Fed Day Signals: Noise or the Start of Something Bigger?

Key Takeaways

- The Fed delivered as expected, but the market may have wanted more dovishness.

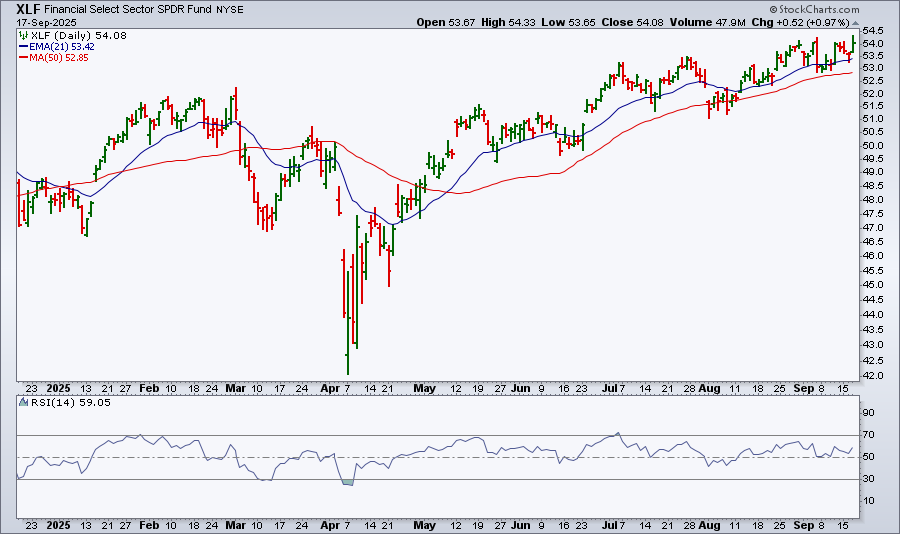

- Financials are emerging as leaders, with the sector hitting a record high and still showing room to run.

- Bonds and the U.S. dollar will likely influence the next moves in stocks, gold, and silver.

The big day (Fed Day) finally arrived and, just like a made for TV movie where you already know the ending, the Federal Reserve gave us a 25-basis-point rate cut. There’s a strong chance we’ll see two more cuts this year.

While all that sounds good for the market, it may not have been enough. The stock market initially moved higher on the news, but, within minutes, sold off, then recovered. It was a little bit of a roller coaster ride after the Fed meeting.

Here’s where the three major indexes closed on Wednesday.

- S&P 500 ($SPX): 6,600 (-0.10%)

- Nasdaq Composite ($COMPQ): 22,261.33 (-0.33%)

- Dow Industrials ($INDU): 46,018.32 (+0.57%)

For a brief moment, it looked like we were seeing a sell-the-news reaction, but that turned into a bit of a shakeout before the market settled down. Other asset groups also displayed interesting price action. The U.S. Dollar ($USD) initially weakened after the Fed’s announcement, but bounced back and finished the day higher. Treasury yields did the same. Gold and silver, on the other hand, slipped lower. No surprise there, since they tend to move opposite the dollar.

Big Picture: Still Holding Steady

The stock market, as a whole, is still holding strong. Even small-caps, which rallied before the Fed meeting, ended the day relatively unchanged.

Among the sectors, Financials stood out as the leaders. The Financials Select Sector SPDR (XLF) eked out a record close and, if momentum builds up, there’s a chance XLF could continue to rise higher. The Relative Strength Index (RSI) is at around 59, so it has some room to run.

Turning to Bonds

The more interesting price action was in the bond market, especially the 10-year yields. The 10-minute chart of the 10-Year US Treasury Yield Index ($TNX) shows that the yield dropped to below 4% when the interest rate decision was announced, but recovered and closed above 4%.

The last time the Fed cut rates (September 2024), the 10-year yield rallied from 3.64% up to around 4.80%.

While it may look like yields have some work to do before looking bullish, Wednesday’s outside day bar is encouraging. While it may take a while for yields to trend higher, it’s worth saving this chart to one of your ChartLists.

The U.S. Dollar’s Dip

In addition to bonds, the U.S. Dollar ($USD) briefly slipped below its July low before bouncing back and finishing higher for the day. The chart below shows that the U.S. dollar rallied after last September’s rate cuts. This time, the U.S. dollar is much lower than it was in September and, with a more uncertain environment, the dollar could stay low for a while.

The dollar is negatively correlated with gold and silver prices, so, with today’s rise, you can expect gold and silver prices to pull back, which they did.

The Bottom Line

Overall, the Fed’s 25-basis-point rate cut didn’t change the market much. Investors had already priced it in, so there weren’t any big surprises.

The good news is that the market didn’t tank. With not much in the way of economic data this week, trading could be relatively quiet for the rest of this week. Now with the September Fed meeting in the rearview mirror, it wouldn't be surprising to see stocks, bonds, the U.S. dollar, and precious metals settle down and continue moving in the direction of their overall trend.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.