Breaking Out: Cigna's Post-Earnings Recovery Just Getting Started

After spending months trapped below $280, Cigna (CI) just punched through resistance.

CI has rallied hard from the post-earnings low of $270 and is breaking cleanly above the $280 resistance level that capped it for four months. Even better, the relative strength is confirming the break, which indicates that Cigna is starting to outperform the broader market with the breakout.

For a stock that got hammered on a Q4 earnings miss, this breakout signals something shifting beneath the surface.

The Overreaction That Created the Setup

January 30: Cigna reported 27% revenue growth, 9% EPS growth, and $8.6 billion returned to shareholders. But Q4 EPS missed by 14.7% ($6.64 vs $7.79 expected) due to an unexpected spike in stop-loss medical claims.

The selloff was swift. Down 6.7% pre-market. Analyst downgrades. Price targets slashed.

Here's what the market missed: Cigna executive Brian Evanko explained that stop-loss is a full-year product, and the issue was identified late in Q4, which is why the entire impact hit earnings all at once. This wasn't a structural breakdown or a systemic problem; it was a pricing recalibration.

Management's plan is straightforward: recapture roughly 100 basis points of margin over two years, with most of it in 2026.

Meanwhile, the rest of the business is thriving:

- Evernorth (PBM/Specialty), Cigna's high-margin crown jewel, grew revenue 14% in 2024.

- Medicare divestiture closed on March 19 for $3.3B, with proceeds going to share buybacks.

- $8.6B returned to shareholders in 2024, with billions more coming from the Medicare sale.

- Analyst consensus: Still "Strong Buy" with average PT $329 (11%+ upside from here).

The stop-loss issue was real, but fixable. The market overreacted to a one-time hit in a diversified healthcare giant with a dominant PBM, aggressive buybacks, and a streamlined portfolio.

How to Trade the Breakout with Options

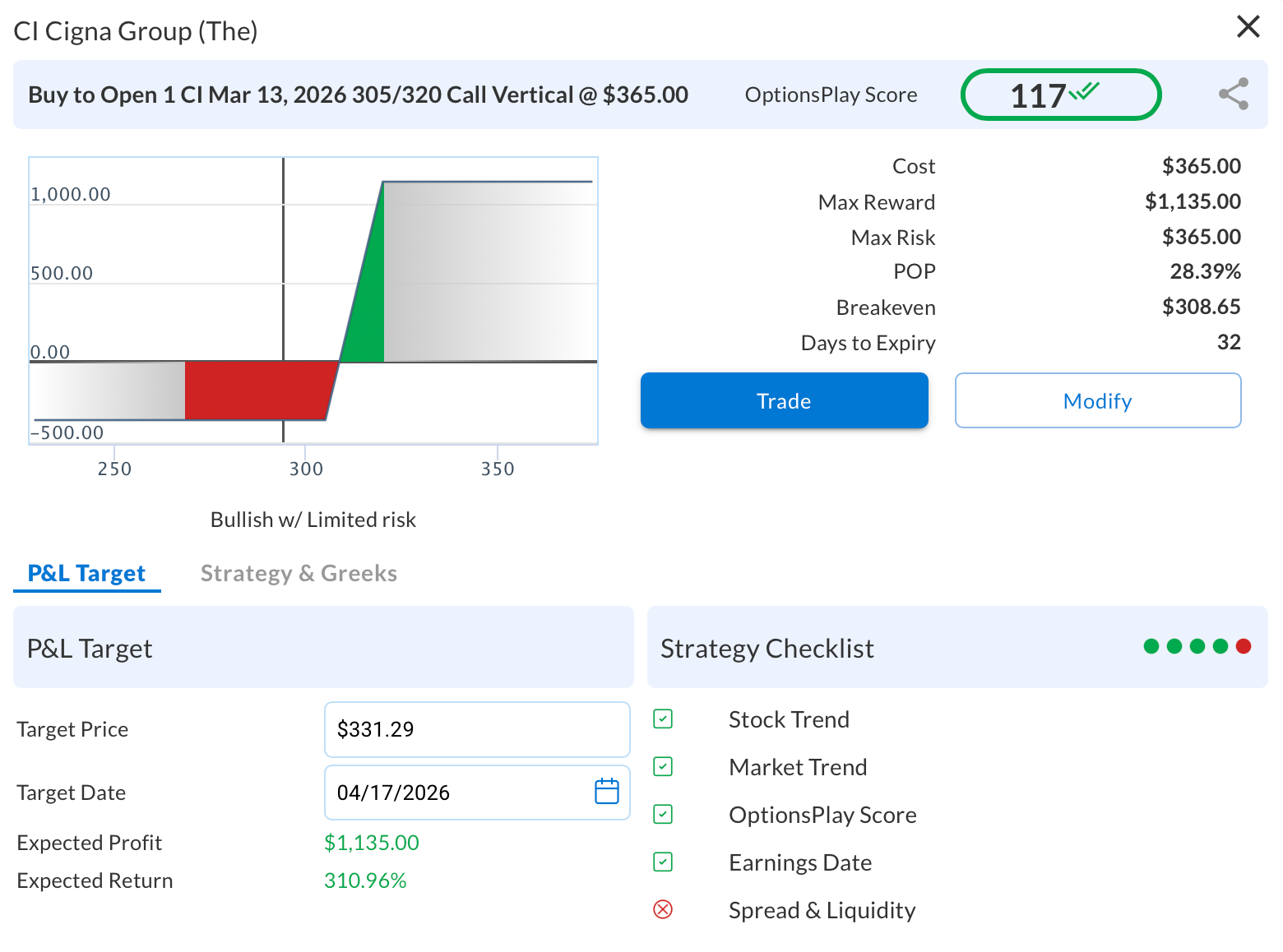

- Buy the March 13 $305/320 Call Vertical @ $3.65 Debit

- Buy $305 Call

- Sell $320 Call

- Max Risk: $365 per contract if CI is below $305 at expiration

- Max Profit: $1,135 per contract if CI is above $320 at expiration

- Breakeven: $308.65 (4.84% above current price)

- Risk/Reward: 3.1 to 1

- OptionsPlay Score: 117

Why This Setup is Compelling

Asymmetric payoff. Risk $365 to make $1,135. The stock just broke multi-month resistance and is showing improving relative strength. If the breakout holds and CI continues recovering toward the $329 analyst consensus, this spread captures substantial upside.

Technical + fundamental alignment. CI broke above $280, a level it failed at repeatedly from September through January. The breakout coincides with improving relative strength vs the S&P 500, and the fundamental picture (stop-loss recovery + buyback acceleration) supports continuation.

No earnings risk. Cigna doesn't report until May, well after the March 13 expiration. You're not exposed to another guidance cut.

Valuation still has room to run. Even at $294, CI is still well below its September highs ($345+) and below analyst targets. The 28% probability of profit reflects needing a 5% move in 31 days but, with the stock already up 8%+ from post-earnings lows and breaking out technically, the 3.1-to-1 payoff rewards you handsomely if the recovery continues.

Finding Trades Like This in Under 5 Seconds

Here's the traditional workflow most options traders us to find setups like this.

- Scan for bullish breakouts → 50-100 stocks

- Research fundamentals → Narrow to 10-15

- Analyze options chains → Check liquidity

- Build spreads → Calculate risk/reward

- Compare → Pick the best one

Time: 3-5 hours.

Confidence: Low to Medium (always wondering what you missed).

Here's how we found the setup:

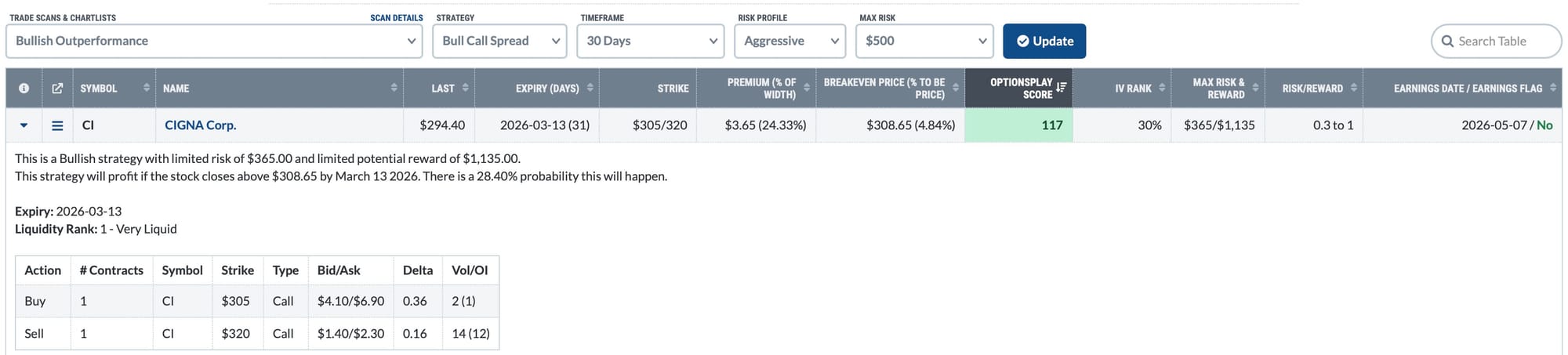

In the OptionsPlay Strategy Center, select the following:

- Scan: Bullish Outperformance

- Strategy: Bull Call Spread

- Timeframe: 30 Days

- Risk: Aggressive

Then click Update.

Time: 5 seconds.

Result: CI at the top with Score 117.

The Strategy Center scans for stocks with bullish breakouts, liquid options, optimal strikes for current IV, and best expirations for theta/time value balance. Instead of hoping good stocks have good options trades, you start with the best options opportunities, and then validate the thesis.

For CI:

✅ Breakout above resistance

✅ Stop-loss recovery + buybacks

✅ 3.1-to-1 risk/reward

✅ No earnings risk

That's not just speed. It's confidence you're working from the strongest setups in the market.

The Bottom Line

Cigna got oversold on a fixable problem. The stop-loss issue was real, but management's addressing it. Evernorth's pharmacy and specialty services, their core business, keeps growing. The Medicare divestiture is done. Billions in buybacks are coming.

The stock just broke above $280 resistance and is outperforming the market. The $305/$320 bull call spread captures the next leg with 3.1-to-1 payoff and no earnings risk.

CI wasn't found by luck or research. It was found in five seconds using OptionsPlay Strategy Center, starting with the best options opportunities and validating the thesis. That's the workflow transformation.