Market Strength is Spreading, Just Not Where You Might Expect

Key Takeaways

- Market leadership is broadening, even as major indexes consolidate.

- Strength is rotating toward small- and mid-cap stocks and select sectors.

- Headline risk may be slowing large-cap momentum, creating room for rotation.

Geopolitical tensions briefly put investors on edge on Wednesday, but those concerns now appear to be fading. The stock market has largely retraced its moves from earlier in the week. Oil prices pulled back, stocks rebounded, volatility eased, and gold gave up some ground.

Despite the rebound in stocks, the S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) remain in “consolidation mode”, grinding higher without the momentum you’d typically see in a decisive breakout. Even so, market breadth continues to favor the bulls, suggesting underlying demand for equities remains intact. Ongoing headline risk, however, may be limiting upside follow-through.

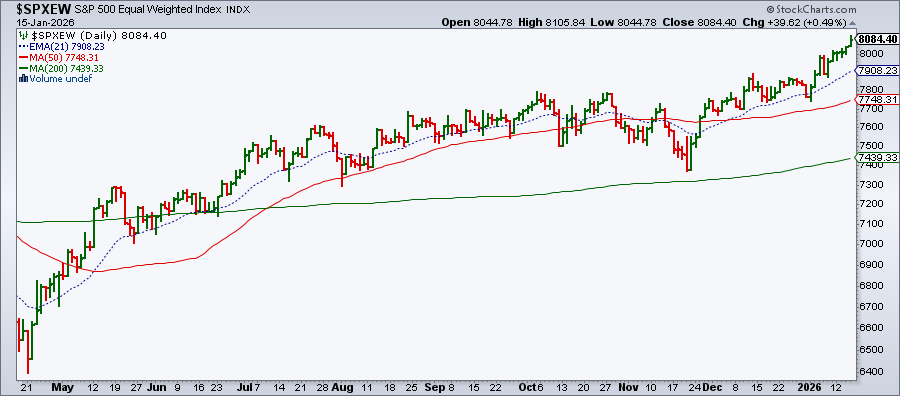

One exception is the S&P 500 Equal-Weighted Index ($SPXEW), which continues to trend higher and notched an all-time closing high on Thursday.

The strength in the equal-weighted index suggests participation is expanding beyond the heavily weighted Magnificent Seven. Semiconductors continue to perform well, with the VanEck Semiconductor ETF (SMH) pushing into record territory. Taiwan Semiconductor Manufacturing (TSM) reported better-than-expected earnings, providing another catalyst for the group.

Small- and Mid-Caps Join the Advance

The S&P 600 Small Cap Index ($SML) and the S&P 400 Mid-Cap Index ($MID) hit record closes. Comparing the one-year performance chart of the iShares Russell 2000 ETF (IWM), a proxy for small-cap stocks, has begun to marginally outperform the SPDR S&P 500 ETF (SPY).

Which Stocks Are Leading the Rally?

The US Industries panel on the Market Summary page highlights Transportation, Regional Banks, Homebuilders, and Retail as the top-performing groups, each gaining more than 1%. These industry groups are made up of several small and mid-cap companies, reinforcing the theme for expanding market participation.

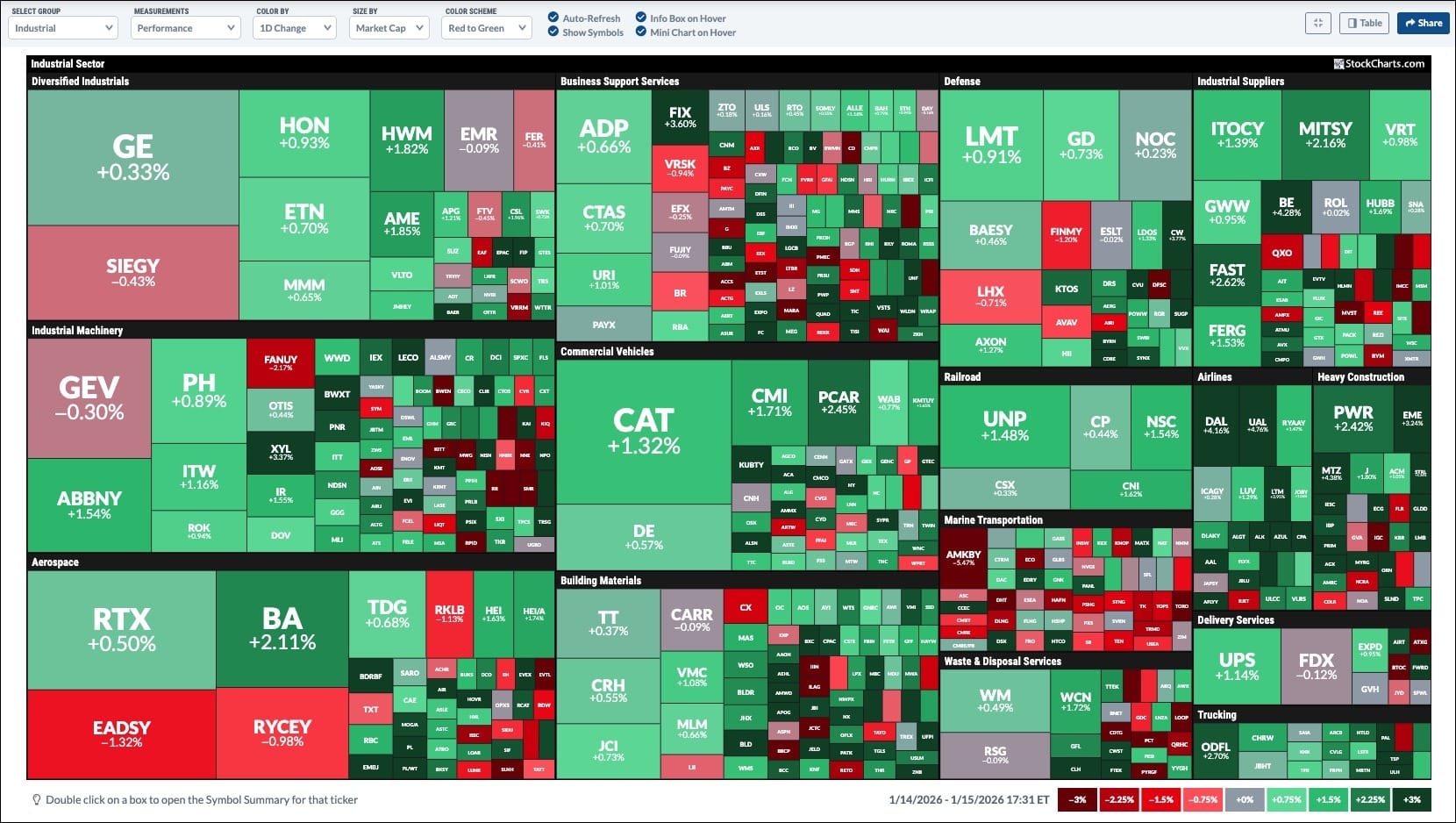

The StockCharts MarketCarpet for the Industrial group shows broad strength across Transportation stocks, with Airlines, Delivery Services, Trucking, and Commercial Vehicles largely represented by green squares.

For a closer look at Consumer Discretionary, select the group from the Select Group dropdown menu. This view clearly illustrates the strength in Homebuilders and Retail stocks.

Within Financials, bank earnings were met with mixed reactions earlier this week. However, strong earnings from Goldman Sachs (GS) and Morgan Stanley (MS) provided some support to the sector. Regional banks continue to show their strength, with the SPDR Regional Banking ETF (KRE) hitting a 52-week high close. The Relative Strength Index (RSI) and Percentage Price Oscillator (PPO) have room for further upside moves.

The Bottom Line

Market participation continues to broaden as leadership from the Mag 7 shows signs of slowing. If this trend persists, smaller and mid-sized stocks may have an opportunity to catch up. A return to a headline-driven environment could keep large-cap growth stocks advancing at a more measured pace until uncertainty clears.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.