Major AI Announcement Sparks Repricing Across Tech Stocks

Broadcom (AVGO) surged today after announcing a $10 billion deal with a new customer to supply custom-designed AI chips. The customer is reported to be OpenAI, and the deal is set to deliver hardware beginning in 2026. It marks one of the largest single AI semiconductor contracts to date.

The stock jumped 9% on the news, pushing its market cap toward the $1.6 trillion mark. The company also raised its AI revenue projections from $30 billion to more than $40 billion annually. CEO Hock Tan reinforced investor confidence by confirming he will remain at the helm through 2030.

Technical Perspective of AVGO

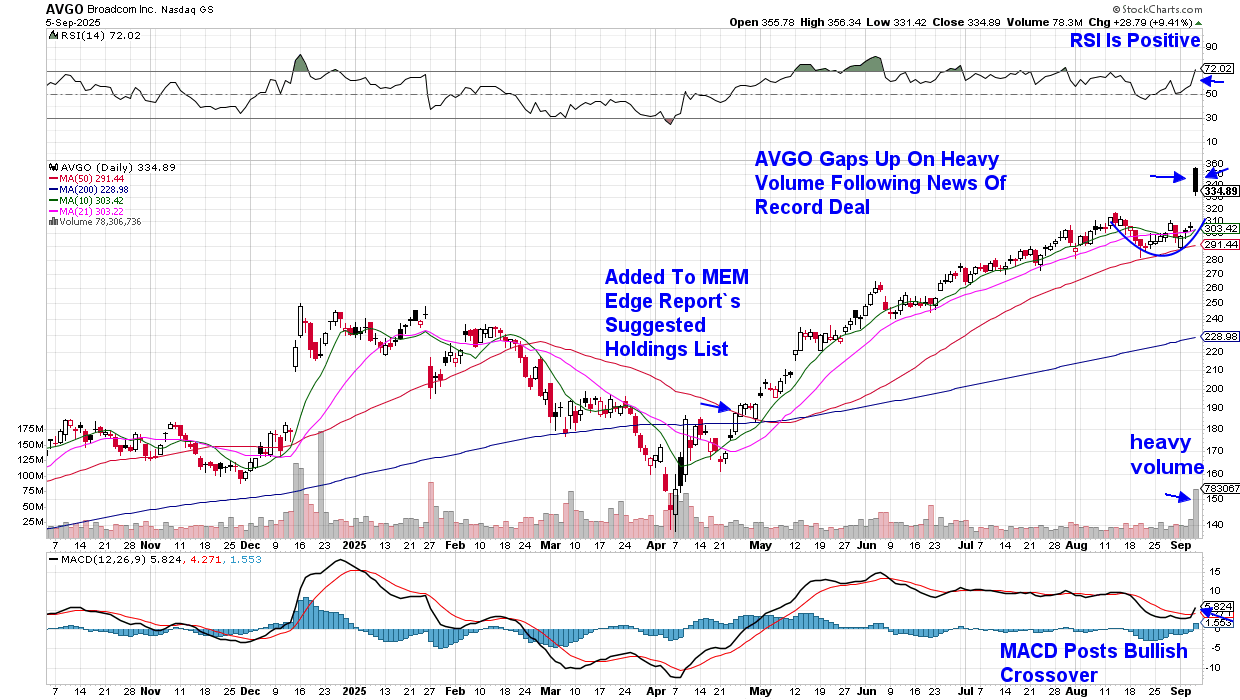

Below is a daily price chart of AVGO and, as you can see, the stock broke out of a three-week base on heavy volume, with a gap up in price following the news. This price action puts the stock in a position to trade even higher.

Also of note is that AVGO was added to my MEM Edge Report’s Suggested Holdings List in April, as it entered a new uptrend coming out of a bear market. My twice-weekly report uncovers leadership names just as they are emerging, and this is a prime example.

As noted in my ChartWatchers article last week, I was trained on how to spot a leadership name from my 15 years of working directly with Bill O’Neil, founder of a proven system that helps identify names poised to outperform the markets.

Why Broadcom is a Leader

So why is Broadcom a leader? For one, the company delivered steady revenue and earnings growth, often above market expectations. In addition, the company has been a top player in semiconductor stocks powering AI, cloud, and networking, giving it direct exposure to some of the fastest-growing areas in tech.

AVGO consistently outperformed its peers, while also being heavily owned by mutual funds and pension managers. Broadcom’s custom AI chips and networking solutions positioned them as a critical supplier to hyperscalers like Alphabet (GOOGL), Meta Platforms (META), and others.

In essence, AVGO was then, and is now, a leadership name because it combines fundamental dominance, strong institutional support, and chart leadership in one of the market’s most powerful themes — AI and data infrastructure.

But Broadcom’s rally came at the expense of rivals. NVIDIA (NVDA) slipped 2%, while Advanced Micro Devices (AMD) fell as much as 6% as investors reassessed the competitive landscape. The sell-off reflected concerns that hyperscalers and AI labs are beginning to diversify away from NVDA’s general-purpose GPUs in favor of custom silicon that offers greater efficiency for specific workloads.

To stay on top of opportunities like this, consider subscribing to my widely acclaimed twice-weekly MEM Edge Report. If you’d like immediate access at no cost, use this link here to receive a two-week trial beginning with this week’s report on Sunday.

In addition, I’ll be launching a five-part course that will teach you how to uncover these winning stocks using a step-by-step guide. You can use this link here to be kept up to date on this exciting launch, which will take place this month!

Warmly,

Mary Ellen McGonagle

Founder, MEM Investment Research