A Hint of Holiday Cheer for the Market—Or a False Start?

Key Takeaways

- The stock market got some welcome relief from the cooler-than-expected CPI report, but it's not a green light yet.

- Investor risk appetite is improving, but not across the entire market.

- Volatility remains low, suggesting investors are calm.

Thursday’s CPI report felt a bit like an early Christmas gift. Inflation came in slightly cooler than expected, and that was all the stock market needed to perk up and move higher.

The day's price action was a welcome change from Wednesday’s, which had investors feeling uneasy. The S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) closed below the 50-day Simple Moving Average (SMA). When major indexes slip below a key support level, it tends to raise a few eyebrows and your anxiety level.

Stocks Look Less Wobbly

On Thursday, the S&P 500 steadied itself. It bounced off the support of its 50-day SMA and even poked its head above the 21-day Exponential Moving Average (EMA). It couldn’t hold above it, but it finished the day above the 50-day SMA.

Since November 21, the market has been trying to work its way higher. The S&P 500 even closed at an all-time high on December 11 before pulling back. While Wednesday’s pullback felt uncomfortable, it’s still well above the late November low.

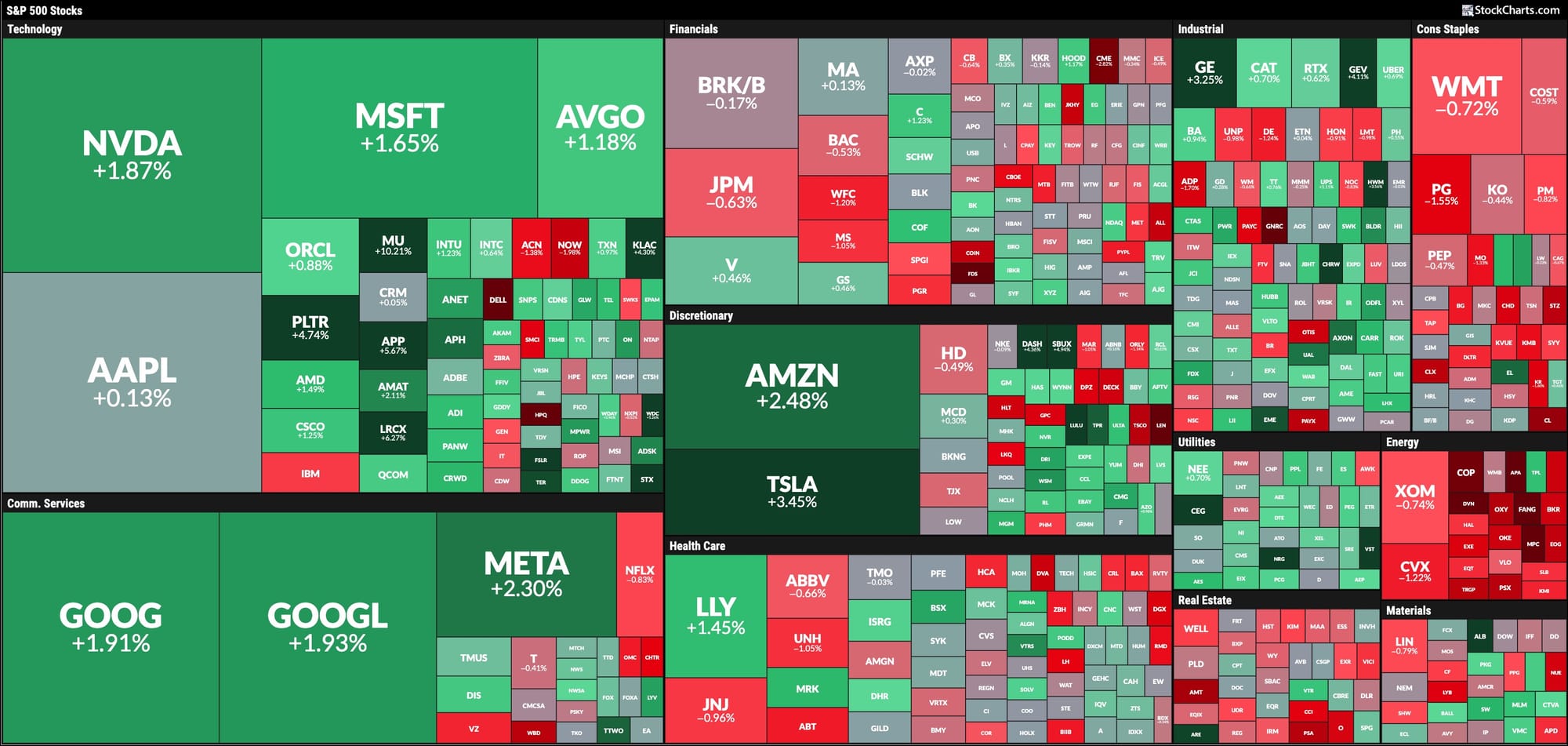

When big-tech and growth stocks take the lead, it’s usually a sign that investors are feeling more confident and willing to take on risk. That showed up clearly in Thursday’s StockCharts MarketCarpet, where many of the S&P 500 heavyweights were firmly in the green.

The “Mag 7” stocks moved higher, with the Technology sector leading the charge. Consumer Discretionary and Utilities weren’t far behind. A quick glance at the Market Summary page shows that investors rotated into offensive sectors vs. defensive ones.

With inflation cooling, the idea of future interest rate cuts is back on the table. Generally speaking, that’s good news for small-cap stocks, but, interestingly, they didn’t get much traction. The S&P 600 Small Cap Index ($SML) finished up 0.20% compared to a 0.79% gain for the S&P 500.

Even with Thursday’s rally, the market hasn’t shown enough of a follow-through yet to fully confirm a renewed bullish leg. Part of that may be seasonality. We’re in a low-volume period as the holidays approach, and trading activity tends to thin out.

Volatility has also stayed quiet. The Cboe Volatility Index ($VIX) has been mostly flat, which tells us that investors aren’t in panic mode.

Bitcoin’s Bitter Struggle

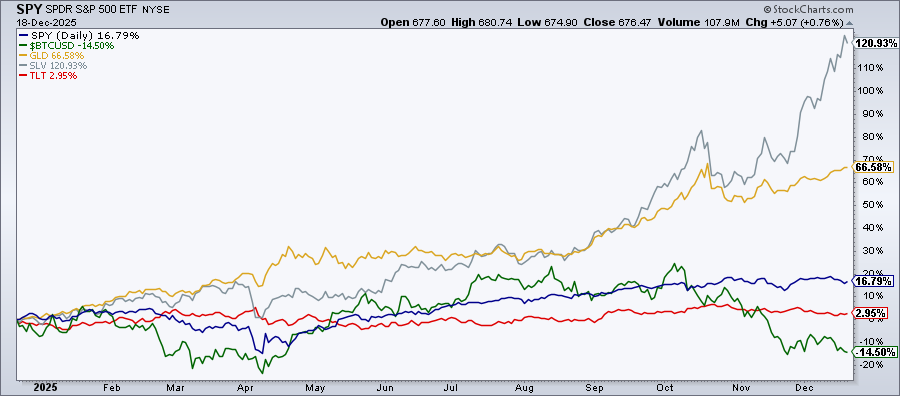

Bitcoin to US Dollar ($BTCUSD), however, is telling a different story. It’s been selling off sharply, and the weekly chart shows it’s sitting at the key support of its 100-week SMA. A bounce here could turn into an opportunity. If that support gives way, though, prices could slide much lower.

Precious Metals are the Shining Stars

Gold and silver remain in solid uptrends, even after a modest pullback. Over the past year, both metals have outperformed most other asset classes, with silver leading the way with a 120.93% return.

Closing Bell

So, where does that leave us? Thursday’s rally was encouraging, but we’ll need to see more upside and follow through to be confident the bull still has legs. For now, let’s see whether this early holiday gift can keep the cheer going and deliver a classic Santa Claus Rally.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.