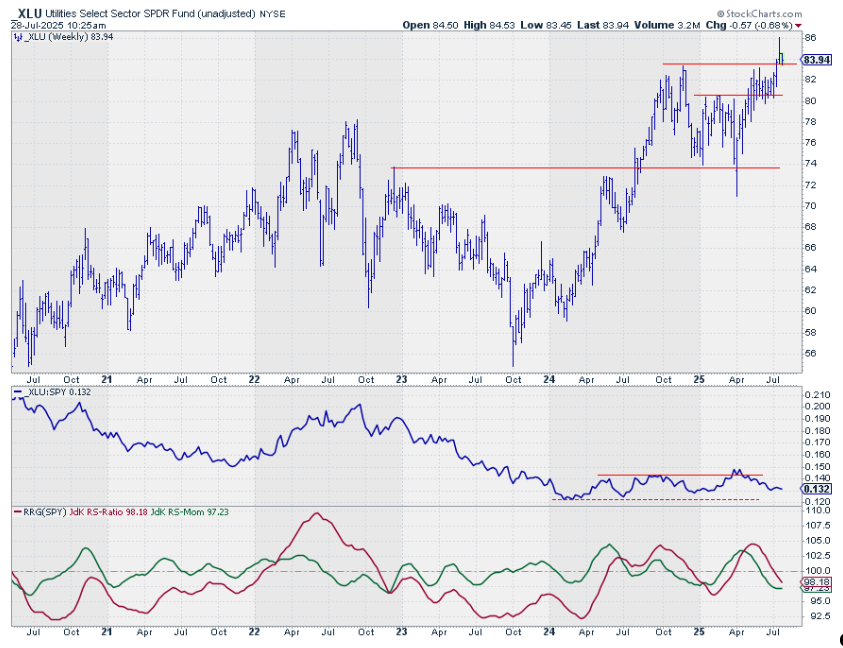

- (6) Utilities - (XLU)*

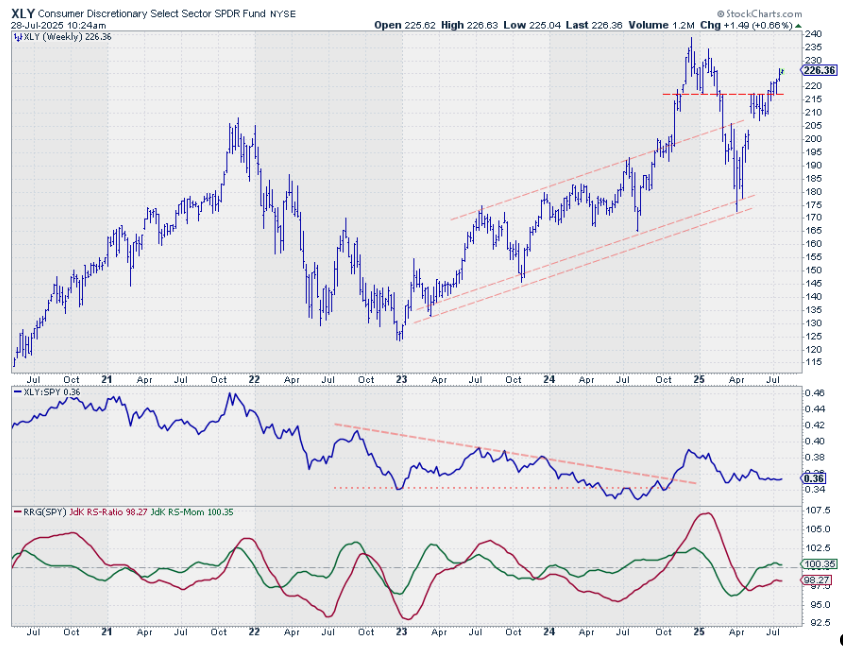

- (7) Consumer Discretionary - (XLY)*

- (4) Financials - (XLF)*

- (5) Materials - (XLB)*

- (9) Real-Estate - (XLRE)*

- (8) Consumer Staples - (XLP)*

- (10) Energy - (XLE)

- (11) Healthcare - (XLV)

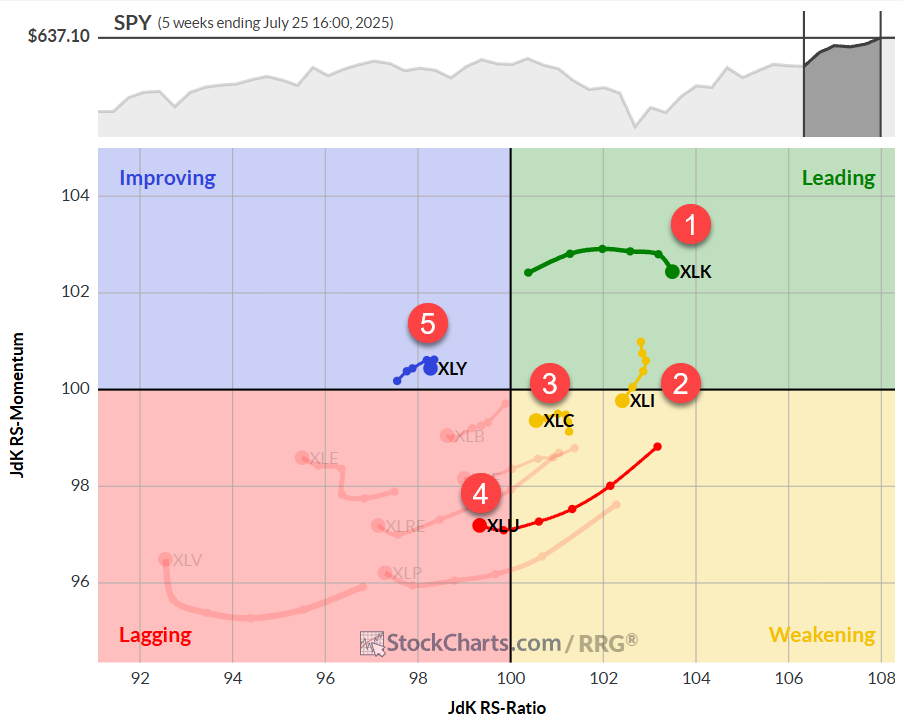

What's Happening on the Relative Rotation Graphs?

The weekly RRG provides some context for these movements. Technology remains firmly in the leading quadrant, boasting both the highest RS ratio and momentum, a bullish sign despite a slight dip in relative momentum. Industrials and Communication Services are rotating out of leading into weakening, but their high RS ratios suggest this might be a temporary shift.

Interestingly, Utilities is rotating into the lagging quadrant on the weekly RRG, which seems at odds with its rise in the rankings. This discrepancy likely stems from its performance on the daily RRG and its position relative to lower-ranked sectors.

Consumer Discretionary is rolling over within the improving quadrant on the weekly RRG. Its entry into the top five is due to a strong showing on the daily timeframe, which offsets the weekly weakness.

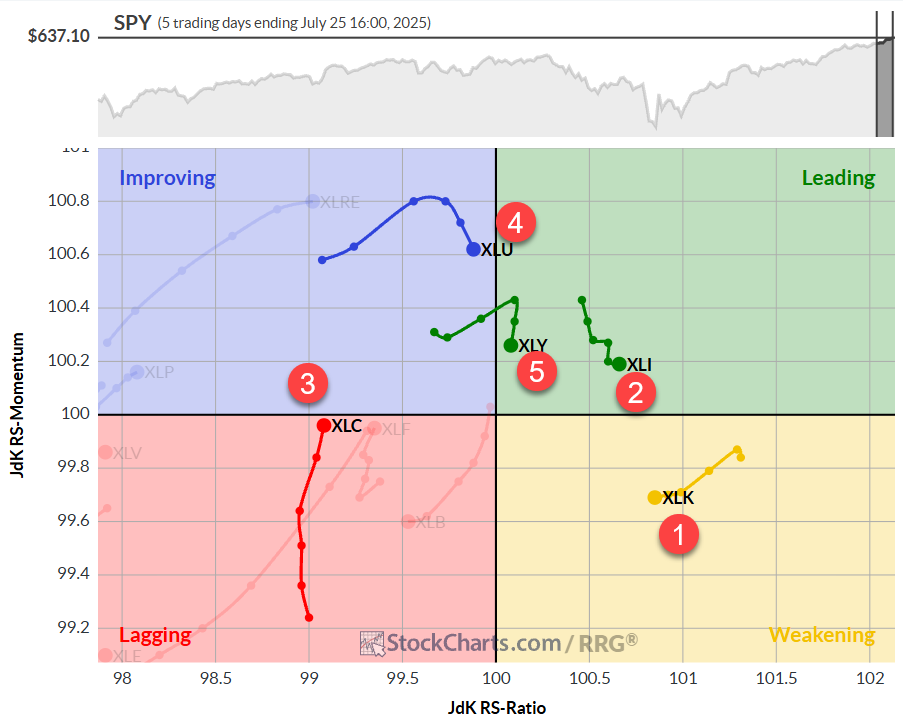

Shifting to the daily RRG, we see Technology in the weakening quadrant, but it is still maintaining the highest RS ratio. This reinforces the idea that its rotation is likely temporary. Industrials remains in the leading quadrant, though it's losing some momentum. Communication Services is making a rapid move towards the improving quadrant, which could help it maintain its top-five status.

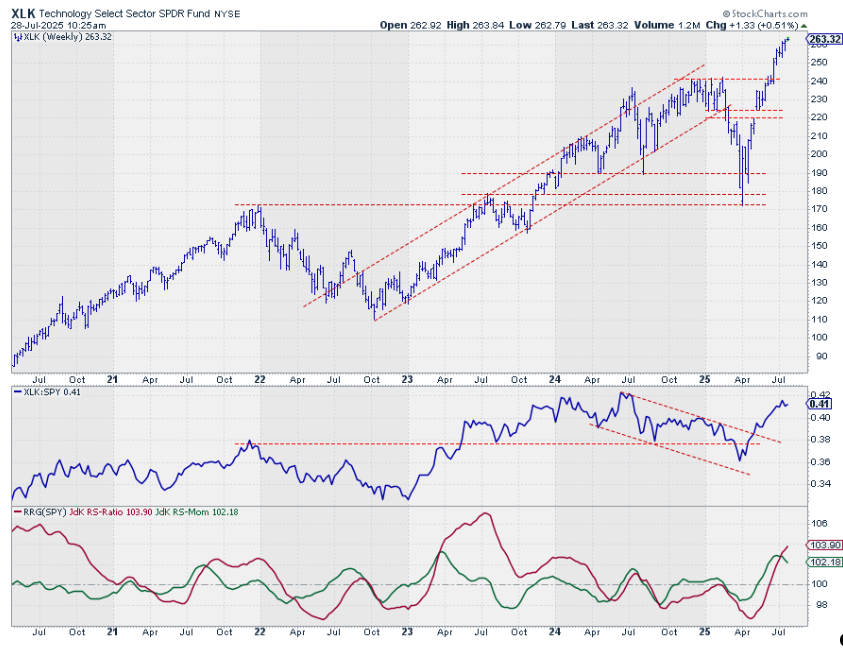

Technology

The Technology sector continues to impress, showing nothing but strength in both price and relative performance. The only slight wrinkle is a rolling over of the RS momentum line at a high level, a result of the raw relative strength line stabilizing rather than continuing to increase. But make no mistake, this sector remains a powerhouse.

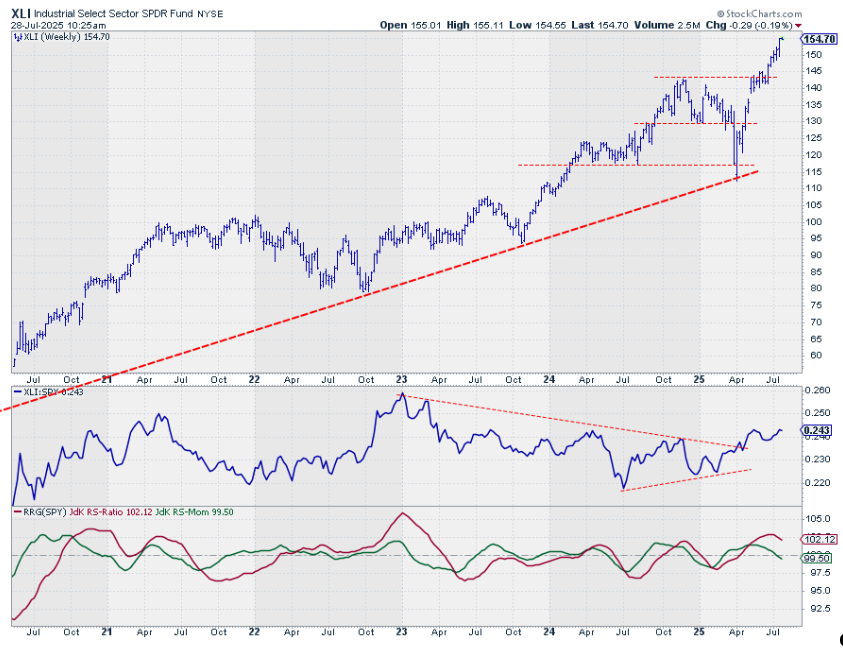

Industrials

Industrials are keeping pace admirably, with a price chart that mirrors the strength of Technology. The raw RS line is on the verge of pushing above its previous high, maintaining a series of higher highs and lows. A slight loss of momentum is visible, but this should resolve once the RS line breaks out to new highs.

Communication Services

This sector is holding above its breakout level but struggling to push higher in both price and relative strength. The raw RS line has broken below its rising support and is now moving sideways. This flatlining is taking its toll on the RRG lines, with RS momentum dropping below 100. Communication Services needs a fresh injection of relative strength soon to maintain its top-five position.

Utilities

Utilities have broken above overhead resistance and are holding that level as positive from a price perspective. However, its relative performance continues to deteriorate slowly. The sector's entry into the top five seems more a function of the weakness of other sectors than its own strength. Keep an eye on this one.

Consumer Discretionary

The Consumer Discretionary sector's situation is more encouraging. A clear breakout is visible and confirmed by last week's move higher. The RS line has stabilized, an improvement over its previous decline. This stabilization has led to an uptick in RS momentum, which is now starting to pull the RS ratio higher. The combination of daily and weekly RRG strength is propelling this sector into a leading position.

Portfolio*

A quick note on portfolio management: I've noticed some discrepancies in my position tracking that need reconciliation. The static underperformance of around 8% is likely to remain accurate, but I want to ensure that all transactions discussed in these articles are properly reflected. I'll provide an update on this shortly, either as an addition to this article or in a new piece.

#StayAlert and have a great week. --Julius