Market Rotation: What’s Really Happening Beneath the Surface

The stock market has entered a decisive rotation, one that’s been building for weeks but is now showing up clearly in sector leadership, money flows, and the behavior of institutional investors. While headline indexes may look range-bound or choppy, we’re seeing a meaningful shift in what’s driving performance under the surface.

Growth Finally Pauses, but It’s Not the End of the Story

The mega-cap growth trade that has dominated the past year — AI leaders, semiconductors, and high-multiple software — has paused as valuation concerns catch up with the strongest names. Many of the market’s prior leaders are experiencing pullbacks on heavier volume, signaling that institutions are trimming exposure after outsized gains.

This doesn’t mean the AI cycle is over, not even close. However, it does indicate that leadership inside the theme is becoming more selective, as investors distinguish between companies with real earnings and those that are not as mature in their growth cycle.

Where Is the Money Rotating?

As Growth takes a breather, we’re seeing a broadening out to other areas of the market. Two areas in particular are attracting steady institutional interest:

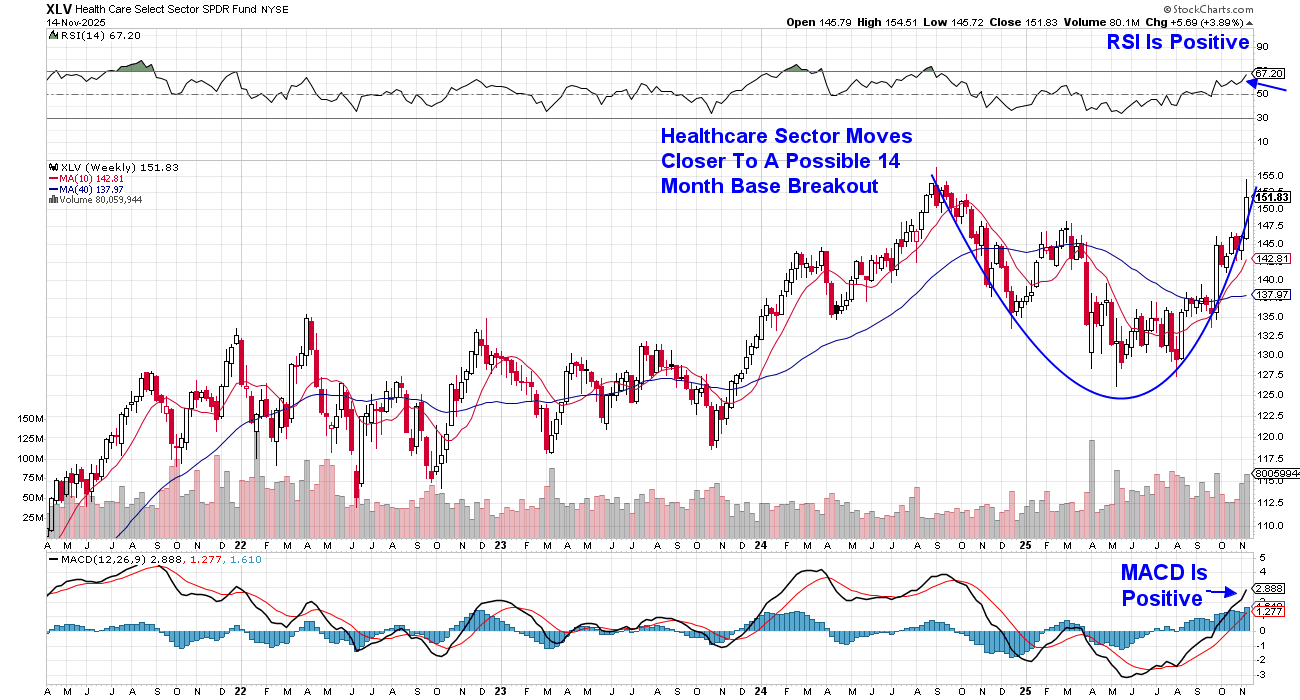

1. Health Care

Health Care has been one of the quiet winners recently, helped by improving earnings prospects across devices, services, and innovative biotech. This group tends to outperform when investors want exposure to growth without paying peak multiples.

The move into Health Care began in late September, following Pfizer’s (PFE) agreement with Trump to lower drug prices. The news greatly reduced uncertainty around drug prices, which had been holding this group back.

Subscribers to my MEM Edge Report were alerted to the new uptrend in this group, and we added names in this area to our Suggested Holdings List. Each of these names is poised to head higher, and you can gain access at no cost by using this link here!

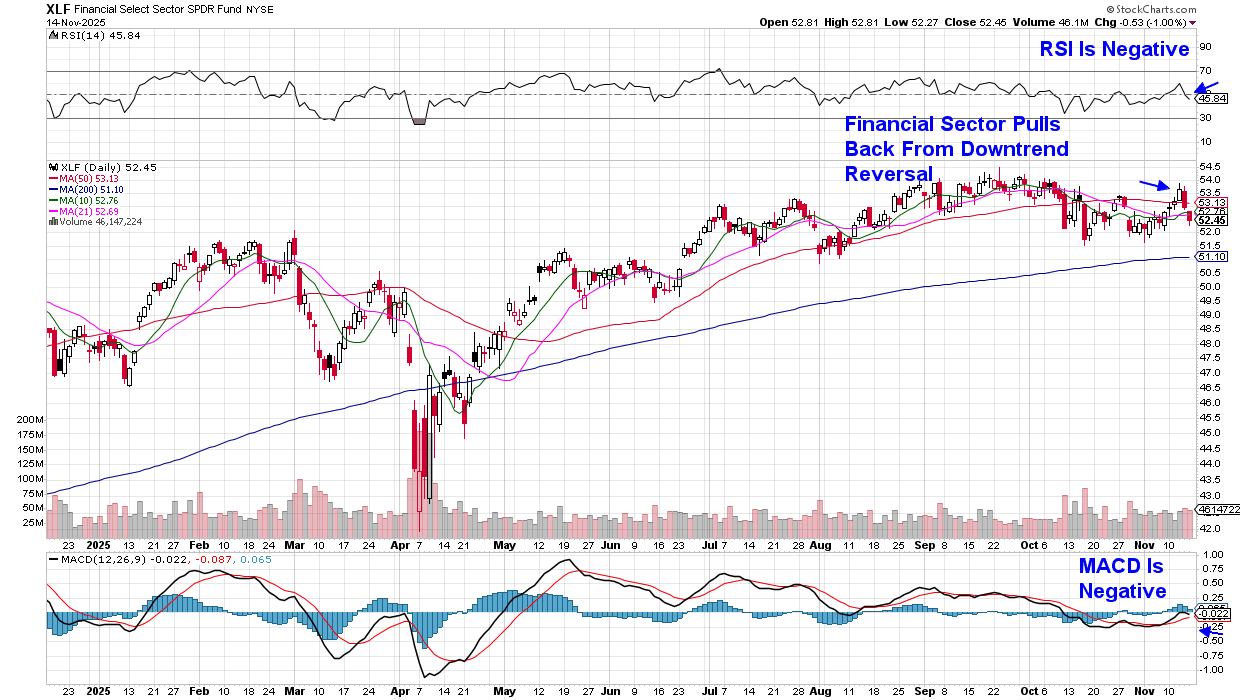

2. Financials

Financial stocks — money center banks, diversified financials, and insurers — are benefiting from stabilizing rates and better visibility into net-interest income. Many of these stocks had lagged dramatically and are now playing catch-up as valuations and fundamentals finally align.

The group is sensitive to moves in interest rates, however, and hints late last week that the Federal Reserve may not cut rates in December had these stocks pulling back.

We have select leadership names in this area poised to trade higher as well, and strongly suggest you use the link above to gain access to my twice-weekly MEM Edge Report at no cost. We intend to put additional names on our Suggested Holdings List this weekend.

Broadening Market Leadership Ahead of Nvidia’s Pivotal Earnings

The shift away from a narrow group of mega-cap leaders toward Health Care and Financials signals growing confidence in a more balanced, economically-supported market. In more good news, the leadership names in these sectors are those that have reported strong earnings and have a positive growth outlook going forward.

Other sectors are beginning to move into a leadership position as well, with Energy stocks poised to break out due to several dynamics that are improving their growth prospects. We’ll be adding top stocks to our buy list this weekend, and you’ll want to be alerted. Use this link!

Next Wednesday, NVIDIA (NVDA) will release results after the markets close, and the company’s numbers, as well as investors' responses, will certainly set the tone for other AI stocks that have been struggling recently.

Until then, remain flexible and consider your investment horizon before selling any core positions. Of course, weak earnings results or a weak growth outlook going forward would be reason enough to reduce any holding.

If you’d like to be kept on top of the current market conditions and be alerted to an opportunity to enter leading stocks on a pullback, use this link to access the MEM Edge Report. It’s released twice weekly with alert reports, such as yesterday’s Thursday Alert, included as well.

Warmly,

Mary Ellen McGonagle

MEM Investment Research