Foreign Markets May Be More Attractive Than the U.S. in 2026

Throughout its current secular bull market run, the S&P 500 has easily outperformed nearly every other foreign market. The tide could be changing, however, as several foreign indices are showing more convincing relative strength. And given all the warning signs I've discussed regarding U.S. stocks as we approached 2026, it might make sense to consider diversification into foreign markets much more than in recent years.

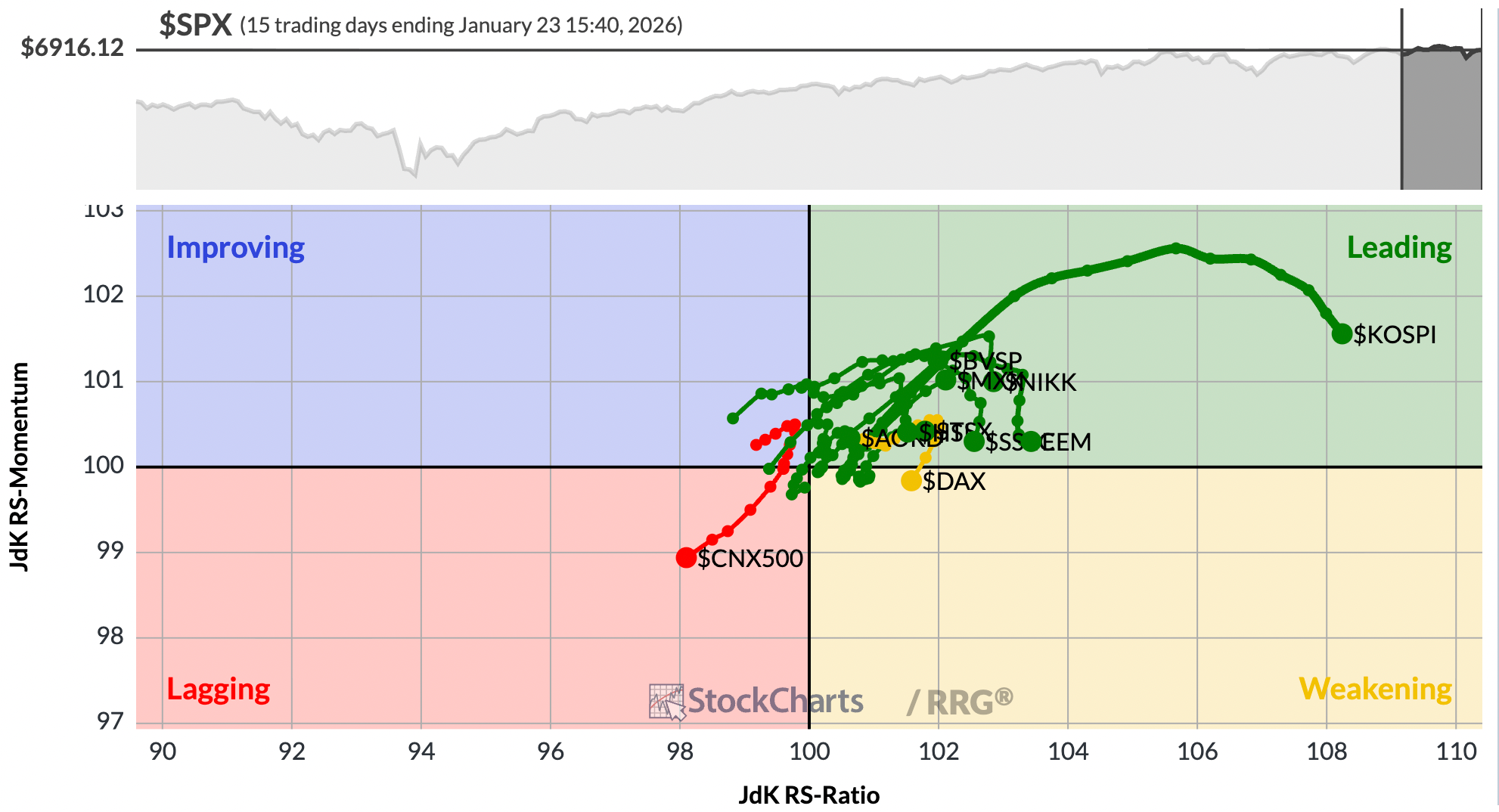

One simple way to analyze relative performance is to use an RRG chart and compare several foreign markets vs. the benchmark S&P 500. For instance, check out this daily RRG chart.

I deliberately used a tail length of 15 days, which covers most of the 2026 performance. The clear takeaway for me is that most every foreign market listed is outperforming the S&P 500 in 2026.

South Korea, for one, has been crushing the S&P 500. Check out this absolute and relative chart since the April 2025 low.

Japan is another absolute and relative winner right now.

While rotation back into foreign markets was likely to occur at some point, it's coming at a time when we've also seen massive rotation away from many growth stocks as money finds a new home in value stocks.

It would seem to make sense to me that Wall Street is moving away from the large-cap growth names that drive the S&P 500 and NASDAQ higher, because they see something later in 2026 that the rest of us don't see. Moving into foreign markets also avoids any further pain inflicted into growth-oriented stocks.

The January Effect

We'll get yet another clue about where the S&P 500 might be headed in 2026 as we close out January. There's an astounding positive correlation between S&P 500 January performance and subsequent performance over the balance of the year. That's the subject of a FREE webinar on Saturday, January 24, 2026, at 10:00am ET, "The January Effect".

Please join me Saturday morning for this very informative, timely, and persuasive presentation. To register and learn more, simply CLICK HERE!

See you tomorrow morning!

Happy trading!

Tom