Will the Fed “Go Big”? Real Estate Stocks Quiet Amid Major Macro Shifts

Key Takeaways

- The Federal Reserve is likely to cut interest rates by a quarter point this week.

- Treasury yields have sunk amid a growth scare, paralleling economic themes from a year ago.

- Real Estate has been a long-time laggard, but a breakout could bode well for the macro in 2026.

Is it déjà vu all over again in the bond market? The Federal Reserve is widely expected to cut its policy rate by a quarter point on Wednesday, and fixed income has been rolling since those “yippy” days in April and May.

Recall that the 10-year yield sold off in mid-April amid uncertainty around President Trump’s tariffs. Losses spread to the long bond in May, just as the One Big, Beautiful Bill (OBBB) progressed through the US House of Representatives. But for almost four months now, the Treasury market has been ebullient. A sagging labor market has stirred fears of a protracted economic slowdown, prompting Chair Powell and the other 11 members of the Federal Open Market Committee (FOMC) to resume the rate-cutting cycle that was paused last December.

10-Year Teeters on 4%: Bond Bulls Back in Charge

Heading into Fed Week on Wall Street, the benchmark 10-year Treasury yield is not far from a three-handle. In fact, 3.996% was tagged last Thursday following a tame August CPI report and a surprising jump in initial jobless claims. Market interest rates crept higher on Friday, but it’s clear that bond bulls are in charge. Stocks, by the way, have been just fine with that, as the S&P 500 ($SPX) notched four straight record closes last week in what’s often a sketchy calendar stretch.

At 4.06%, the 10-year yield remains 0.4 percentage points higher than it was 12 months ago, immediately before the September 2024 central bank gathering. There were similar vibes, just with less drama. You might remember that the back half of last year’s third quarter was a comparable growth scare. Markets were coming off the Japanese yen carry trade volatility event, unemployment claims had climbed, and AI was in full throttle.

Markets Climb as Bonds Flash Warning Signs

Leading into September 2024’s Fed Week, the S&P 500 had just tallied its best week of the year, led by a 16% jump in NVIDIA (NVDA) shares. Utilities (XLU) was the top-performing S&P 500 sector ETF. The previous month’s inflation data featured few surprises, and bond traders were going back and forth on a 25- or 50-basis-point Fed rate cut mid-month. The Treasury yield curve un-inverted, with SMID caps rallying too.

Stocks kept scaling the wall of worry heading into the 2024 election, but Treasuries didn’t fare so well after the Fed went big and slashed the Fed Funds Effective Rate from 5.33% to 4.83%. Just as the time had come for the FOMC to adjust policy, yields reversed higher.

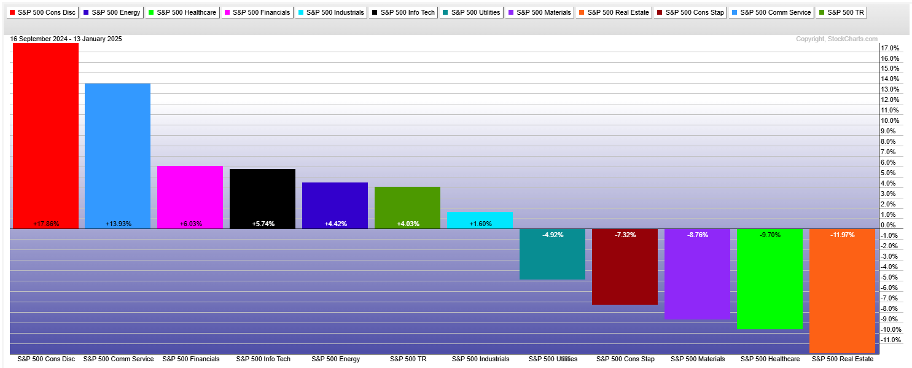

In retrospect, it was a classic “sell the news” event. The 10-year rate bottomed at 3.603% precisely as the Fed began its two-meeting cycle a year ago. Less than four months later, the benchmark yield had swelled to 4.809%. What did the S&P 500 do amid such bond-market turmoil? It returned 4.0%, with heavy gains in Consumer Discretionary (XLY), Communication Services (XLC), and Information Technology (XLK). There was also strength in cyclicals—Financials (XLF) and Energy (XLE) didn’t mind bearish bond price action.

The worst sector to be overweight in the months after the September 2024 Fed decision? Real Estate (XLRE). The property space fell 12%, no doubt stung by a steep rise in mortgage rates and a near-freeze in total transactions. Real Estate remains on its back foot in advance of this Wednesday’s apparent rate cut announcement.

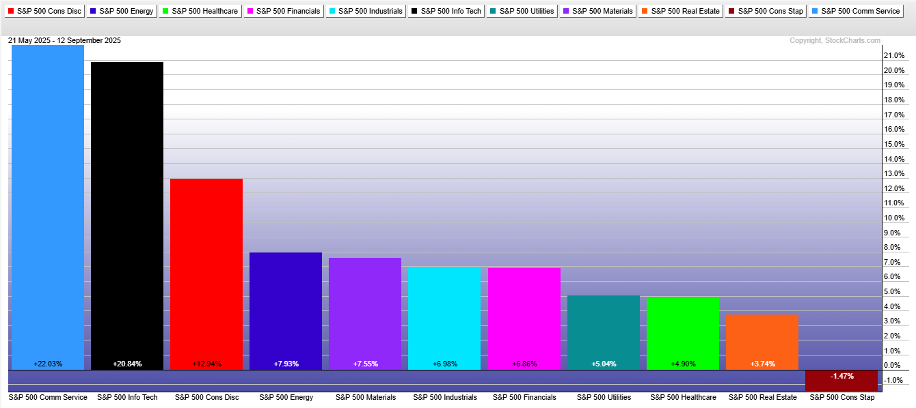

The sector is up just 3.7% since the 10-year rate peaked in May; mortgage rates sinking to 11-month lows have done nothing to reverse the Real Estate Select Sector SPDR ETF’s relative downtrend. Moreover, XLRE’s absolute chart reveals a frustrating and ugly chop that has been going on all year.

What will it take for XLRE to build a foundation and add some stories, chart-wise? It’s hard to conjure. Here we are with mortgage rates closer to 6% than 7%, easy financial conditions, AI data center demand stronger than ever, an imminent domestic capex boost via the OBBB, and somewhat stable inflation near 3%. In such perplexing fundamental and macro situations, we must inspect the chart.

Will Housing Soar? Ignore Rhetoric and Watch XLRE Technicals

In the near term, $43 is resistance. A rally through there could finally break the current months-long consolidation. I’d also like to see a jump in the RSI oscillator to confirm a price breakout. Even if a post-Fed meeting spike occurs, the XLRE bulls must still grapple with a double-top pattern at $45.50 from last September and November. Maybe that happens, though. If so, a test of the late 2021 all-time high of $52.17 could be in play.

Real Estate Attempting a Base, $45-$46 Double-Top Resistance, Neutral RSI

Whether Real Estate rallies or not doesn’t really matter for the broader market, since it’s less than 2% of the S&P 500 Index, but, for traders and portfolio managers tweaking their sector positions, alpha opportunities shouldn’t be ignored. At a macro level, a bid to REITs could portend a healthier real estate market, and that could be a surprising growth driver looking ahead to the 2026 business cycle.

The Bottom Line

The parallels are many when comparing today’s market to the one a year ago. I’ll be watching how the bonds respond to whatever the Fed does and how sector price action shakes out. The Real Estate sector has been coiling, and a breakout could surprise investors.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.