Dow Theory Confirmed: Technology Holds Critical Support

There was no doubt in my mind that we were on the brink of a sell-off of major proportions at the close on Thursday. Right afterwards, Amazon.com (AMZN) reported its quarterly results and the stock immediately slumped 10% in after-hours. QQQ, the ETF that tracks the large-cap, technology-driven NASDAQ 100, fell 1% in after-hours, and the Technology Select Sector SPDR Fund (XLK) fell a similar percentage.

The bulls had their backs against the wall.

Futures improved overnight on Thursday, and the major indices opened in positive territory. WHEW! It was a close call, but the bulls managed to hold serve, and enthusiastic buying took place throughout the trading day on Friday. The Dow Jones Industrial Average ($INDU) gained over 1200 points and finished above 50,000 for the first time in history.

As $INDU closed an all-time high, at the same time, the Dow Jones Transportation Average ($TRAN) approached 20,000, also closing at a new all-time high. When the transports confirm the industrial average, it suggests strong economic conditions that support a further advance in our major indices. This is Charles Dow's theory, the foundation of technical analysis.

I believe the Dow Jones and the small-cap Russell 2000 could lead the market in 2026, at least for a while. Both of these indices are just healthier, pure and simple.

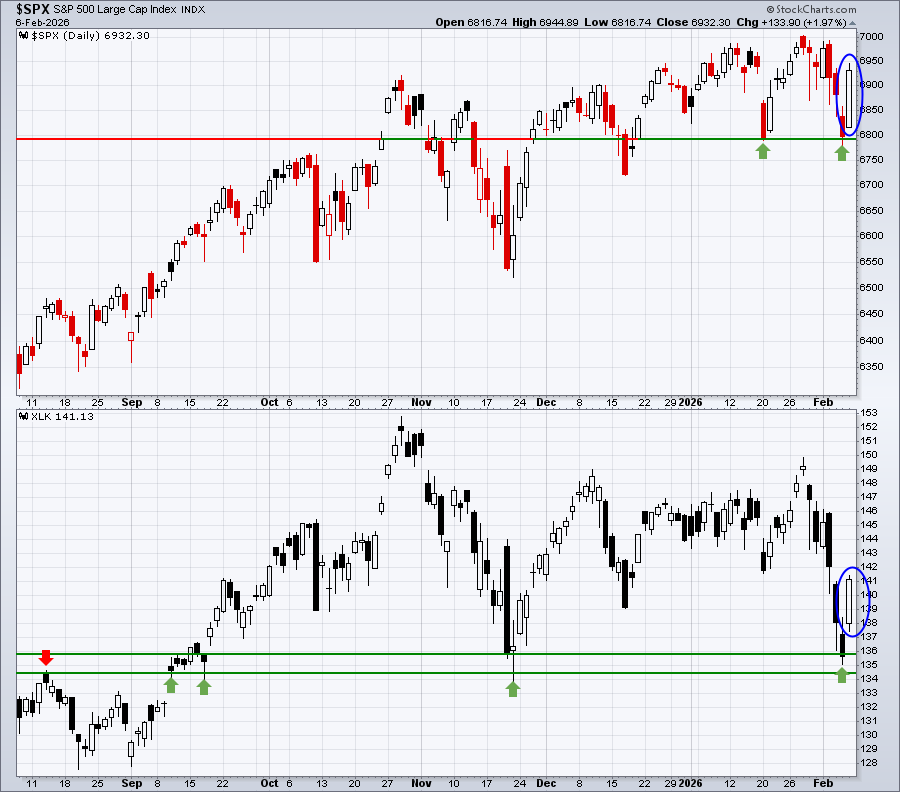

XLK is weak and underperforming. That has a much bigger impact on the S&P 500 and NASDAQ 100. But even XLK bounced back from a potential disaster. Check out the key support on the XLK and the S&P 500 in the chart below.

We tested both into Thursday's close and managed to barely hang onto support. The rally on Friday now gives the bulls some breathing room from these two critical price support levels.

We're not out of the woods by any stretch of the imagination, but it was very important to see the type of rally on Friday. If nothing else, it delayed a potential breakdown and possible trip into a correction.

Stock Fantasy Draft

Grayson Roze, Julius de Kempenaer, and David Keller will be joining me as guests for our first Super Bowley Fantasy Draft Challenge on Saturday morning, February 7th, at 10:00 am ET. It's been a WILD week of volatility, and now we're tasked with drafting 10 equal-weighted stocks to try to outgain our competition! It'll be loads of fun and lots of strategy involved. I know I'm already contemplating how much growth (risk) I'm willing to take over the next few months, given the current market environment, and I'm sure Grayson, Julius, and Dave are facing the same dilemma.

Do we go conservative and look for mostly value-oriented companies? Should we pick up some beaten-down growth stocks that could be poised for a big rally? Quite honestly, I'm still trying to hone in on my exact strategy. It might have been quite different if we hadn't seen such a big, timely rebound today.

Anyhow, the event will be completely FREE for the public. You are most welcome to join us as we try to outsmart the others and the StockCharts "SCTR Team", which will also be drafting and focusing on big momentum winners. To get more information and to register to save your spot, simply CLICK HERE!

I'll see you on Saturday morning!

Happy trading!

Tom