Make Room, AI: This Sector Is Quietly Taking the Lead

Keeping pace with sector rotation is one of the most effective ways to stay ahead in the markets. It means shifting your portfolio to align with areas showing current strength and stepping away from those losing momentum.

Over the past six months, the Technology sector (XLK) has soared more than 41%, outperforming every other area of the market by a wide margin. Investors overweight in Tech have likely enjoyed strong returns.

Markets move in cycles, though, and each phase brings a different sector into leadership. This creates opportunities to capture gains and limit risk by rotating into areas on the rise. In fact, studies by William O’Neil, founder of Investor’s Business Daily, show that nearly half of a stock’s performance can be attributed to the sector and industry group it belongs to.

Health Care Rising

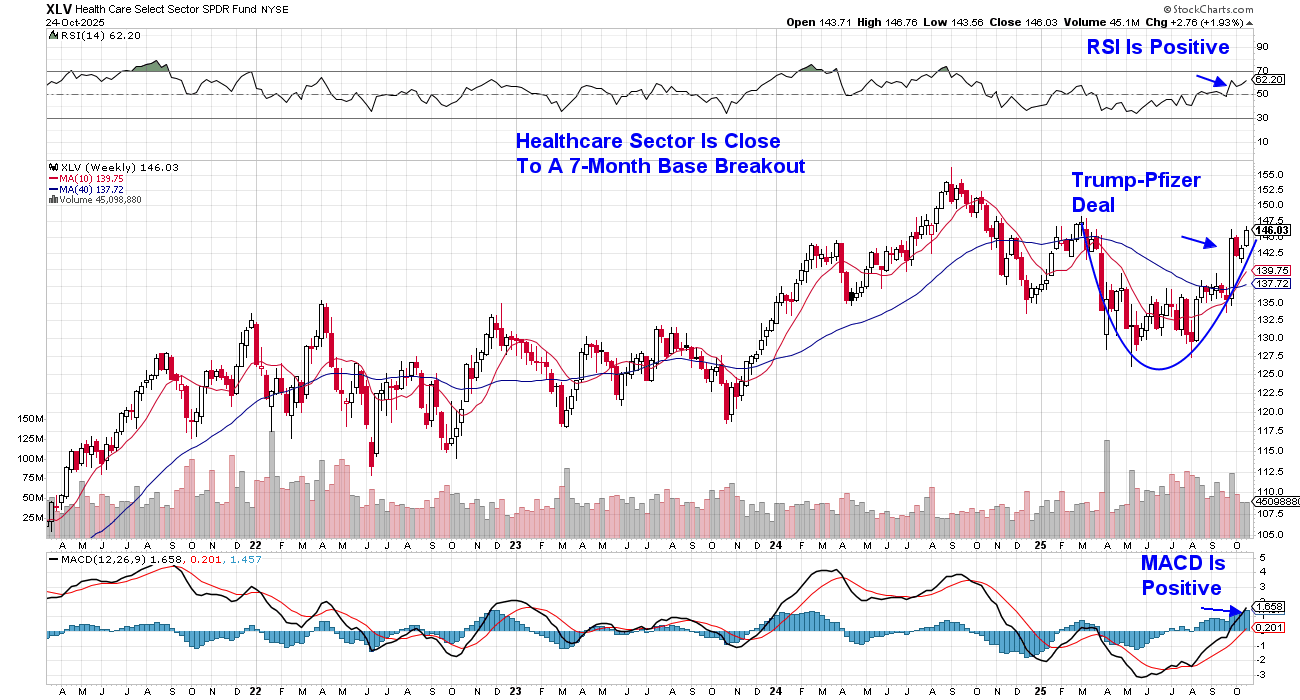

Right now, the Health Care sector is emerging as the next area of strength.

U.S. healthcare stocks surged at the end of September, boosted by a Pfizer–Trump deal aimed at lowering prescription drug prices in Medicaid in exchange for tariff relief. The agreement brought long-awaited clarity to a sector that had faced months of political uncertainty and has sparked optimism for more big pharma deals ahead.

Cardinal Health Shows Strength

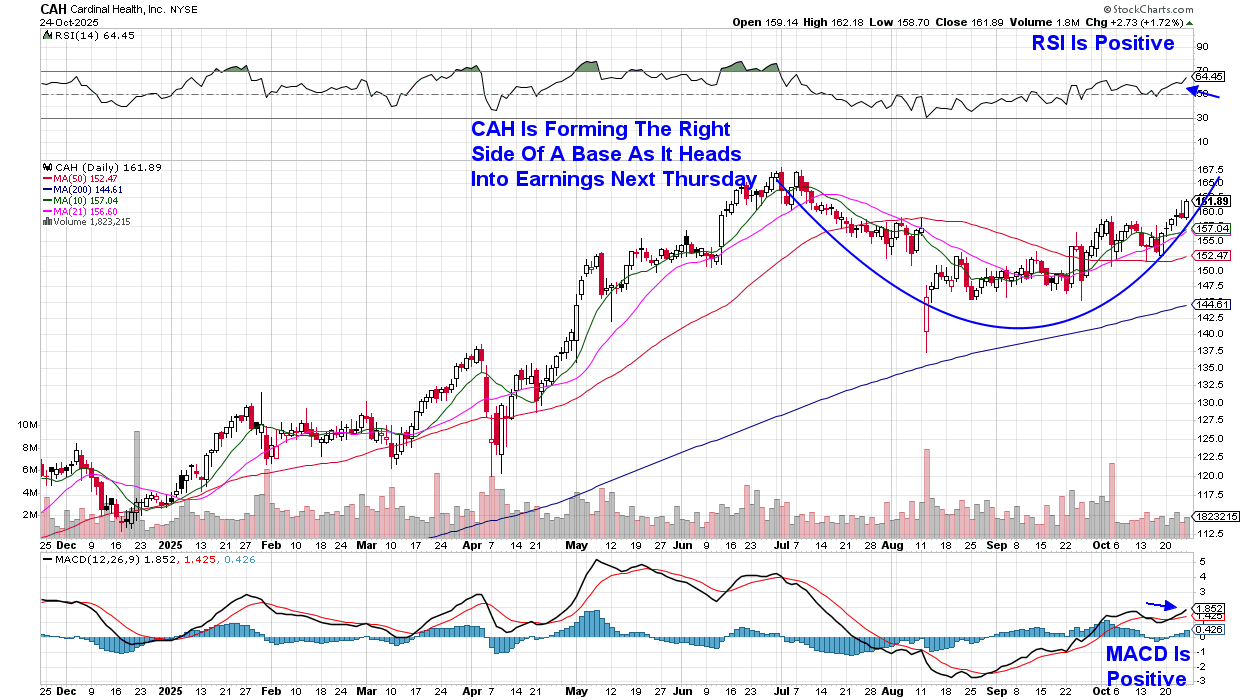

For investors seeking a growth opportunity with less volatility, Medical Products companies are a great place to look. Several large-cap names have rallied sharply this week on strong earnings reports. Cardinal Health (CAH) has been forming the right side of a base going into the release of its earnings on Thursday. After receiving Wall Street upgrades going into their results, the stock is trending higher.

We would not be a buyer so close to earnings, as any negative surprise could pull the stock back sharply. Instead, wait for positive results and a move of CAH toward a possible four-month breakout at $168.50.

The real standout among healthcare has been Biotechs (IBB). The group recently broke out of a nine-month base, fueled by a wave of FDA drug approvals and robust product pipelines. With renewed investor confidence and fresh momentum, Biotech stocks appear poised for further upside.

If you’d like to be alerted to moves such as Technology’s sharp advance over the past six months, and the best stocks to take advantage, use this link here for a no-cost 2- week trial of my twice-weekly MEM Edge Report.

In addition, I’ll be releasing a five-part course on how to uncover top, winning stocks that go on to outpace the markets, and if you’d like to be kept alerted, use this link here!

Warmly,

Mary Ellen McGonagle

MEM Investment Research