Delta is Winning the "K-Shaped" Recovery

For the last six months, the airline trade has been a story of "haves" and "have-nots." While budget carriers struggle with thin margins and price wars, the legacy carriers are pivoting hard to where the money is: the premium traveler.

And Delta Air Lines (DAL) just proved this thesis in their Q4 2025 earnings report released last week.

While the headline market reaction was tepid due to conservative 2026 guidance, the underlying numbers tell a massive bullish story. Delta isn't just selling seats; they are selling an ecosystem. Management revealed that premium and loyalty revenue now accounts for nearly 60% of their total revenue. The "Do-It-For-Me" corporate traveler is back, and the American Express partnership is printing cash, insulating Delta from the slowing "DIY" leisure economy.

The Opportunity: The market's knee-jerk reaction to the guidance has pushed the stock down 4% this week, creating a disconnect between price and value. The fundamental engine is firing on all cylinders, but the stock is trading at a discount. This is exactly the kind of setup I look for: a structural winner on a temporary pullback.

Rather than just buying the stock and hoping for a bounce, though, I instead used the OptionsPlay integration to structure a trade that pays me even if the stock stays flat.

The Technical Signal

The fundamental thesis is strong, but the technical entry is even better.

After a strong run into year-end 2025, DAL has pulled back to the $67–$68 level, a zone that has acted as a launchpad for buyers in the past. We are seeing a classic "Bullish Trend Following" setup. The primary trend remains up, but the short-term momentum has washed out the weak hands. The stock is now testing key support, and the selling pressure is drying up — a perfect spot to sell expensive downside premium.

The Perfect Trade Execution

Buying calls here would be risky. If the stock consolidates for two weeks, time decay will eat your profits. Instead, I wanted a strategy that puts time on my side.

With that in mind, I plugged my bullish outlook into the OptionsPlay strategy engine, from which it optimized a Bull Put Spread.

The Trade:

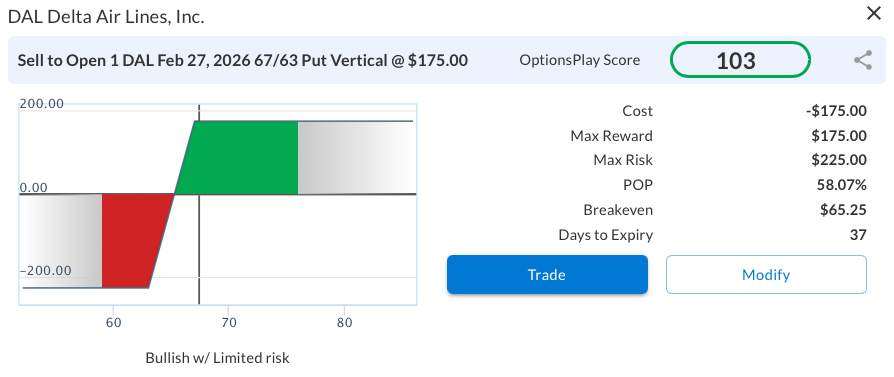

- Strategy: Bull Put Spread

- Expiry: Feb 27, 2026

- Trade: Sell $67 Put / Buy $63 Put

- Net Credit: ~$1.75

- Breakeven: $65.25

Why this trade is a standout: The math on this trade is incredible. Because implied volatility is slightly elevated post-earnings, we are collecting $1.75 in credit on a $4.00 wide spread.

That means we are generating a return on risk of over 75% if DAL simply stays above $67 by late February. Even if the stock drops another 3% to $65.25, we still break even. We don't need a massive rally; we just need the floor to hold.

How I Found This Trade

Normally, finding a credit spread that yields 40%+ of the width of the spread takes hours of hunting through option chains. You have to check liquidity, calculate the Greeks, and ensure the risk/reward makes sense.

I found this DAL trade in under 5 seconds.

All I needed to do was open the OptionsPlay Add-On, select the "Bullish Trend Following" scan, and choose “Bull Put Spread” as my preferred strategy. From there, the tool instantly scanned thousands of combinations and surfaced Delta (DAL) as a top-ranked opportunity with a score of 104. It recognized that the premiums were unusually rich relative to the risk, matched it with the technical support level, and presented the optimal strike prices on a silver platter.

The "analyst" side of me loves the Delta fundamentals. The "trader" side of me loves that I found the perfect way to monetize them without doing any of the math myself.

Let the math find trades just like this for you with the OptionsPlay Add-On.

Add the OptionsPlay Add-On for StockCharts To Your Account.