The Best Five Sectors This Week, #33

Key Takeaways

- Technology remains top sector, but is losing relative momentum.

- Consumer discretionary climbs to #4, pushing utilities down to #5.

- Communication services and consumer discretionary show strength on daily RRG.

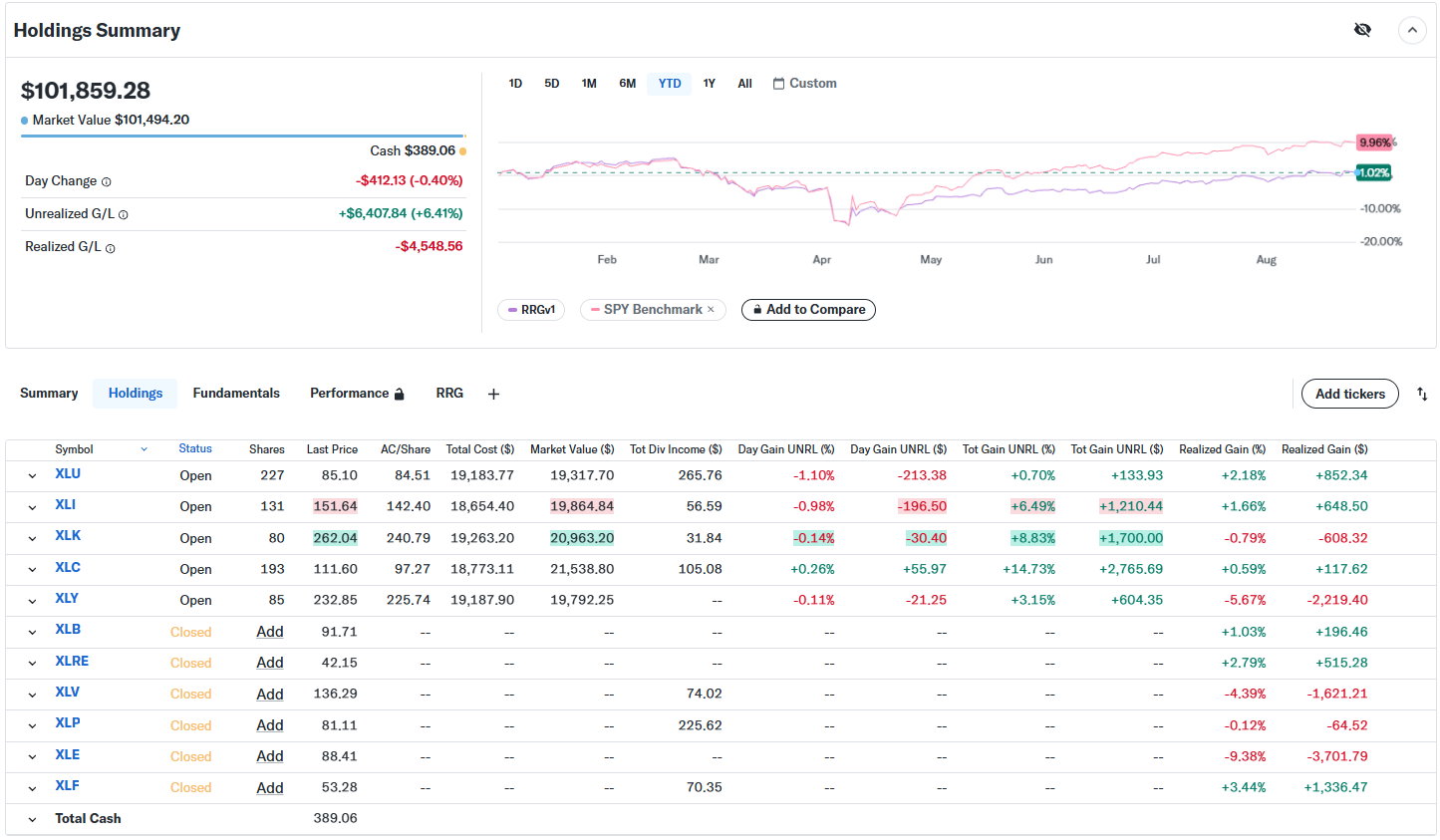

- Portfolio performance gap with S&P 500 holds steady at ~9%.

After a quiet week with virtually no change for the S&P 500, the sector ranking remains stable. There were no changes in the composition of the top 5, and only two position swaps.

In the top 5, XLY moves to #4, pushing down XLU to #5, and in the lower half of the ranking, XLE moves to #9, pushing XLRE down to #10.

- (1) Technology - (XLK)

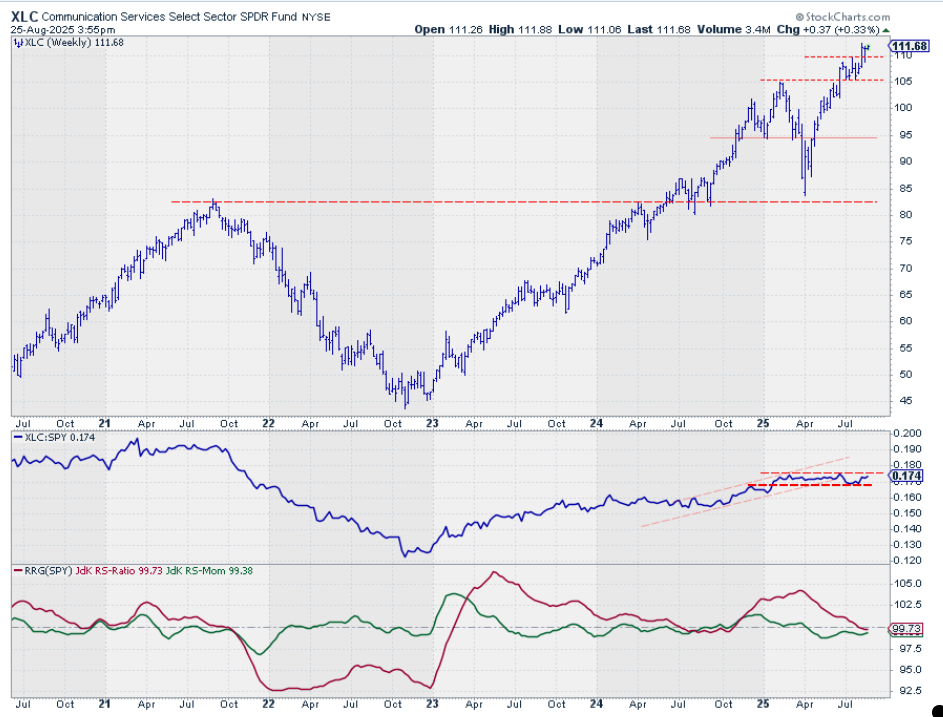

- (2) Communication Services - (XLC)

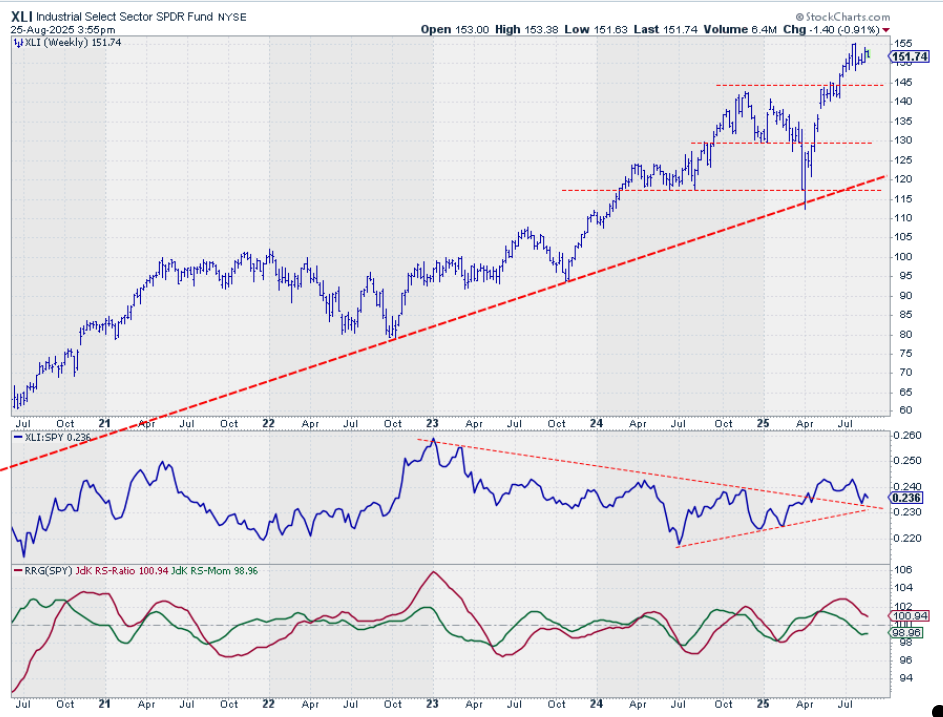

- (3) Industrials - (XLI)

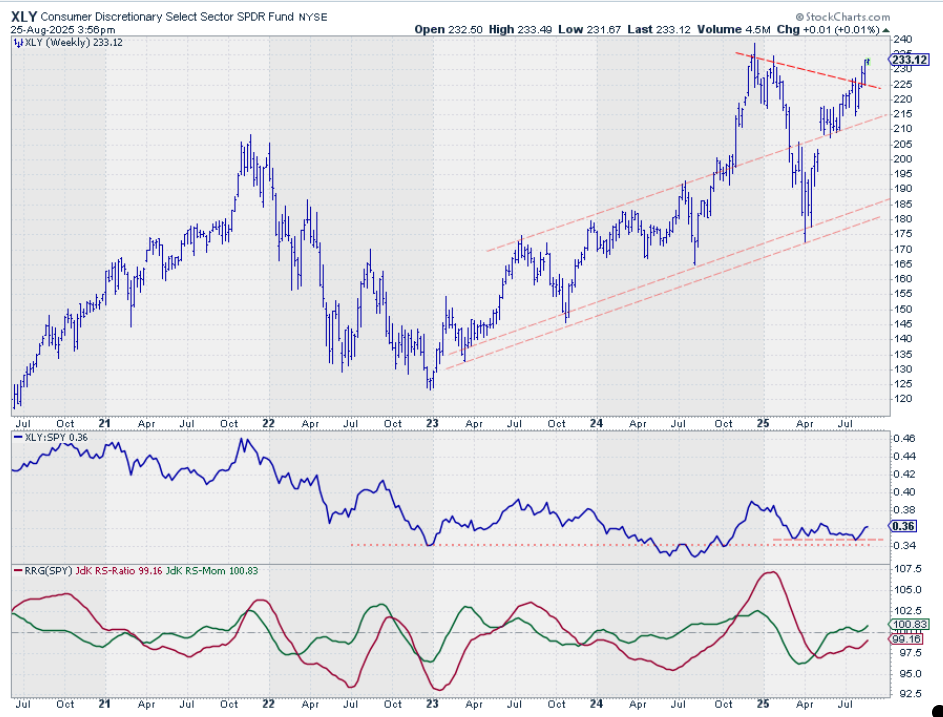

- (5) Consumer Discretionary - (XLY)*

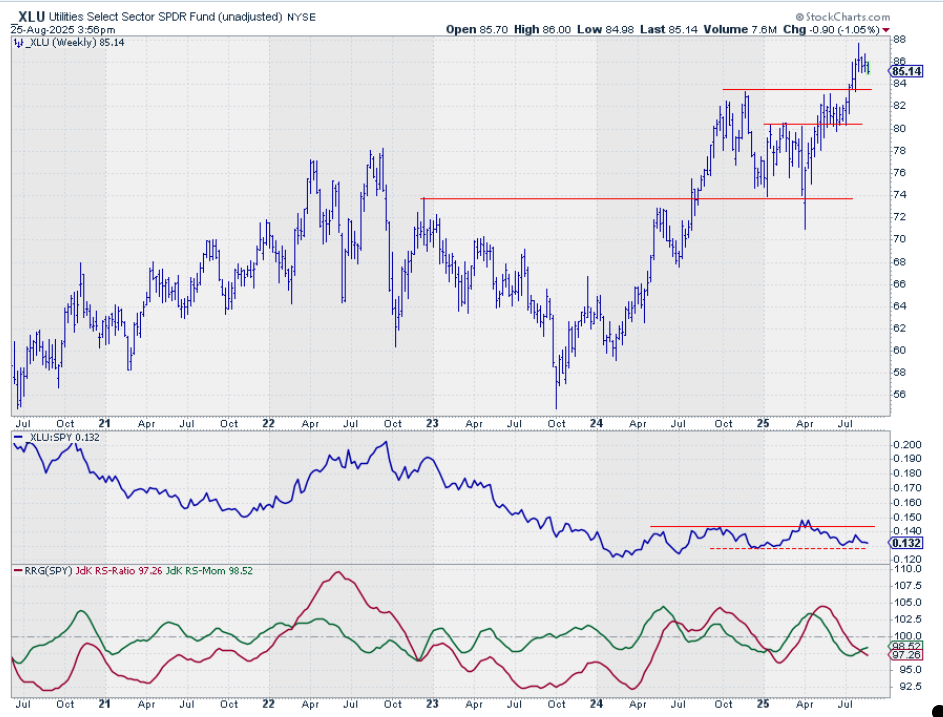

- (4) Utilities - (XLU)*

- (6) Financials - (XLF)

- (7) Materials - (XLB)

- (8) Consumer Staples - (XLP)

- (10) Energy - (XLE)*

- (9) Real-Estate - (XLRE)*

- (11) Healthcare - (XLV)

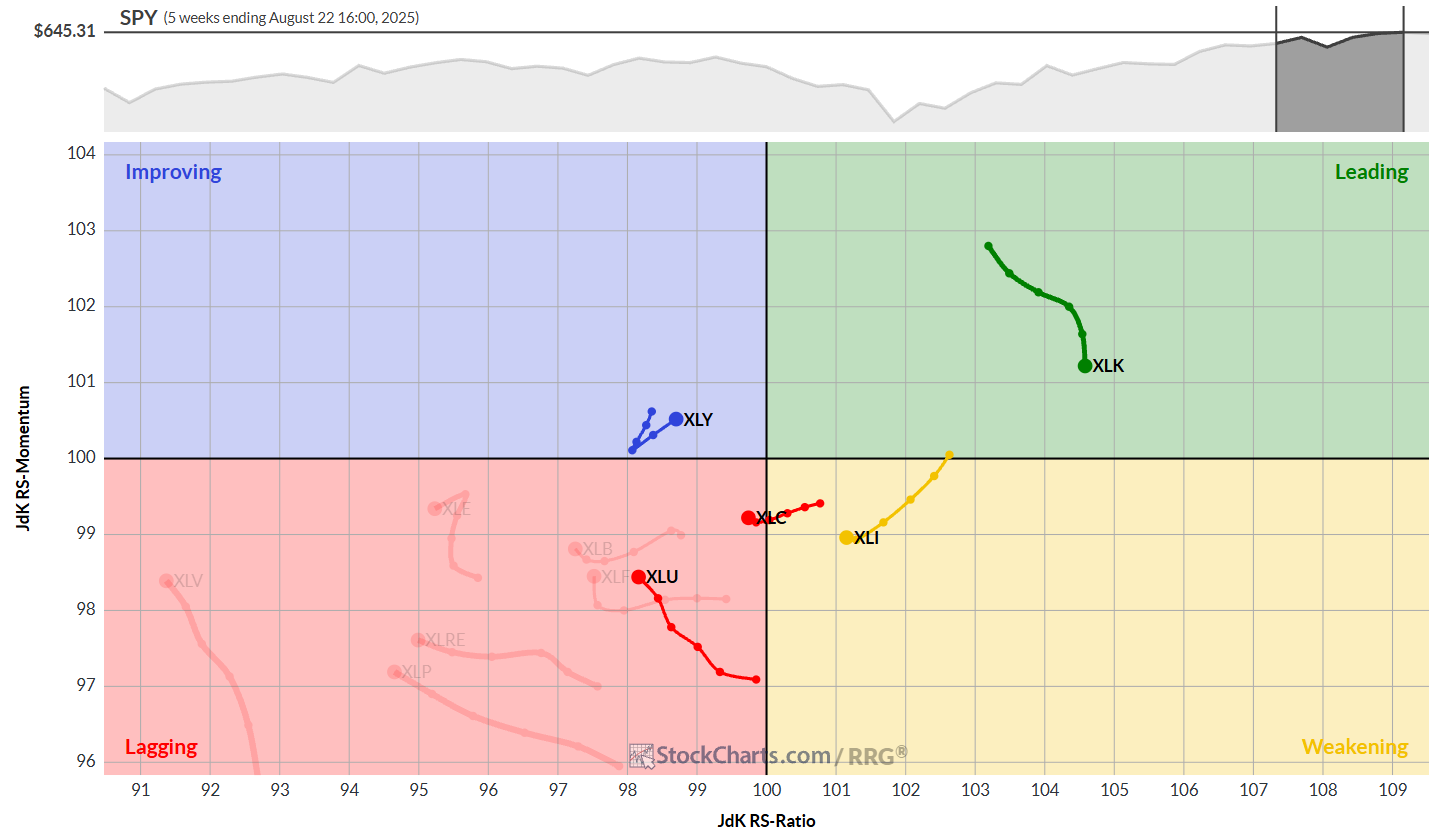

Weekly RRG

On the weekly Relative Rotation Graph (RRG), Technology, our lone ranger in the leading quadrant, continues to lose relative momentum. It's still king of the hill, but the crown is looking a bit wobbly, imho.

Industrials is well into the weakening quadrant, heading towards lagging at a negative RRG Heading. Communication services have already made the leap into lagging on this timeframe – not a great look, but let's not write it off just yet, as the daily tail is picking up strength, which can spill over to the weekly.

On a more positive note, consumer discretionary is showing some moxie. It's hooked back up into a positive heading two weeks ago and is now eyeing the leading quadrant. Utilities is lurking in the lagging quadrant, but has been consistently picking up relative momentum over the past few weeks.

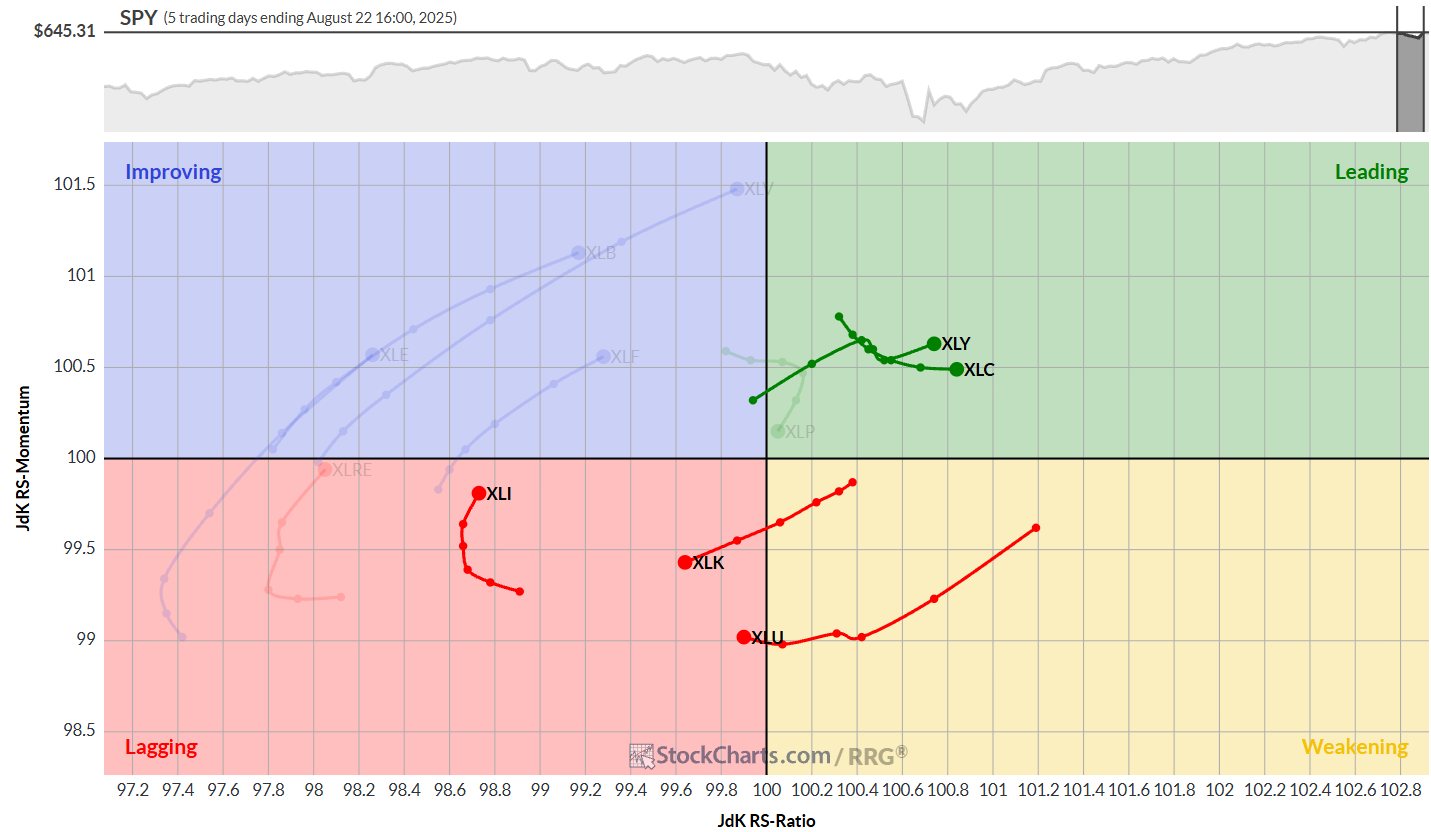

Daily RRG

Switching gears to the daily RRG, we're getting a slightly different read:

- Consumer discretionary and communication services are flexing in the leading quadrant.

- Utilities just crossed over from weakening to lagging.

- Technology is on a pretty strong downward move into lagging.

- Industrials, while still lagging, has curled back up and is heading towards improving.

The combination of this daily snapshot combined with the weekly results in the ranking that we are monitoring.

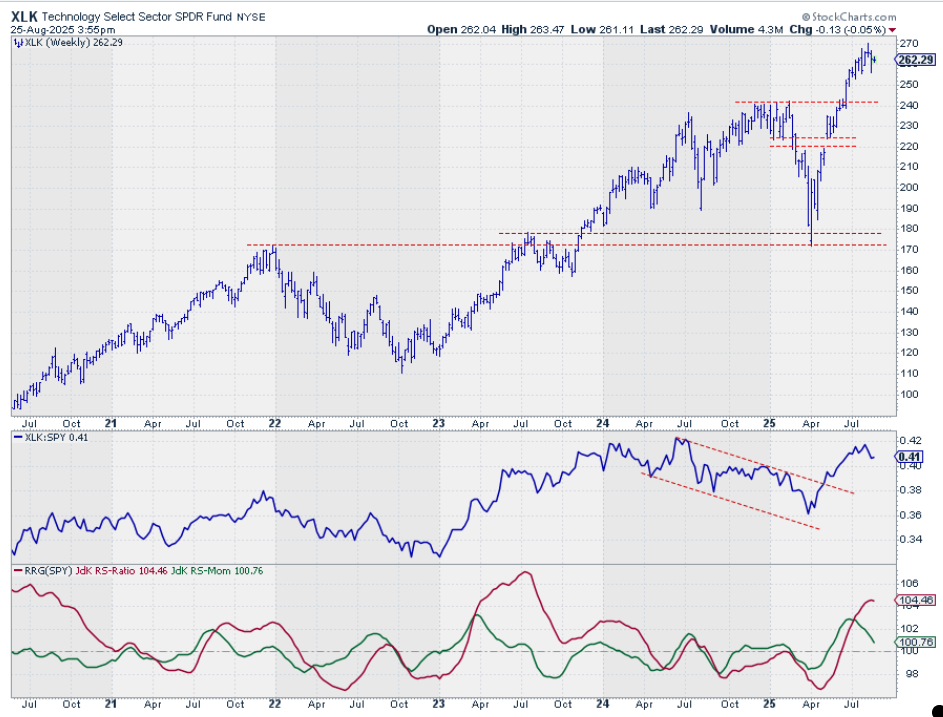

Technology

XLK is holding up well above resistance, and its relative strength chart just put in a small peak at the July high. A minor setback in both price and relative strength wouldn't be the end of the world here; it might even be healthy, before jumping beyond resistance.

Communication Services

XLC is looking solid after last week's upward break. The relative strength line, which had been moving sideways, is now pushing against the upper boundary of that range. If it can punch through, we might see those RRG lines curl back up.

Industrials

While XLI is holding up on the price chart, what's really catching my eye is the relative strength line. It seems to have bottomed out at the old falling resistance line. If this low holds, we've got a new higher low in the relative strength trend, a good sign for the continuation of the relative uptrend.

Consumer Discretionary

XLY is following through nicely after its upward break two weeks ago. The new low in relative strength is becoming more visible, and we've moved well off the support area just above 0.34. Both RRG lines are moving up, pushing XLY towards the leading quadrant.

Utilities

XLU had a so-so week, mainly trading sideways. It's still well above the breakout level, though, and the relative strength line remains within its trading range. Not exciting, but not terrible either.

Portfolio Performance

Again, no trades this week. The composition remains unchanged, and our performance gap with the S&P 500 is holding steady at around 9%. Not exactly setting the world on fire, but we're sticking to our guns and waiting for more significant relative trends to emerge.

#StayAlert, and have a great week, – Julius