The Best Five Sectors, #30

Key Takeaways

- S&P 500 down over 2% last week, but the top 5 sectors remain relatively stable.

- Utilities climb to #3, pushing communication services down to #4.

- Technology maintains its lead, but shows signs of potential weakness.

- Consumer Discretionary's position in the top 5 is becoming questionable.

- The portfolio performance gap is narrowing as market declines.

The composition of the top 5 sectors remains unchanged. But Utilities moved up to the #3 position, pushing Communication Services down to #4.

The lower half of the ranking remains static, with financials at #6, followed by materials, real estate, consumer staples, energy, and health care bringing up the rear at #11.

- (1) Technology - (XLK)

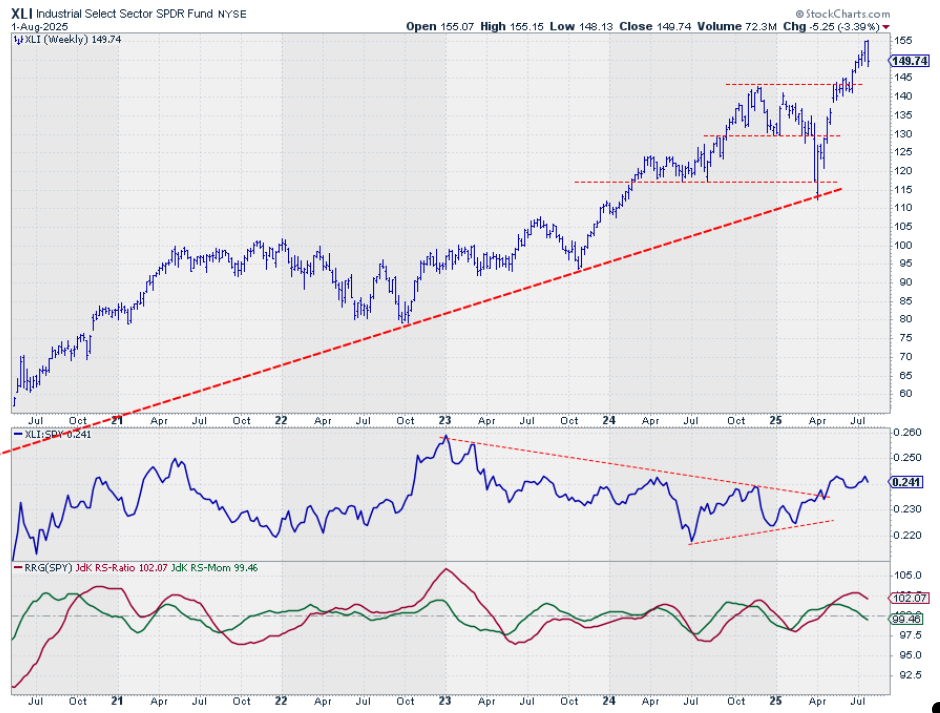

- (2) Industrials - (XLI)

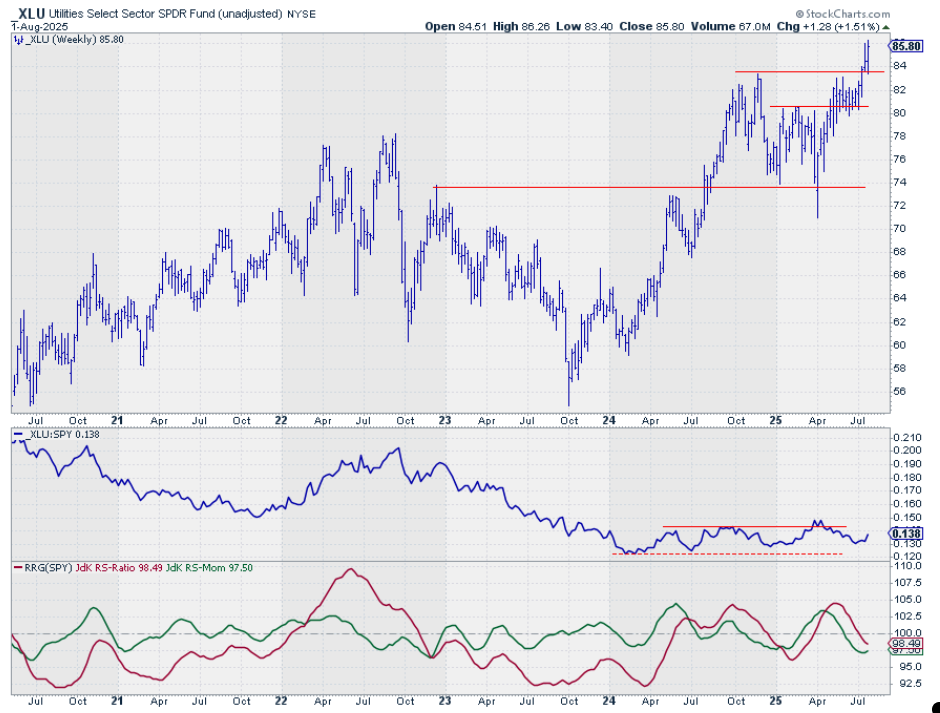

- (4) Utilities - (XLU)*

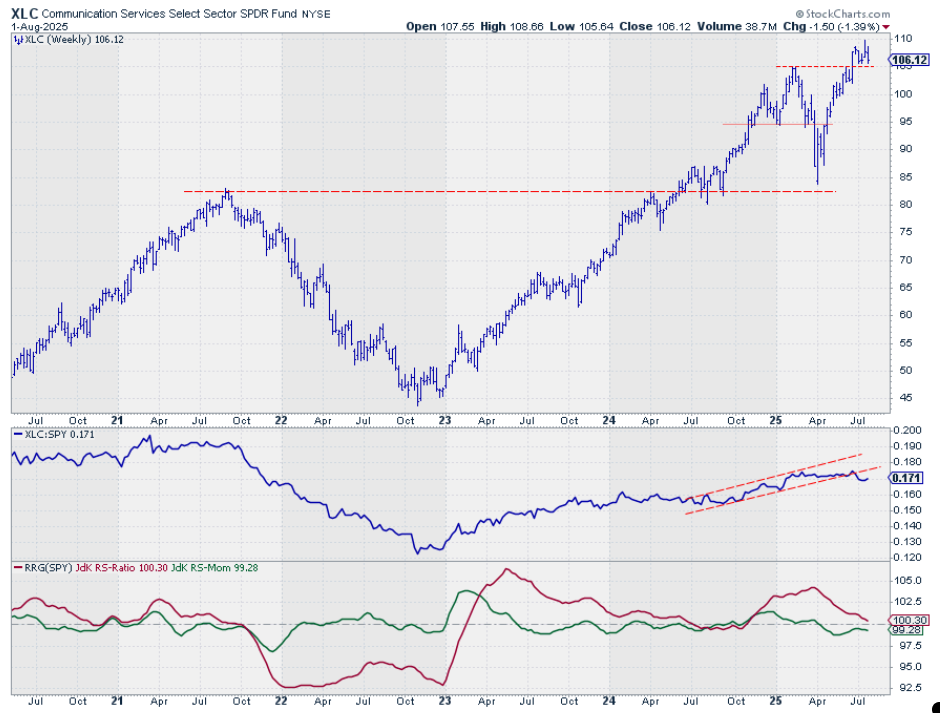

- (3) Communication Services - (XLC)*

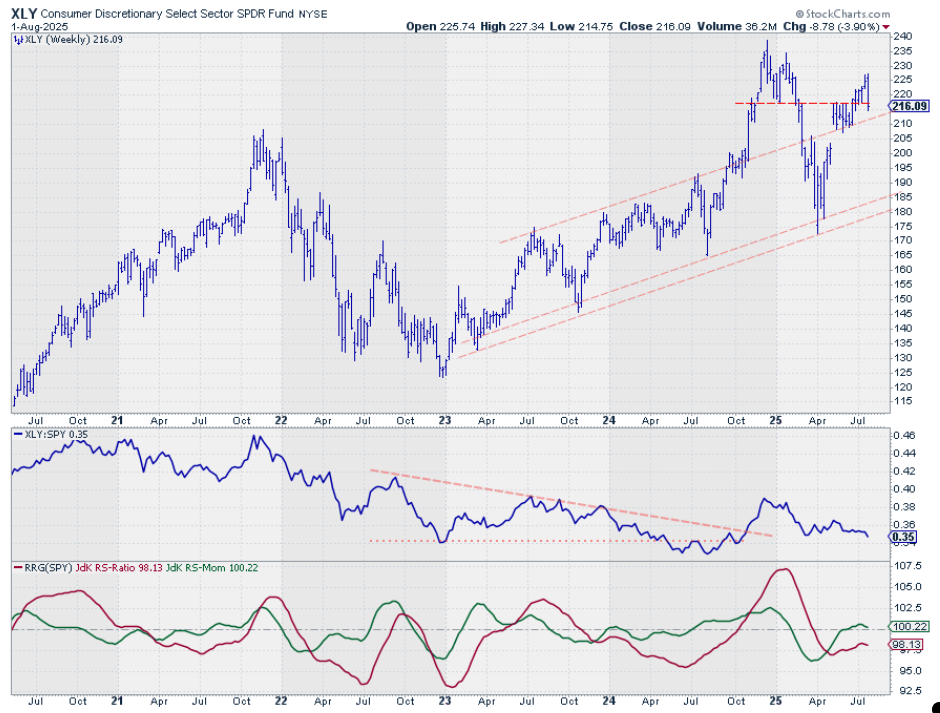

- (5) Consumer Discretionary - (XLY)

- (6) Financials - (XLF)

- (7) Materials - (XLB)

- (8) Real-Estate - (XLRE)

- (9) Consumer Staples - (XLP)

- (10) Energy - (XLE)

- (11) Healthcare - (XLV)

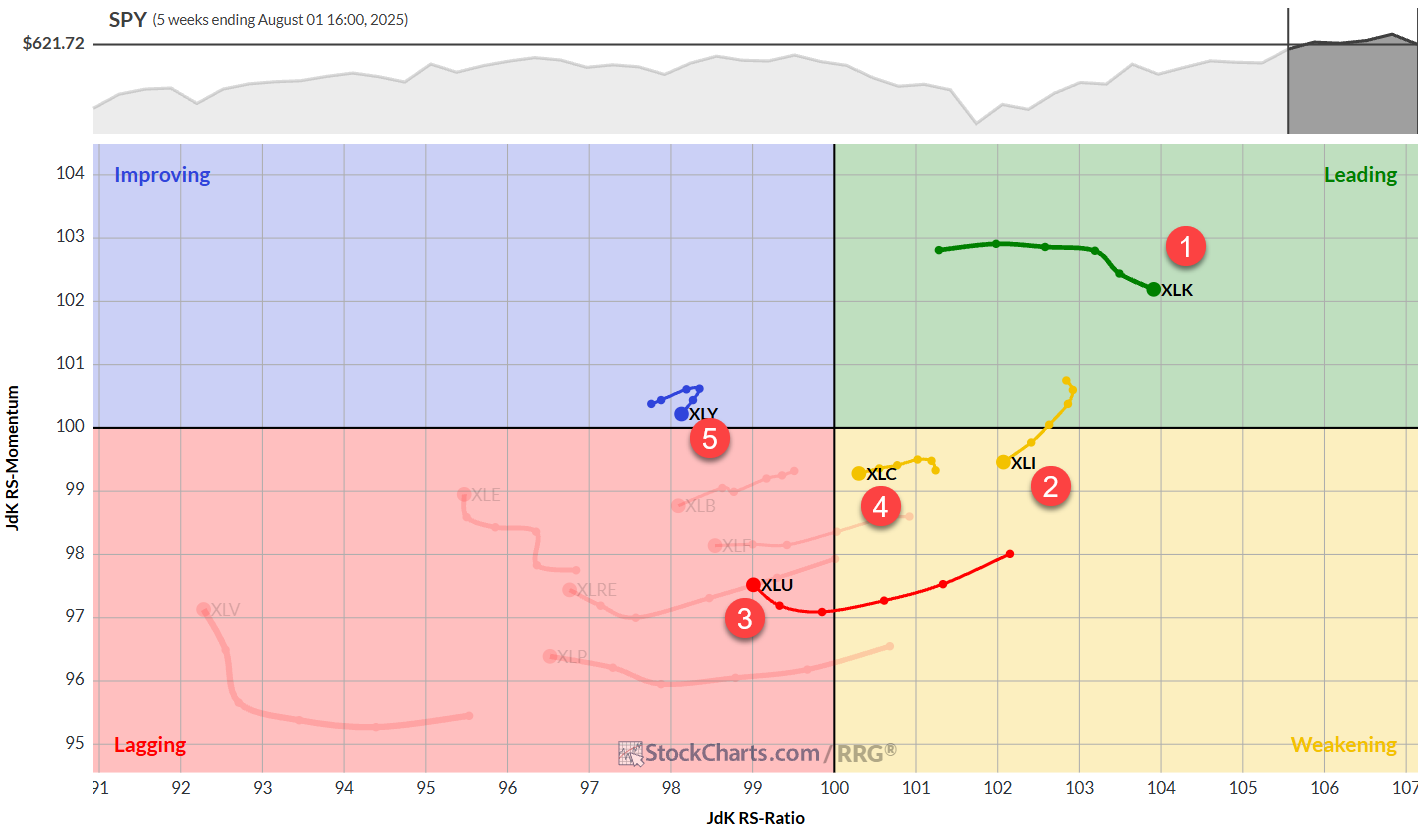

Weekly Relative Rotation Graphs

Looking at the weekly Relative Rotation Graph (RRG), we see some interesting developments:

- Technology remains the lone sector in the leading quadrant, continuing to push higher on the RS ratio scale with only a minor drop in relative momentum.

- Industrials have moved into the weakening quadrant but maintain high RS-ratio levels, indicating there's still room for a potential turn back towards leading.

- Utilities, despite being in the lagging quadrant, are picking up relative momentum.

- Communication Services are dangerously close to crossing into the lagging quadrant.

- Consumer Discretionary is rolling over towards lagging, a serious deterioration that puts its top 5 position at risk.

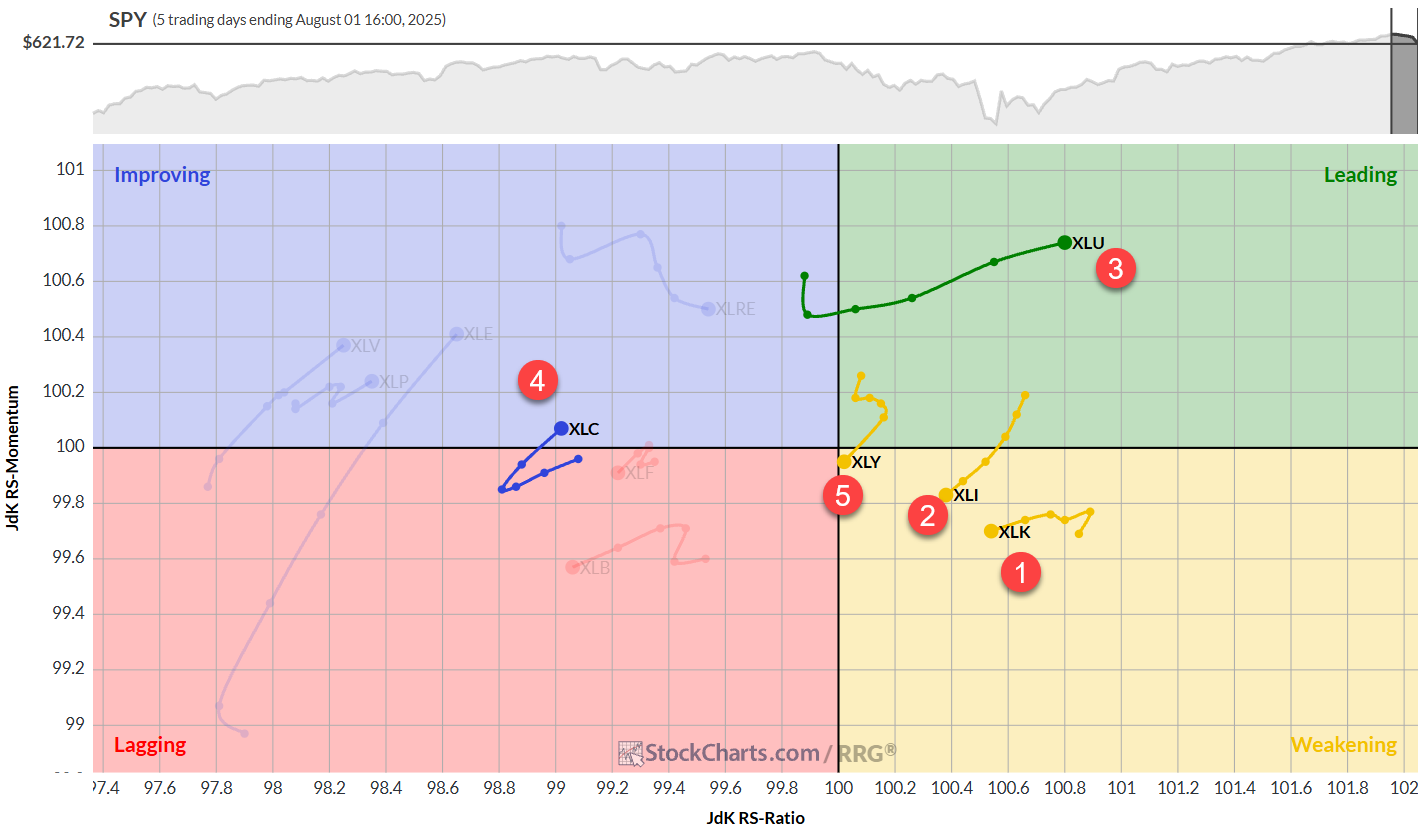

Daily RRG

Switching to the daily RRG, we get a more nuanced picture:

- Technology is losing on the RS ratio scale, but still has room for a potential turnaround.

- Industrials mirror technology's position, crossing into weakening but maintaining elevated RS-ratio levels.

- Utilities is the star performer, firmly in the leading quadrant and pushing higher on the RS-ratio scale.

- Communication Services have rotated through lagging and back into improving – this could be its lifeline to remain in the top 5.

- Consumer Discretionary is heading towards lagging, corroborating its weak position on the weekly RRG.

Individual Sectors

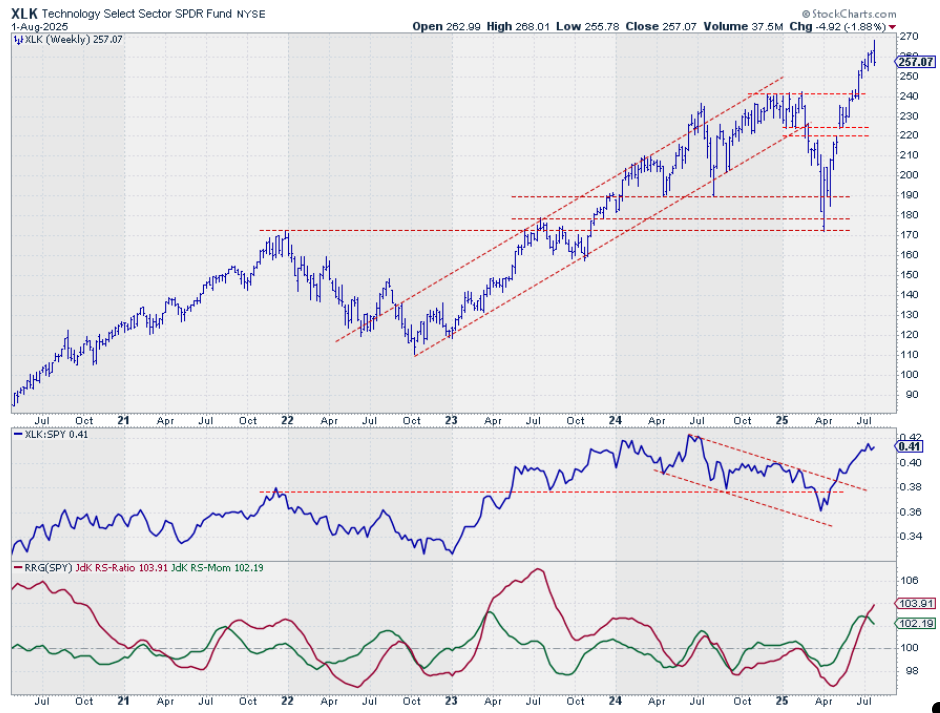

Technology

The breakout is still evident in both price and relative strength. However, last week's long bar with a close at the lower end signals a potential reversal. We might see some weakness in the coming weeks, but the strong follow-through after the breakout provides a cushion for correction without harming the overall uptrend.

Industrials

Industrials present a similar picture to Technology, a solid breakout followed by a reversal bar last week. Again, there's room for correction without threatening the uptrend in price and relative strength.

Utilities

XLU is getting more interesting. After breaking out two weeks ago and then retesting the breakout zone, last week saw a rally pushing the sector to the top of its range. The relative strength line is curling back up, which could lead to further improvement on the weekly RRG.

Communication Services

XLC is barely holding above its breakout level. A break below 105 would likely complete a double-top formation, signaling more downside. The relative strength chart shows the sector has already left its uptrend, putting communication services under pressure from both price and relative perspectives.

Consumer Discretionary

XLY is in danger. Friday saw a drop below the former resistance area, and it would take a very strong week to negate this downward break. The relative strength line is moving below previous lows, pulling down RS momentum and causing the RS ratio line to curl over. This rotation back towards lagging without hitting leading is a bearish signal.

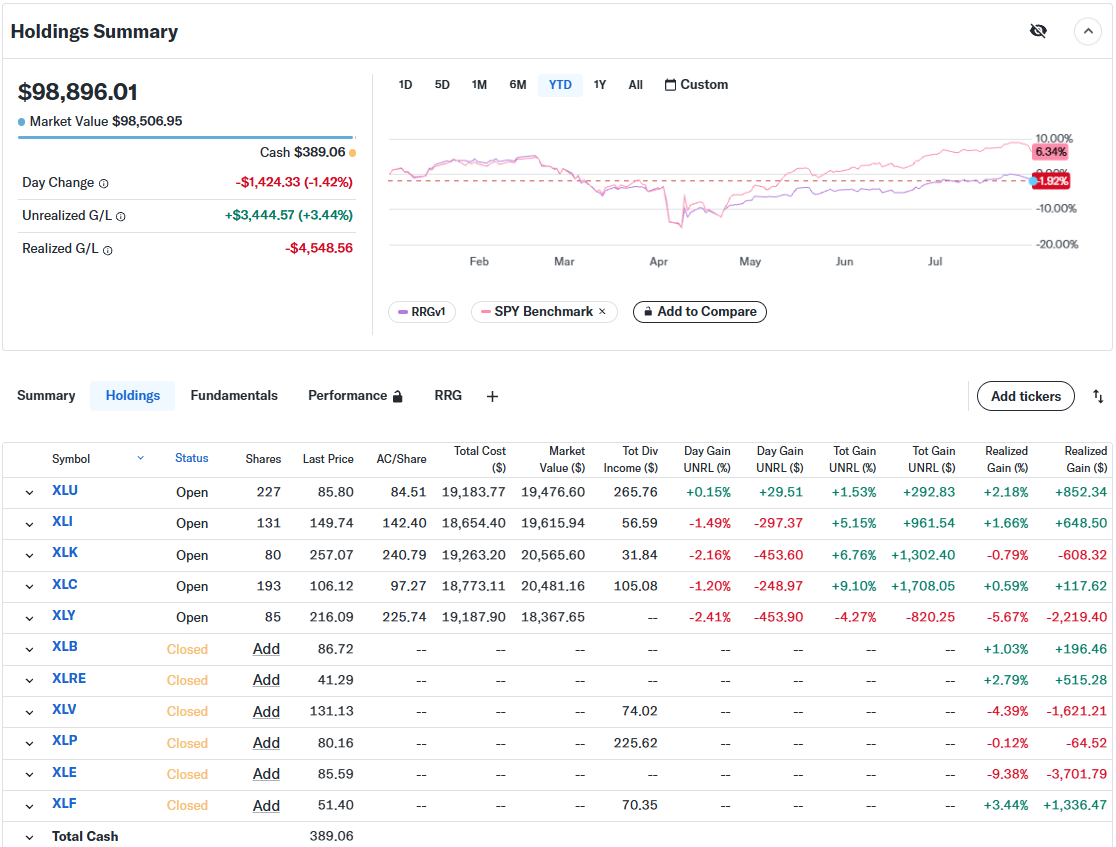

Portfolio Performance Update

I apologize for the absence of an update last week. It appeared I missed the entry of the changes of 7/14, which I noted last week. After correcting for the missed change in July and subsequent adjustments, our portfolio is now up to date. We're still lagging the S&P 500 by about 8%, but the good news is that with the recent market decline, the gap is narrowing.

#StayAlert and have a great week. --Julius