China Tech Breakout: Alibaba Sparks a FXI Rally Despite Powell's Warning

Key Takeaways

- The AI boom has spread overseas, all the way to emerging markets

- The stock price of Alibaba spiked 9% after the Chinese tech giant announced $50 billion in additional AI investments

- The FXI China Large-Cap ETF now eyes all-time highs, perhaps sooner rather than later

Fed Chair Powell poured cold water on the hot stock market in his Tuesday speech to the Greater Providence Chamber of Commerce. Some dubbed it his “irrational exuberance” moment, stating that stock prices appear “fairly highly valued.”

How did the S&P 500 respond? It fell, but selling was by no means intense. It was even a stretch to describe the afternoon retreat as a garden-variety September decline. By Wednesday morning, AI enthusiasm was back in the spotlight, this time thanks to a key partnership inked between Alibaba (BABA) and NVIDIA (NVDA). The deal wasn't on the scale of what Jensen Huang and Sam Altman announced on Monday, but the Chinese tech giant will integrate NVIDIA’s AI tools into its cloud software.

BABA and FXI: A Dual Signal of Market Revival

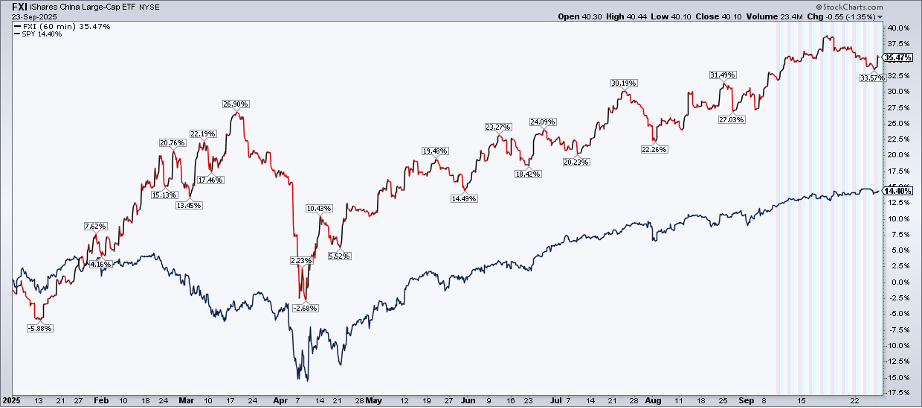

NVDA was little changed, but BABA ADRs soared 9% in U.S. pre-market trading. The agreement was well-timed, too. The iShares China Large-Cap ETF (FXI) had been down four sessions running heading into Wednesday, the longest losing streak since late July into early August.

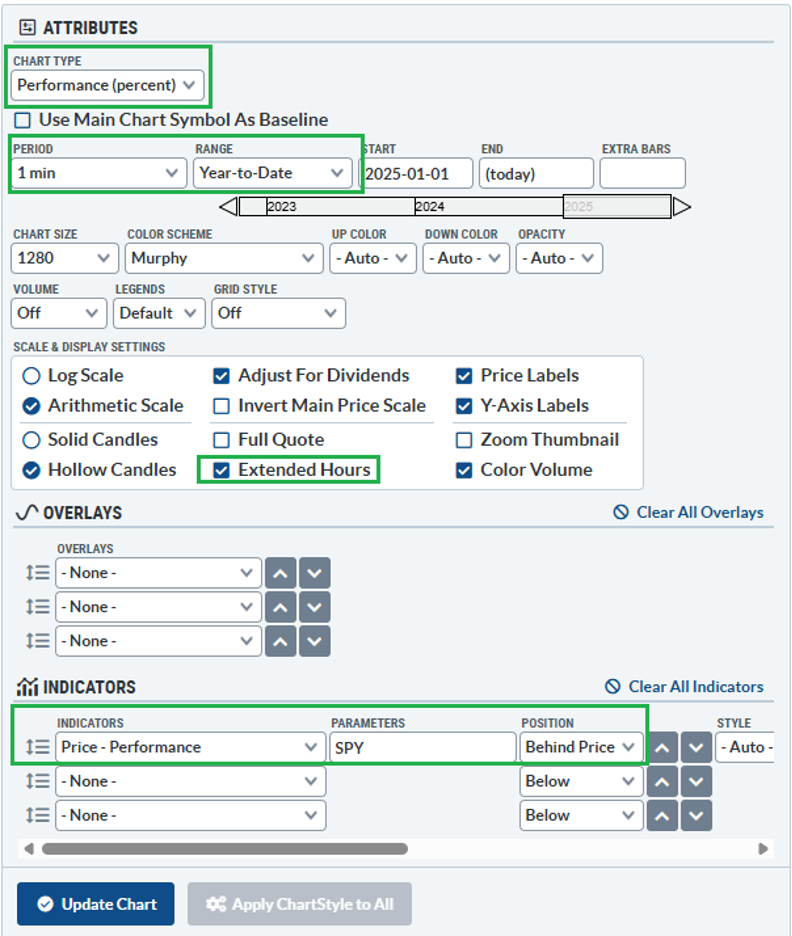

When I perform my early-morning macro market and price action checks, there's one tool that helps me see the big picture. On SharpCharts, I encourage traders to apply the “Extended Hours” feature. Simply check the box and ensure the chart timeframe is set to a more granular interval than daily. My preference? A “Performance (percent)” chart type with a “1 min” period. With those settings, you can immediately view how a security is faring with the pre-market activity incorporated.

Applying that procedure, FXI was up 35.5% (dividends included) year-to-date once the Alibaba-NVIDIA news crossed the wires and was digested. We can take our charting analysis to the next level by superimposing another security for a relative performance comparison. My default when analyzing foreign country ETFs is to put them head-to-head with the S&P 500 ETF (SPY). Here, the FXI chart is even more revealing, illustrating more than 20 percentage points of alpha versus the U.S. large-cap ETF.

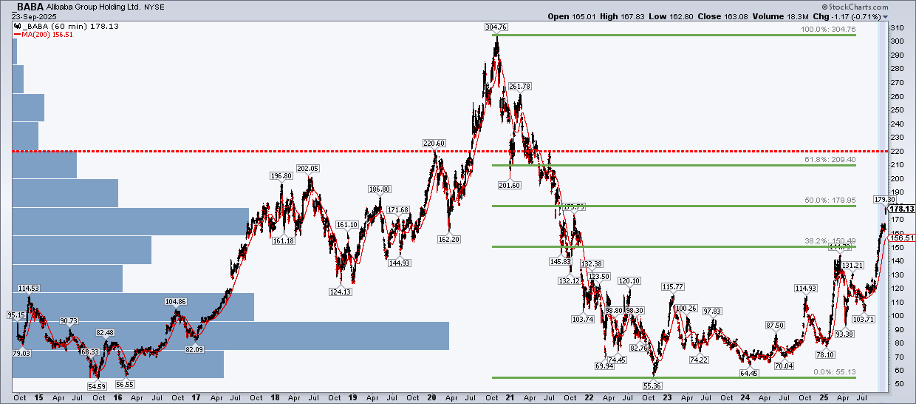

So, there's your ChartSchool for today. Let's shift gears and attempt to forecast price. On the heels of $50 billion in incremental AI investment headlines, the stock surged to its highest level since August 2021. Said another way, BABA has returned 0% for more than four years. That tells me its bearish-to-bullish reversal may still have room to run.

BABA Price Target: Is the Runway Clear?

Notice in the chart below that the all-time high is above $300, notched way back in October 2020. A brutal bear market played out over the ensuing 24 months. Shares plunged a whopping 82% peak to trough as the Chinese economy sputtered during and after the COVID-19 pandemic. But BABA has now 3x’d in less than three years.

Recall that barely more than a year ago, the Chinese Politburo unleashed a massive stimulus program, prompting an equity resurgence. Though the rally has had its fits and starts over the past 12-plus months, here we are at fresh rebound highs for both BABA and FXI.

I also applied the “Volume by Price” overlay to better sense where there may be a significant amount of potential supply or demand. Dating back to BABA’s September 2014 IPO, there really isn't a significant supply level above $180, which bodes well for a continued advance.

For BABA, I would not be surprised to see the stock ascend to $220 in the year ahead. That was where the tech giant paused in January 2020 and where it met selling pressure on a corrective upswing in July 2021. We'll also have to watch the $210 spot — that's the 61.8% Fibonacci retracement level of the 2020-2022 bear market. Keep in mind that 50% is not a traditional Fibonacci number, so I would downplay the significance of BABA being smack-dab at the recovery midpoint.

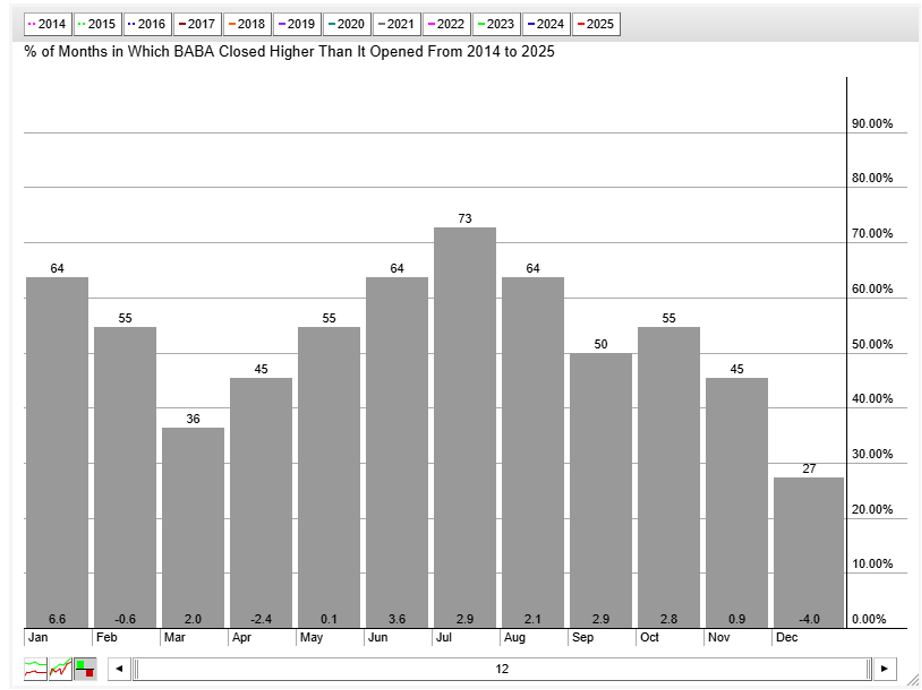

Finally, the $400 billion Consumer Discretionary stock has historically performed well in October and November, rising an average of 2.8% and 0.9% respectively since 2014. December has not been so jolly, however, with a 4% average loss.

Will FXI Reach Its All-Time High?

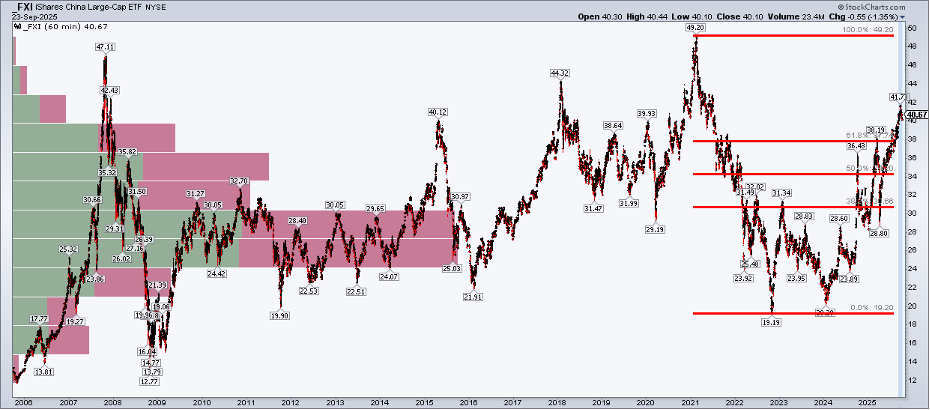

Zooming out, top-down traders may be more interested in FXI trends. Here, I see similar bullish clues. The all-time high of $49.20 reached in early 2021 is certainly in play as we approach the end of 2025. A 20% climb from current levels may seem ambitious, but Chinese equity rallies tend to be sharp when they occur.

Today, with a high amount of volume under the current $40.65 level, there may be ample cushion if shares dip. FXI’s 61.8% Fibonacci retracement is now below today’s price, too, putting the record level in the bulls' crosshairs.

The Bottom Line

China was dubbed “uninvestable” years ago, and that sentiment persisted even after its stock market bottomed in September 2024. Now, the bulls appear to be in charge. FXI has outpaced the S&P 500 year-to-date, and major AI investment is fueling a new wave of optimism. I expect BABA’s bull run to continue, lifting FXI, and potentially emerging markets more broadly.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.