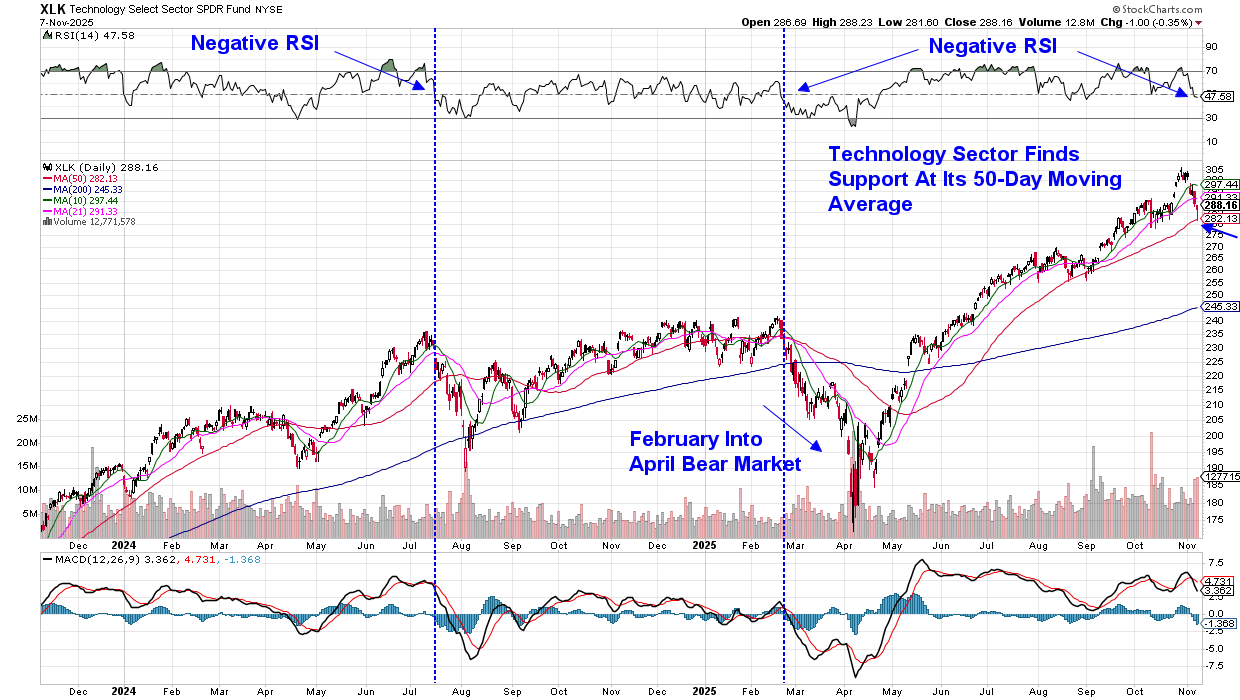

Is The Sharp Advance In Technology Stocks Over?

After a remarkable stretch of outperformance, Technology stocks have recently hit pockets of volatility that have investors questioning whether the trade has run its course. Concerns about stretched valuations, shifting interest rate expectations, and mixed reactions to earnings have added fuel to market anxieties. So has the rotation into Tech peaked? Or is this just a pause within a longer-term leadership trend?

2-Year Daily Chart Of Technology Sector

At the heart of the Technology rally lies one undeniable force: the accelerating adoption of Artificial Intelligence. Semiconductors, data-center infrastructure, cloud platforms, and high-performance computing continue to benefit from strong demand trends, not just in the U.S. but globally.

Corporate spending is shifting toward digital transformation and automation. These are structural investment priorities — not short-term fads — which support continued revenue and earnings expansion for Tech leaders.

While we’ve seen a rotation into other areas such as Industrials and Financials, this is more of a broadening of the rally than a complete shift in leadership. Technology isn’t losing relevance; it’s simply sharing the spotlight as more sectors begin to participate in economic strength.

However, as the AI transformation moves into a more mature phase, investors will need to be increasingly selective. Market leadership won’t be uniform, as different companies will see demand accelerate at different points in the innovation cycle.

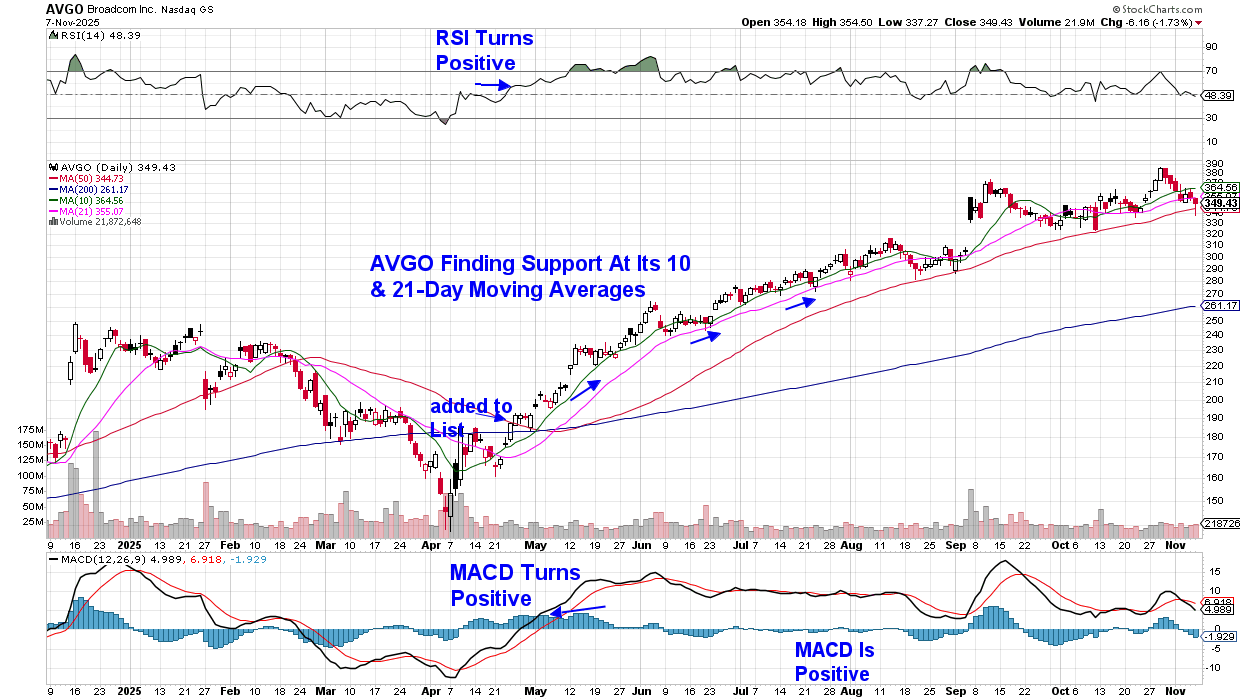

Daily Chart Of Broadcom (AVGO)

A clear example comes from a leading semiconductor stock, Broadcom (AVGO), which has recently been struggling to keep pace with its peers on the heels of a sharp advance out of the bear market. We added the stock to our MEM Edge Suggested Holdings List in April, and it was a clear outperformer until recently, when it encountered competition from other semiconductor companies that now have a stronger leadership potential.

My MEM Edge Report captured the strongest new leadership name, and this stock still has room to trade higher. If you’d like to have access to the name of this company as well as a current marked-up chart along with other leaders, use this link here for a no cost trial of my twice weekly report. You’ll be kept on top of broader market conditions as well. We’re in an environment where shifting leadership offers immense opportunities, and I urge you to take me up on this offer.

I’d also like to invite you to learn about my upcoming 5-part course that will provide you with the precise steps needed to uncover leadership names. The course is developed from my 25+ years of teaching this system to top portfolio managers around the globe. Please use this link to stay informed about this exciting opportunity.

Warmly,

Mary Ellen McGonagle

MEM Investment Research