Before CPI and PPI: 5 Things to Watch This Week

Key Takeaways

- Friday's softer jobs report boosted odds of a September cut with more priced in. Stocks sold off but remain above short-term trends.

- The S&P 600 Small Cap Index ($SML) is in an uptrend and above its 21-day EMA. Look for a move above resistance with expanding breadth.

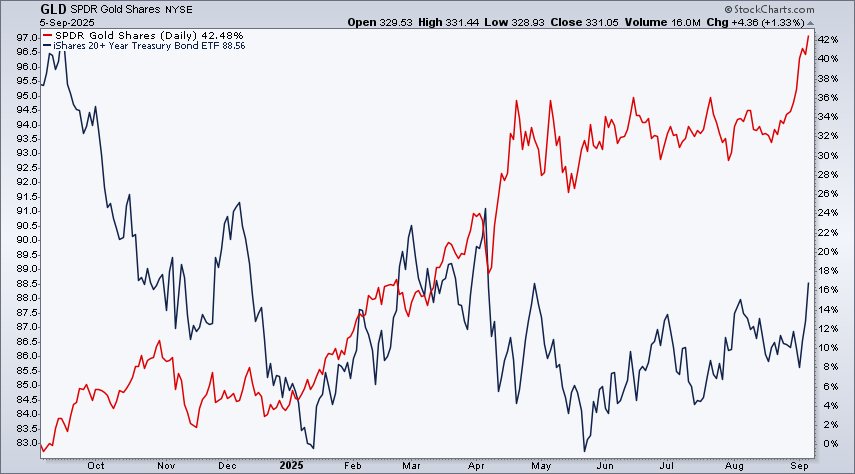

- Bond prices rose while gold continued to reach record highs. The two are moving in tandem.

Friday’s jobs report came in softer than expected. The cooling job market has traders and investors betting the Fed will cut rates in September, with two more 25 basis-point cuts likely in October and December.

Stocks popped at the open but gave up those gains about an hour into the trading day. Here’s where the big three indexes finished:

- S&P 500 ($SPX): 6,481.50 (-0.32%)

- Nasdaq Composite ($COMPQ): 21,700.30 (-0.03%)

- Dow Industrials ($INDU): 45,400.86 (-0.48%)

Why it matters: Lower rates mean more favorable borrowing terms, which help smaller companies the most. That’s why you should watch small-caps closely.

Trend Check: Still Above Short-Term Support

Despite Friday’s selloff, the S&P 500, Nasdaq, and Dow are still above their 21-day Exponential Moving Average (EMA). The S&P 400 Mid Cap Index ($MID), S&P 600 Small Cap Index ($SML), and Nasdaq 100 ($NDX) closed higher.

In a falling interest rate environment, you want to see small-caps gain strength because they tend to be more interest-rate sensitive than large-cap stocks.

Small Caps: Quietly Climbing

The daily chart of the S&P 600 Small Cap Index ($SML) below shows that the index is in an uptrend and trading above its 21-day EMA. About 61% of $SML stocks are trading above the 200-day Simple Moving Average (SMA), and advancers outnumber decliners. Both are signs of healthy breadth in small-caps.

Note that $SML is approaching the resistance of its January–February highs (horizontal blue dashed line). If it breaks above that area, the next logical target is the November 2024 high.

A healthy uptrend in small-cap stocks will complement an upward move in the overall market. Ahead of the September 17 Fed meeting, investors should keep an eye on the performance of small-cap stocks.

Small But Showing Some Steam

The chart below displays the relative performance of the SPDR Portfolio S&P 600 Small Cap ETF (SPSM) vs. the SPDR S&P 500 ETF (SPY). While SPSM is still underperforming SPY, the trend in the ratio is turning up, which is a sign that small-caps are trying to catch up.

Beyond Stocks

With three rate cuts now priced in for the year, bond prices made a significant upside move on Friday. The 5-year weekly chart of iShares 20+ Year Treasury Bond ETF (TLT) below shows that bond prices have a long climb ahead.

A break above the 40-week SMA (roughly the 200-day on a weekly chart), plus a rise in the ICE MOVE Index ($MOVE), which is a measure of bond volatility, would add confidence that the uptrend in bonds is in play.

Meanwhile, gold continues to grind higher. The performance chart of gold vs. bonds shows that more recently, the two are moving higher in tandem. This is typical of a slower growth and falling interest rate environment.

The Bottom Line

This week’s price action in the stock market was in line with the macro backdrop. Next week, we get the August PPI and CPI. Those inflation numbers could nudge the Fed’s path, but it’ll take a big surprise to “upset the apple cart.”

Keep your eyes peeled on the charts in this article as we head into next week.

End-of-Week Wrap-Up

Stock Market Weekly Performance

- Dow Jones Industrial Average: 45,400.86 (-0.32%)

- S&P 500: 6,481.50 (+0.33%)

- Nasdaq Composite: 21,700.39 (+1.14%)

- $VIX: 15.20 (-1.04%)

- Best performing sector for the week: Communication Services

- Worst performing sector for the week: Energy

- Top 5 Large Cap SCTR stocks: Credo Technology Group Holding, Ltd. (CRDO); Celestica, Inc. (CLS); Astera Labs, Inc. (ALAB); MP Materials Corp. (MP); Oklo Inc. (OKLO)

On Our Radar Next Week

- August PPI

- August CPI

- September Consumer Sentiment

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.