History Is Repeating: Why Today’s AI Pullback Looks Familiar

AI stocks suffered their sharpest drop since early April during last week’s pullback, with NVIDIA (NVDA), Palantir (PLTR), and Microsoft (MSFT) sliding as valuation concerns resurfaced. A shift in the outlook for interest rates also hurt these stocks. The pattern mirrors the late-2023 pullback that first exposed the gap between massive AI investment and slower-to-arrive revenue.

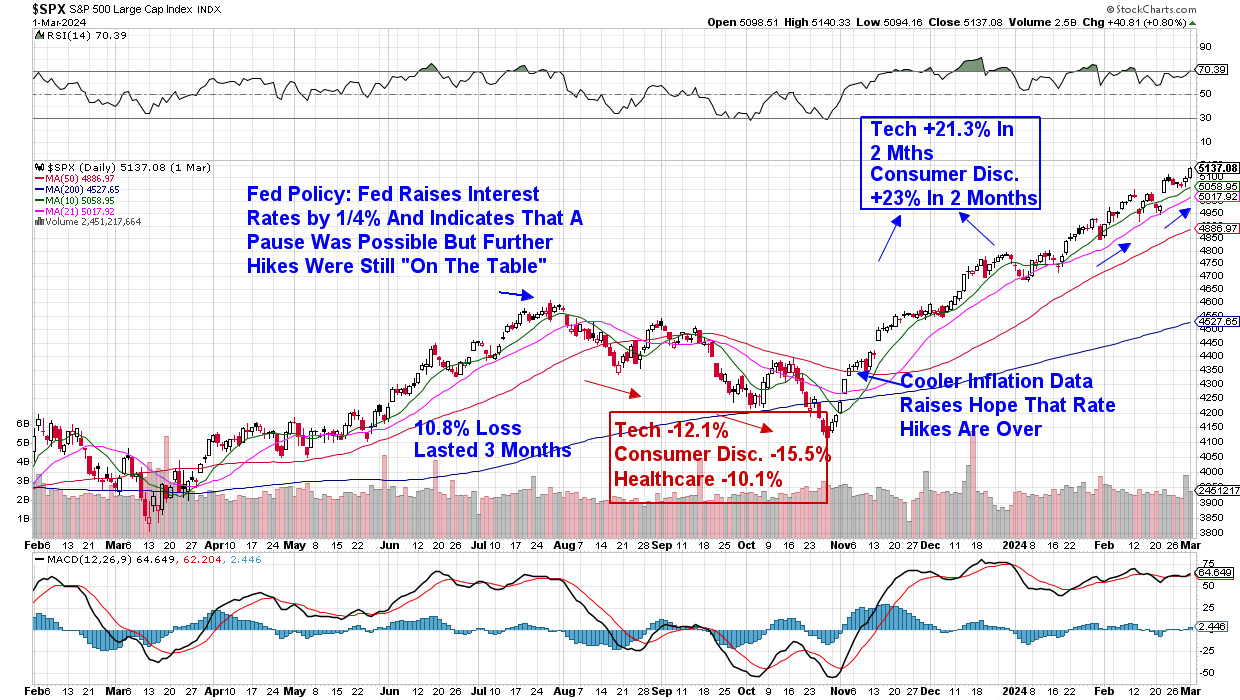

The 2023 Precedent

In November and December 2023, the AI-driven market rally hit its first real wall. Mega-cap tech stocks had fueled a 20% S&P 500 surge, but investors began to question whether soaring valuations, such as Palantir trading at 22x sales, were sustainable. As triple-digit winners pulled back and the Nasdaq logged some of its worst weeks of the year, the market realized that even groundbreaking technology can’t justify limitless multiples.

A 2025 Replay

Two years later, the setup looks strikingly similar. The Nasdaq just posted its worst week since the April tariff-driven selloff, this time driven purely by valuation anxiety. Palantir fell 11% despite recent strong results, highlighting that prices, not fundamentals, are the issue.

AI mega-caps continue to dominate: they’ve accounted for roughly 75% of S&P 500 returns and nearly all earnings and capex growth since 2022. Their outsized influence means that when they wobble, the entire market feels it.

The Capex Question Returns

The same concerns from 2023 have resurfaced: Big Tech is spending unprecedented amounts on AI infrastructure, yet investors are unsure whether profits will scale to match. With AI capex expected to exceed $330 billion by the end of 2025, managers increasingly worry about overinvestment and stretched price-to-book ratios.

Why This Pullback Lands Differently

In 2023, the AI boom was still young, and corrections were seen as buying opportunities. By 2025, after two years of elevated multiples, investors are again skeptical. This isn’t a repeat of the dot-com era — today’s AI giants are profitable and diversified — but history shows that investors will question whether even strong companies can justify increasingly lofty prices.

What History Suggests

The 2023 decline didn’t lead to a crash. Instead, the market staged an extraordinary rebound, with AI leaders driving a renewed bull phase. But it also taught investors that valuation-driven pauses are part of the AI cycle.

The current pullback isn’t a crisis, but it reinforces the lesson that valuations can matter and even transformative technologies experience meaningful resets.

Also of note is that in 2023, the AI-driven rally was halted by a more hawkish tone from the Federal Reserve, very similar to the current environment.

Don’t Miss the Turn: Get Instant Alerts When the Bullish Trend Returns

My twice-weekly MEM Edge Report has been alerting subscribers to the shift taking place in the markets as we began to remove some of our top-performing AI stocks from our Suggested Holdings List. We also highlighted the rotation into Healthcare stocks, which began in October, when we added stocks such as Intuitive Surgical (ISRG) to our Suggested Holdings List. We’ve been providing detailed Alert Reports as needed over the past 2 weeks amid sharp sentiment shifts due to Fed policy uncertainty.

Don’t miss out. Use this link here for a no-cost 2-week trial so you too can be kept up to date on changes in the markets.

Warmly,

Mary Ellen McGonagle

MEM Investment Research