Silver's Big Breakout: Is This Move Just Getting Started?

Key Takeaways

- Stocks are quietly climbing as the Santa Claus Rally gets underway

- Precious metals are leading the action, with silver dramatically outperforming gold

- Silver's momentum is still strong, but big moves can come with sharp pullbacks

The Santa Claus Rally is underway, and so far, it looks like Wall St. could be landing on Santa’s nice list.

It’s still early, but the S&P 500 ($SPX) appears to have energy left for another push higher. A lot of “under the hood” data looks encouraging, too. Market breadth remains bullish, and investor sentiment remains upbeat. Volatility is staying low, which makes sense during this quiet stretch of the year. There aren’t many big events on the calendar right now to shake things up. The stock market is slowly but steadily grinding higher, which is what it often does in late December.

Precious Metals Are Stealing the Spotlight

While stocks are inching forward, the real stars right now are precious metals. Gold, silver, copper, and platinum have all been on a serious run.

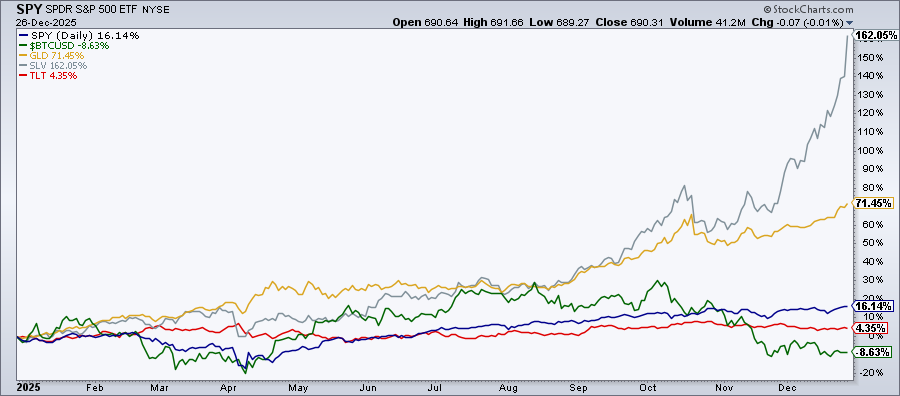

Gold and silver are the two metals stock traders keep a close eye on, and both have been relentless this year. The chart below paints a clear picture of how much SPDR Gold Shares (GLD) and iShares Silver Trust (SLV) have surged.

Over the last year, GLD is up over 70% and SLV is up more than 160%. These are major moves!

Silver is Outrunning Gold

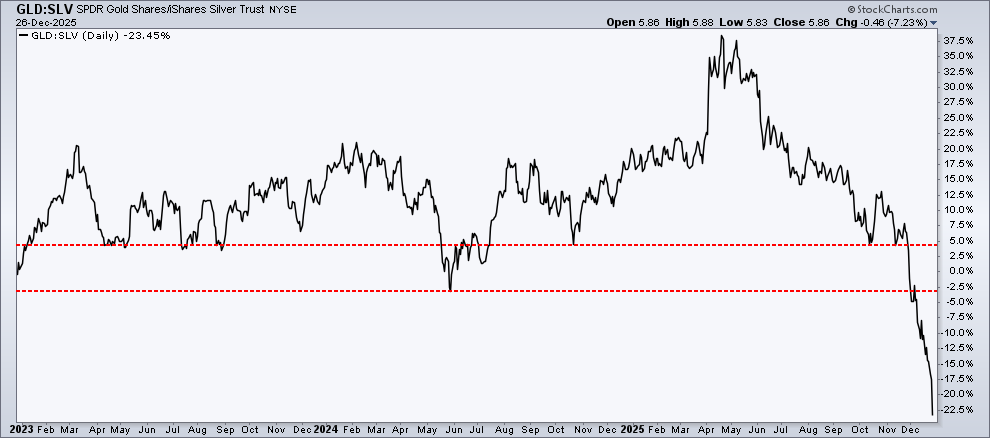

One of the more interesting signals right now is the GLD:SLV ratio. Right now, it’s at -23.45%, meaning silver has outperformed gold by a significant margin. It’s a level we haven’t seen since 2013.

What’s driving silver? Part of the story comes from industrial demand. Silver is a key component in the solar, medical equipment, and AI-related industries. This demand gives the white metal a tailwind that gold doesn’t necessarily have.

Silver’s explosive rise has been one of the biggest market stories of 2025. Yes, it had pauses along the way (consolidation zones in blue) but, since late November, SLV has been on a powerful move, and it’s been doing it with serious momentum.

The Relative Strength Index (RSI) has mostly stayed above 70 as the Percentage Price Oscillator (PPO) continues to rise higher. Both signal strong momentum. Friday’s move was especially dramatic, with SLV gapping higher, gaining more than 8%, and closing near the top of its range. Even more impressive is that volume was the highest SLV has seen in the last year, on what was a light trading day.

How much higher could silver go? That’s a million-dollar question. Right now, the PPO and RSI aren’t showing signs of slowing down, and as long as that stays true, SLV could continue to move much higher.

But moves like this don’t go straight up forever. Strong trends often come with sharp pullbacks along the way. If you start to see divergences between the price action and the indicators, that would be the first sign of a potential pullback. In the past, SLV has pulled back to its 21-day EMA and sometimes crossed below it. But momentum built up, and it continued rising. A run like this can feel like the sky’s the limit.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.