Market Pullback or Pause? Inside the November Dip and What Comes Next for Stocks

Key Takeaways

- Stocks have cooled in November as tech and speculative names have faced weak earnings reactions and rate-cut doubts

- A rising dollar and liquidity strains pressure risk assets, while equity volatility gauges stay elevated

- Seasonal trends still favor a year-end rally, but ebbs in leadership may dictate direction over 2025’s final stretch

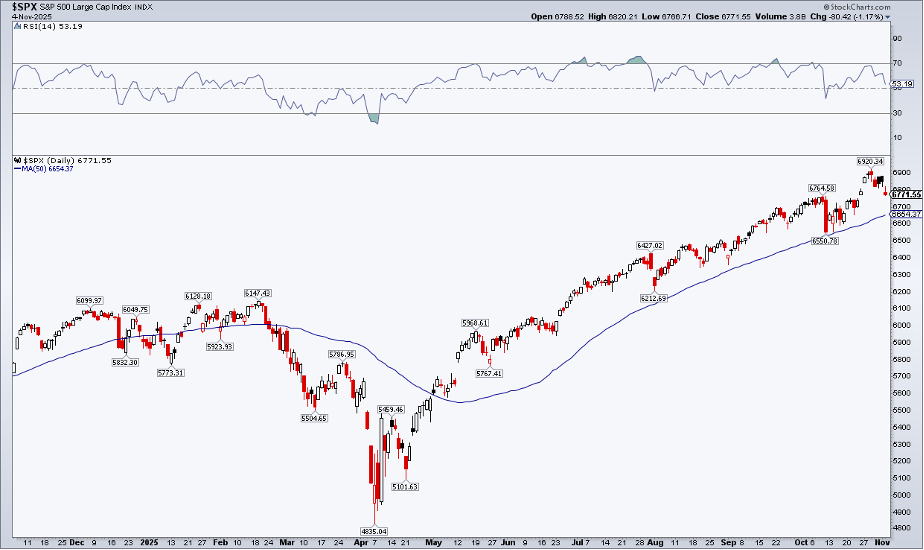

What led markets higher off the April bottom and through the third quarter — tech stocks and speculative, unprofitable names — have been the culprits for a mild November downturn. We can pin the move to poor earnings reactions and suddenly uncertain odds of a December rate cut. There’s also the chance that seasonal gains were simply pulled forward in September and October.

Still, data clearly show that when the S&P 500 posts big returns through early Q4, the final two months of the year tend to be bullish, culminating with the vaunted Santa Claus Rally period (the final five sessions of December and the first two trading days of January).

To be clear, we are nowhere near technical correction levels. The VIX hovers close to 20, though, and traders remain on edge. Perhaps investors are bracing for what could be a data deluge once the federal government reopens, possibly next week.

Liquidity and Crypto Pressures

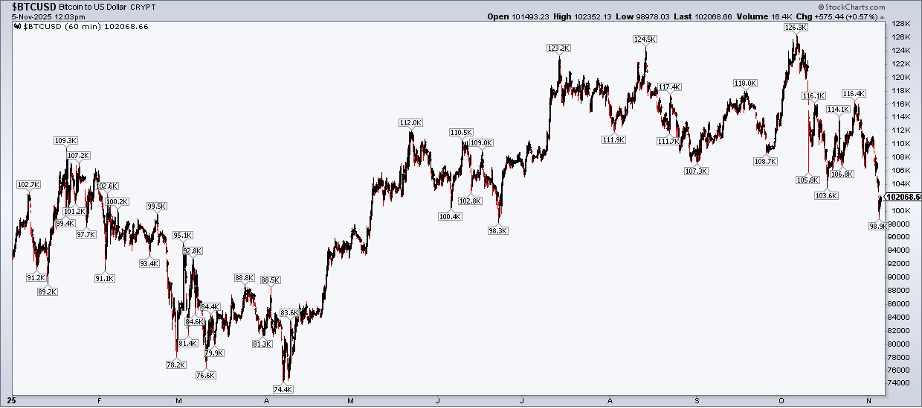

Liquidity is a Johnny-come-lately risk, too. Overnight SOFR rates have bounced around, jarring parts of the funding markets. What’s more, cryptocurrency has come under intense pressure, with Bitcoin moving in thousand-dollar increments when its volatility kicks up. Ether, Solana, and Cardano are hibernating in bear-market conditions. Some are calling for a crypto winter. We’ll see.

The Dollar’s Strength & Intermarket Relationships

The U.S. Dollar Index ($USD) fits right into that narrative. The index has scaled to its best level since late May, above the psychological 100 mark. That has debased the so-called “debasement trade” (long gold, long bitcoin) in the short run.

Putting all the macro piecemeal into one mixing bowl, intermarket relationships have reverted to correlations most of us should be familiar with. Bonds rally when stocks fall, the dollar is seen as a mild safe haven, and industrial metals are no longer under a perma-bid halo.

But where do equities go from here? What are the key catalysts that can get the normally reliable seasonal cheer into risk assets? Here are a few indicators I’m watching.

1. The Dollar

The greenback may be the key barometer of macro stress. I don’t think stocks will take well to the DXY rising further above 100. While 2025’s rally has by no means been pinned to a softer buck, there seems to be a connection between funding-market stress and the dollar’s climb.

2. Risk-On Quality

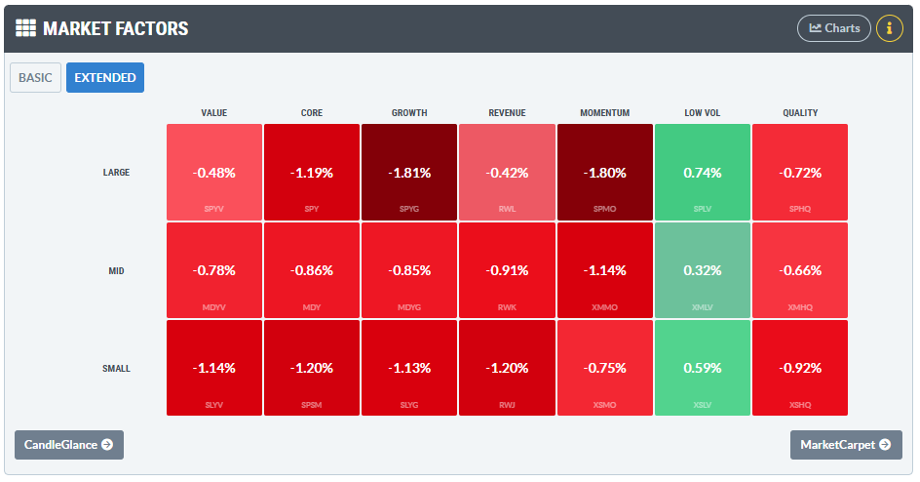

That’s not an oxymoron. “Risk-on quality” can be thought of as the non-junky cyclical corners of the domestic stock market. (Think mid-caps and profitable small caps.) To gain a sense of daily swings in this factor, I look to StockCharts’ Market Factors (extended) style box. It takes the traditional Morningstar style box to the next level.

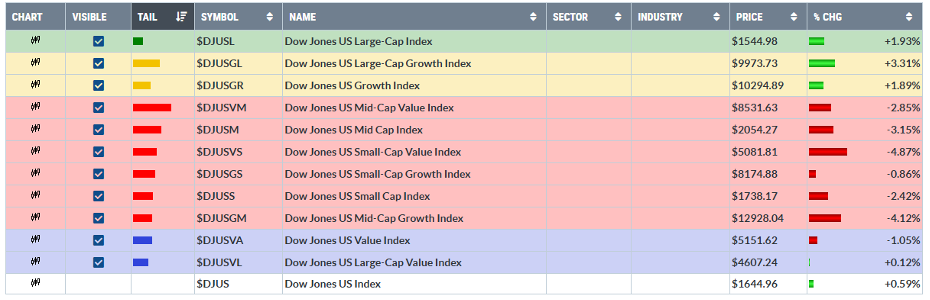

From there, venture to the RRG page. Using the Growth/Value/Size Group (and other default settings), we see that the past year has seen U.S. SMID-caps firmly in the red “lagging” section (I call it the penalty box). A year-end catch-up trade, amid improved relative strength for those real-economy areas, would be a nice stocking stuffer.

3. The VIX

The bond market is doing its part to cast a sense of calm. The ICE BofA MOVE Index ($MOVE) of Treasury volatility is low, under 70. The VIX, however, is stubborn. The reality is that almost half of the S&P 500’s market cap is now linked to the AI trade in some form or fashion.

It will be tough to bring SPX implied volatility much lower when a single theme ties everything together. If new leadership emerges and sector rotation takes hold, then the VIX should ease. That would potentially breed confidence.

Continued Consumer Jitters

From a more fundamental standpoint, it will be key to monitor price action once “official” data dumps onto the wires. Jobs numbers, retail sales updates, and housing market trends will all impact that risk-on quality market section I mentioned above.

Troubles in the restaurant industry and dismal performance among larger Consumer Staples plague the “Main Street” stock market. Just a modest inflection in those spots would bode well for early next year, when household stimulus arrives via larger-than-normal tax refunds.

Zooming out, it’s not as if the fate of 2025 hinges on an immediate broadening out or a 10%-plus jolt between now and December 31. Global stocks remain on pace for one of their better years this century and, in the near-term, the S&P 500 has traded above its rising 50-day moving average since May 1 (now 131 trading days). Consolidation ahead of Turkey Day may prevent December indigestion.

The Bottom Line

The intermarket backdrop is mildly unsettled at the moment. Classic relationships have emerged — stocks down/Treasuries up, dollar strong/commodities weak, among others. Big-cap tech now appears to be enduring its own bout of sideways action. This could all be a healthy sign, and we must remain on watch for macro clues via the dollar, non-glamour quality stocks, and the VIX.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.