The Best Five Sectors this Week, #32

Key Takeaways

- S&P 500 gained almost 1% last week

- Top 5 sectors unchanged, but positions shifted

- Technology remains the leader, Communication Services jumps to #2

- Consumer Discretionary is showing a promising outlook

The S&P 500 picked up nearly 1% last week, providing a backdrop for some interesting sector movements. While the composition of the top five sectors remains unchanged, we are seeing some notable shifts in their relative positions.

Technology maintains its crown at #1, showcasing its continued dominance. However, the real story lies in Communication Services, which leaped from #4 to #2. This jump pushed Industrials down a notch to #3, with Utilities sliding from #3 to #4. Consumer Discretionary holds steady at #5, rounding out our top performers.

In the bottom half, we see less movement: Financials and Materials remain at #6 and #7 respectively, while Consumer Staples edged up to #8 from #9, swapping places with Real Estate. Energy and Health Care bring up the rear at #10 and #11.

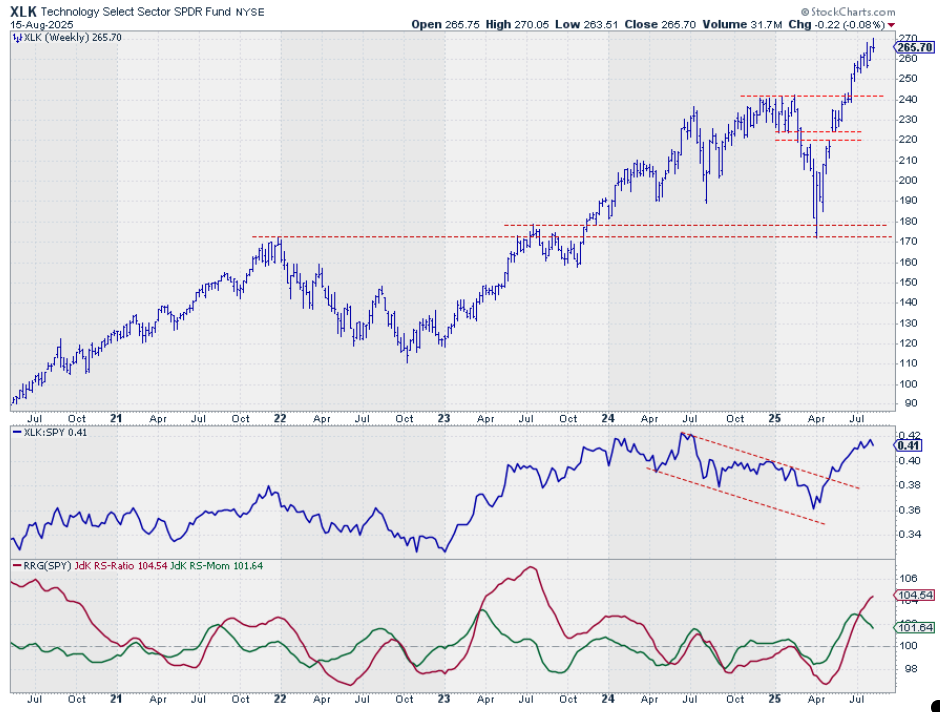

- (1) Technology - (XLK)

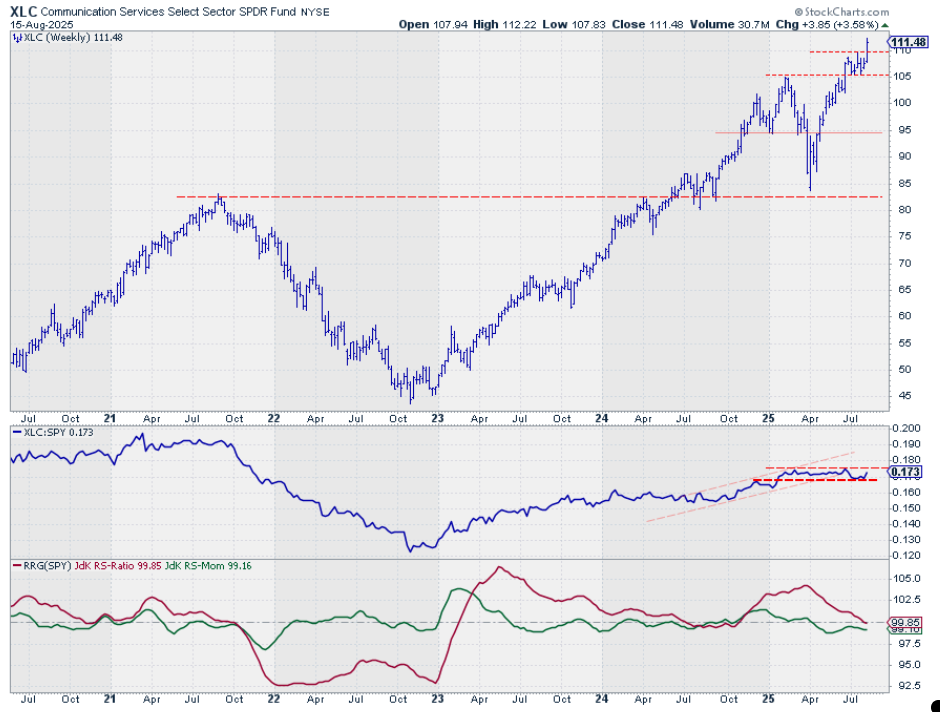

- (4) Communication Services - (XLC)*

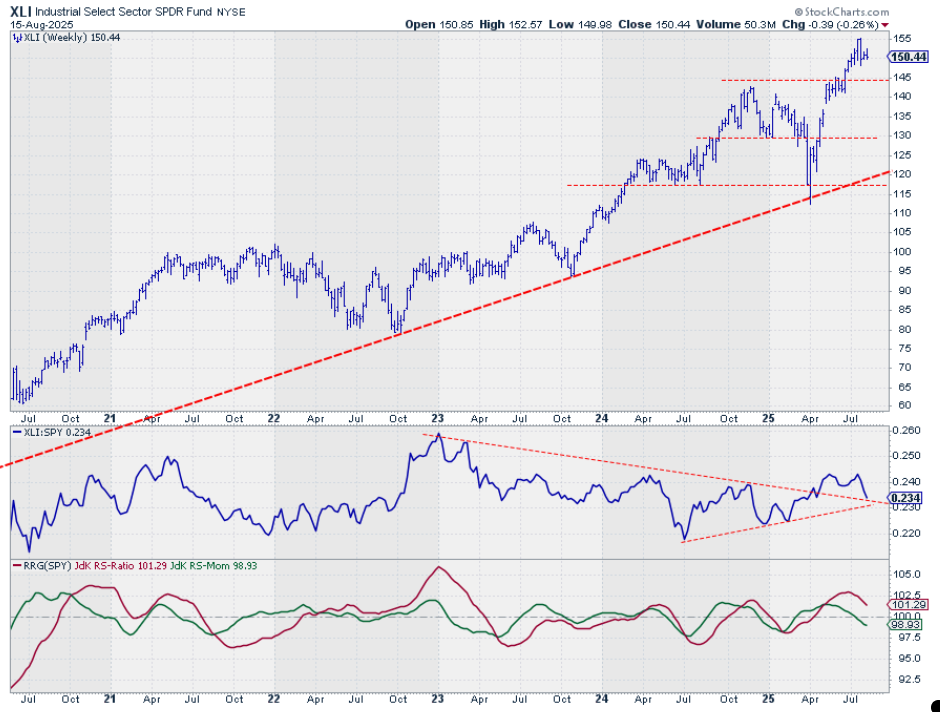

- (2) Industrials - (XLI)*

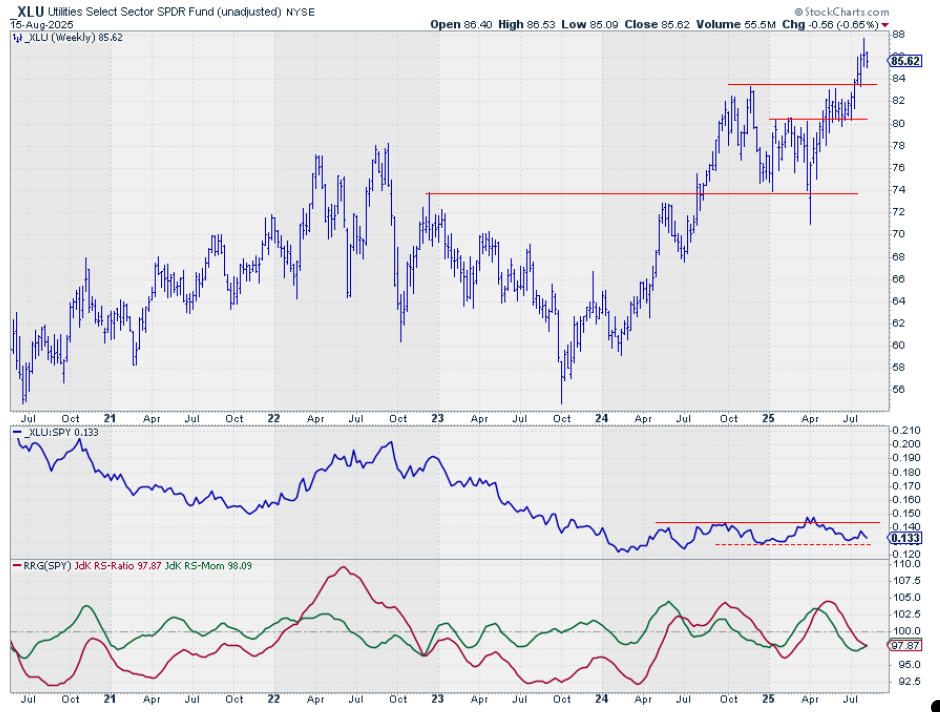

- (3) Utilities - (XLU)*

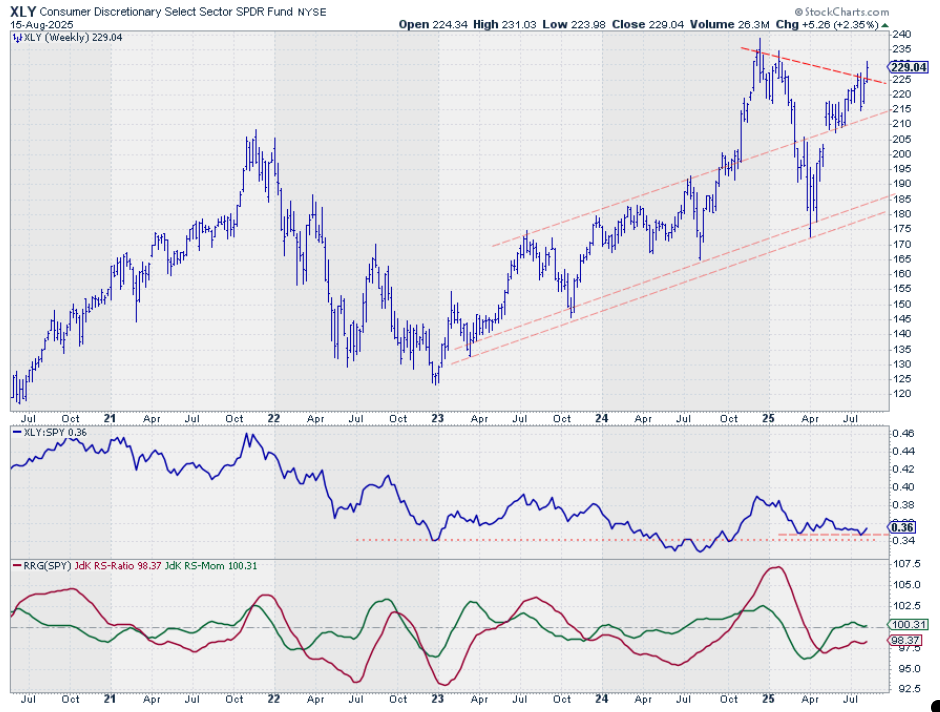

- (5) Consumer Discretionary - (XLY)

- (6) Financials - (XLF)

- (7) Materials - (XLB)

- (9) Consumer Staples - (XLP)*

- (8) Real-Estate - (XLRE)*

- (10) Energy - (XLE)

- (11) Healthcare - (XLV)

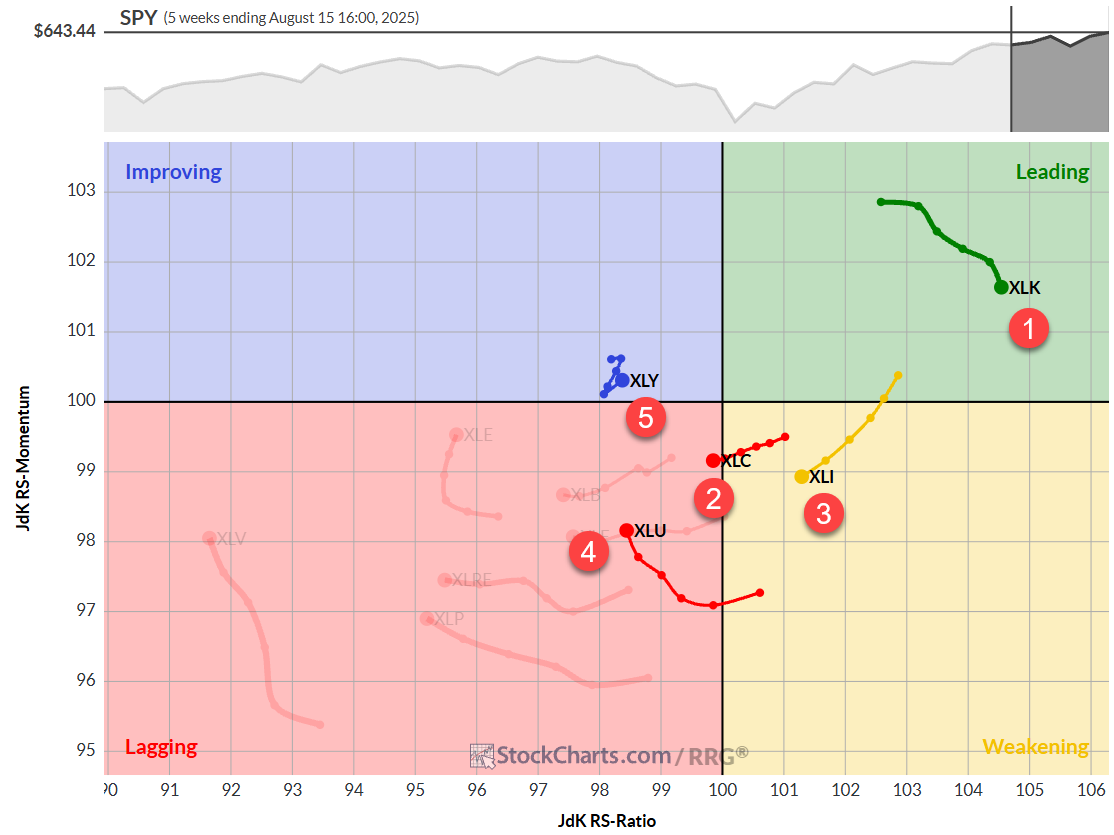

Weekly RRG

The weekly Relative Rotation Graph (RRG) paints an intriguing picture. Technology continues to stand alone in the leading quadrant, pushing higher on the RS-Ratio scale but losing some momentum. Communication Services has crossed into the lagging quadrant, a move that might seem at odds with its ranking jump, but the daily RRG offers some explanation (more on that in a moment).

Industrials is moving deeper into weakening territory, while Utilities, though in the lagging quadrant, is showing signs of picking up relative momentum. Consumer Discretionary, meanwhile, has made a sharp hook back up in the improving quadrant, now pointing towards leading, a promising sign.

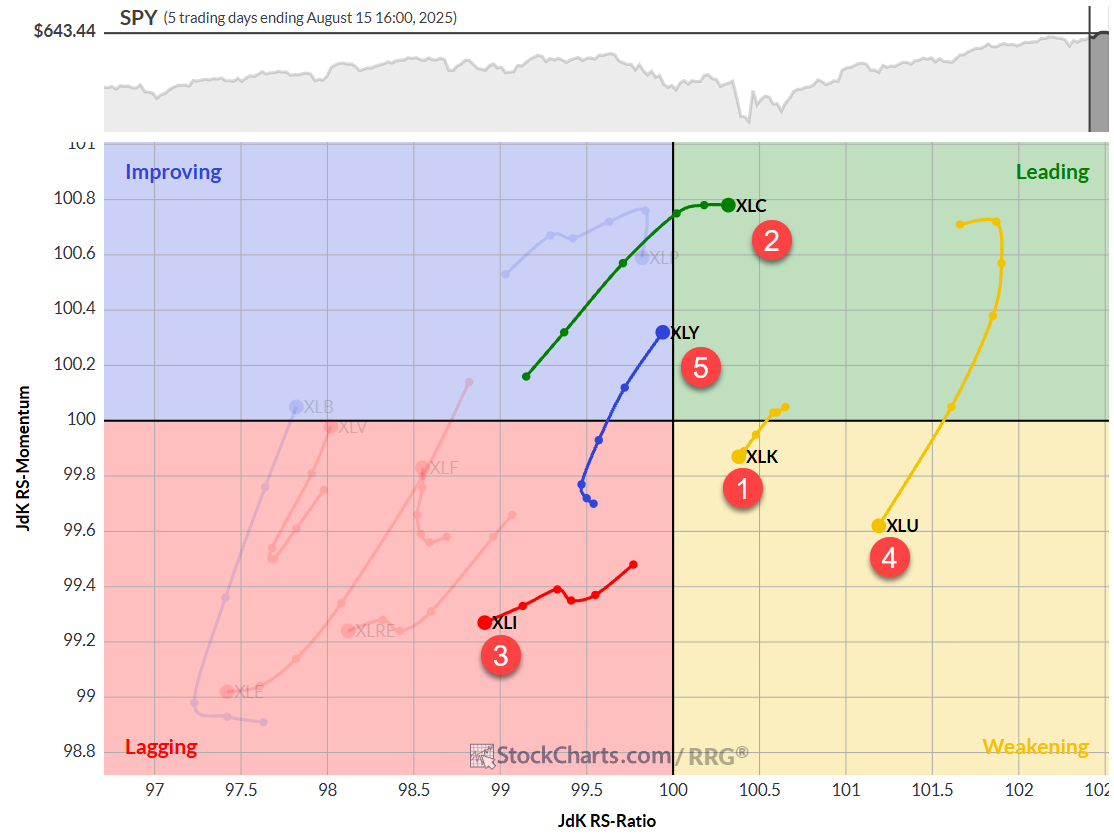

Daily RRG

Shifting to the daily RRG, we get some additional context:

- Technology just tiptoed into the weakening quadrant

- Communication Services pushed into the leading quadrant, explaining its weekly ranking jump

- Industrials sits in lagging, but its strong weekly tail compensates

- Utilities travel with a negative heading on a long tail in weakening

- Consumer Discretionary is making a strong move, nearly crossing into leading

This daily view helps reconcile some of the apparent contradictions in the weekly picture, particularly for Communication Services and Utilities.

Technology

Technology (XLK): Still strong, though losing some relative momentum. There's room for correction without damaging the uptrend.

Communication Services

Communication Services: The sector made a surprise move to new highs last week. The RS line has bottomed out within a trading range; a breakout here could signal renewed strength.

Industrials

Industrials: Price remains stable above the breakout level, but RS is dropping and testing former resistance as support. The apex of the former triangle formation will likely be a critical juncture.

Utilities

Utilities: Holding well above its breakout level (~$86 vs. $83.50), with RS stable within its trading range.

Consumer Discretionary

Consumer Discretionary (XLY): Showing a nice price breakout, unlocking potential upside. RS line is holding at the previous low and potentially moving higher, indicating a promising outlook supported by improving RRG lines.

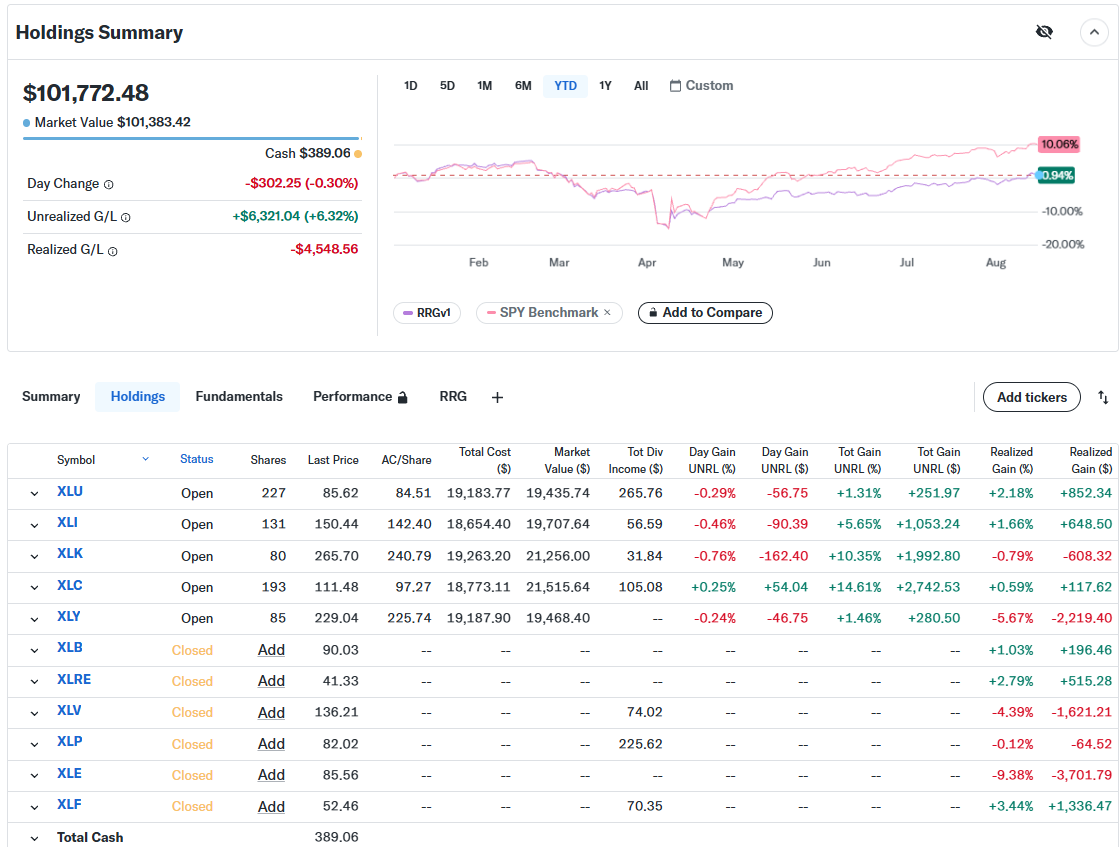

Portfolio Performance

The Portfolio performance remains static, still about 9% behind the S&P 500. However, the lack of recent significant changes could be seen as a positive; I am still waiting for more meaningful relative trends to emerge.

#StayAlert and have a great week, -Julius