J.P. Morgan's Top Picks for 2026: A Closer Look at the Charts

As artificial intelligence moves into its next growth phase, J.P. Morgan believes the biggest winners in 2026 may extend well beyond the headline GPU names. The bank is zeroing in on semiconductor and networking companies that form the critical backbone of data center infrastructure.

Data Center Spending Surge

In a recent outlook, J.P. Morgan's top-ranked technology analyst, Harlan Sur (ranked 105 out of 42,540 Wall Street experts), outlined a powerful growth story. Data center capital spending is expected to jump roughly 50% in 2026, building on an estimated 65% increase in 2025. This rapid expansion is the foundation of the bank's bullish stance on select chip stocks tied to AI infrastructure.

The Top Four Picks

Based on this outlook, J.P. Morgan has identified four companies positioned to benefit from the ongoing AI infrastructure buildout.

1. Broadcom (AVGO)

Broadcom (AVGO) is a familiar name at MEM Investment Research, having been one of the first semiconductor stocks added to our MEM Edge Report buy list following the bear market earlier this year.

Broadcom's diverse exposure spans custom chips, networking solutions, and high-speed connectivity systems that power modern data centers. It’s forecasted that Broadcom will generate between $55 billion and $60 billion in AI-related revenue during fiscal 2026, underscoring its central role in the AI supply chain.

AVGO was removed from our buy list following last week’s close below its 50-day moving average, with a now negative RSI and MACD. We remain constructive on the stock’s longer-term outlook, however, and if you’d like to be alerted to when AVGO reenters a buy zone, use this link here!

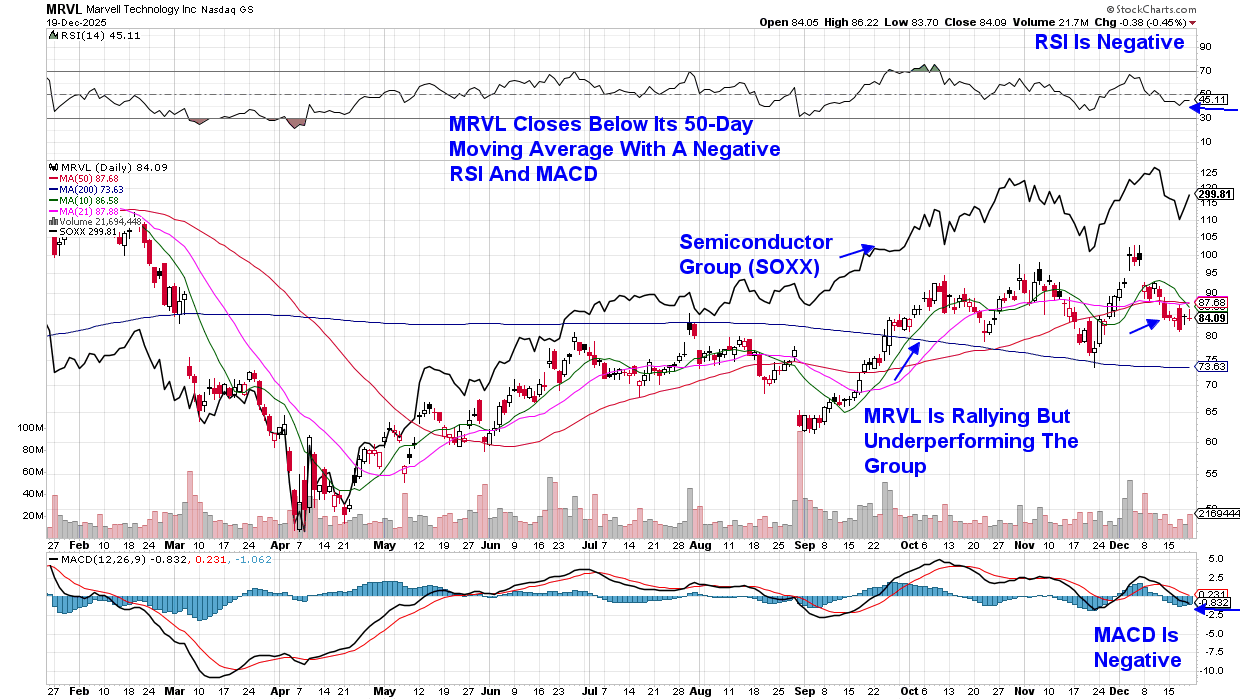

2. Marvell Technology (MRVL)

In J.P. Morgan's view, Marvell represents another compelling opportunity. As AI models grow complex and data-intensive, the demand for custom silicon and advanced networking capabilities continues to accelerate. The bank expects this trend, particularly the need for faster data movement within data centers, to be a significant growth driver for Marvell throughout 2026.

This stock has not made it to our MEM Suggested Holdings List, as it hasn’t displayed the relative outperformance needed to make it a candidate for leadership status. (The chart below shows the relative performance of MRVL vs the Semiconductor group.) Other needed leadership characteristics are not present as well.

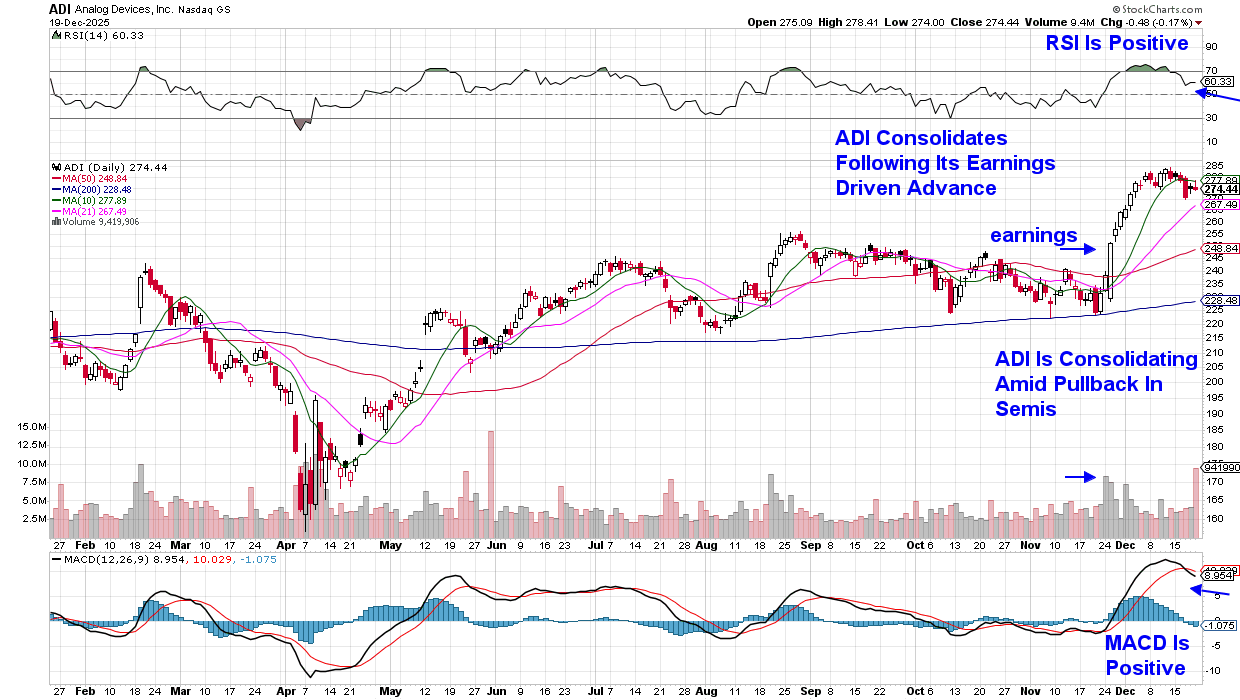

3. Analog Devices (ADI)

While not a pure-play AI stock, Analog Devices supplies essential components for power management, signal processing, and data center systems. J.P. Morgan anticipates that recent AI-related design wins will translate into approximately $500 million to $600 million in revenue, demonstrating how AI infrastructure demand is creating opportunities across the semiconductor sector.

ADI’s strong earnings report in late November pushed the stock into a strong uptrend due to an improved outlook for its growth going forward. The stock has a history of posting short-lived advances and then fizzling, and I would not be a buyer, particularly as there are better AI-related candidates.

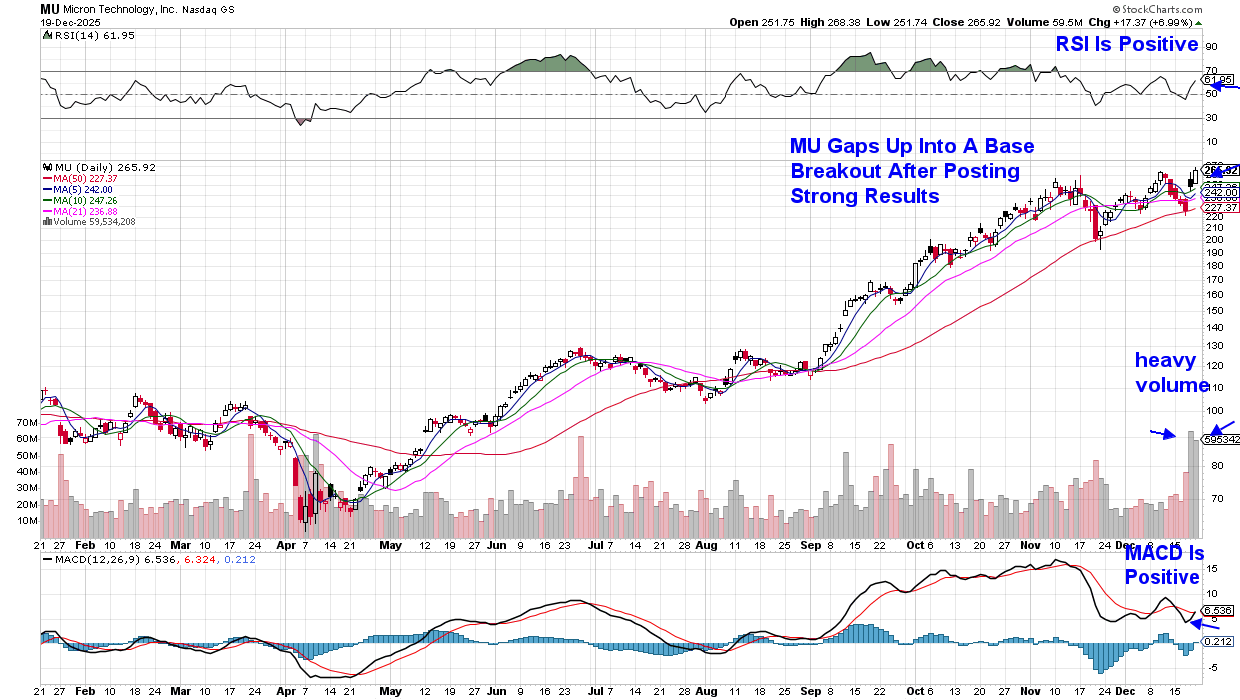

4. Micron Technology (MU)

Rounding out the list is Micron, the memory chip leader. MU was added to the MEM Edge Report in mid-August following its two-month base breakout amid analyst upgrades. We remained with the stock, which exhibited another base breakout last week after reporting exceptional earnings.

AI workloads are driving substantially higher demand for high-bandwidth and high-capacity memory solutions. Micron appears well positioned to benefit further as memory pricing improves amid a current shortage.

To be kept up to date on new buy points for MU, sign up for our twice-weekly MEM Edge Report now!

The Broadening AI Trade

J.P. Morgan's outlook reveals an important evolution in the AI investment landscape. While GPU manufacturers captured most of the attention in AI's early phase, chips, memory, and networking equipment are now equally critical components as data center spending continues its rapid ascent.

For investors looking toward 2026, the move into Agentic AI, an advanced form of artificial intelligence focused on autonomous decision-making and action, will be the next focus for MEM Investment Research. Unlike traditional AI, which primarily responds to commands or analyzes data, agentic AI can set goals, plan, and execute tasks with minimal human intervention.

The Bottom Line

The AI revolution is expanding beyond its initial beneficiaries. As data centers scale up to handle sophisticated AI workloads, the companies building the infrastructure, from custom chips to memory to networking gear, stand to capture further significant gains into 2026.

For a professional and informed newsletter that alerts you to the next market leaders, be sure and trial my twice weekly report at no cost.

Warm Regards,

Mary Ellen McGonagle

MEM Investment Research