Six Reasons Why the Fed Will Not Raise Rates; One Bad Reason Why it Will

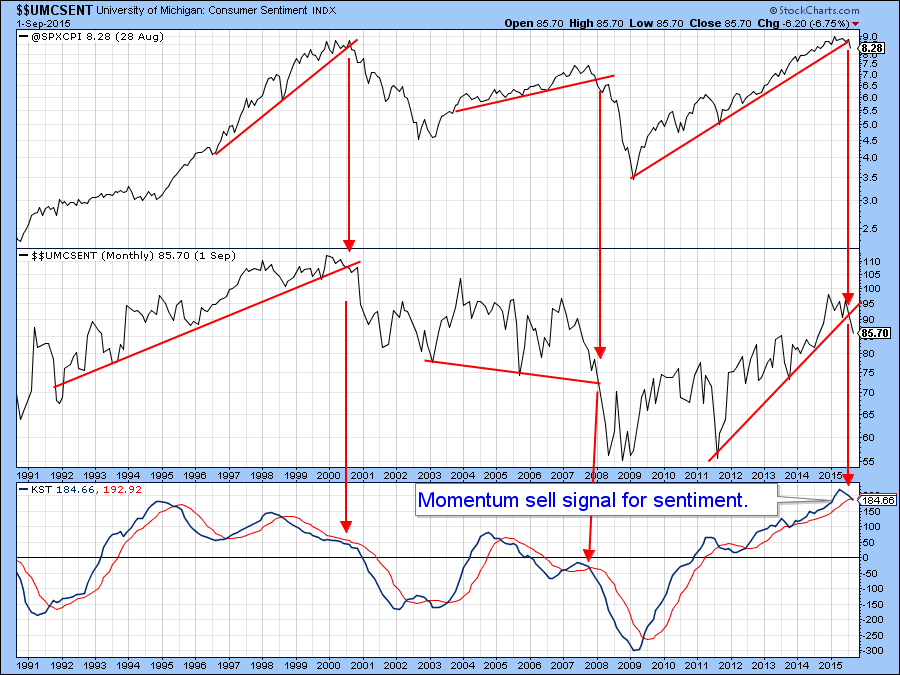

- Consumer sentiment flags a sell signal

- Short rates rise before commodity prices do. That's not supposed to happen.

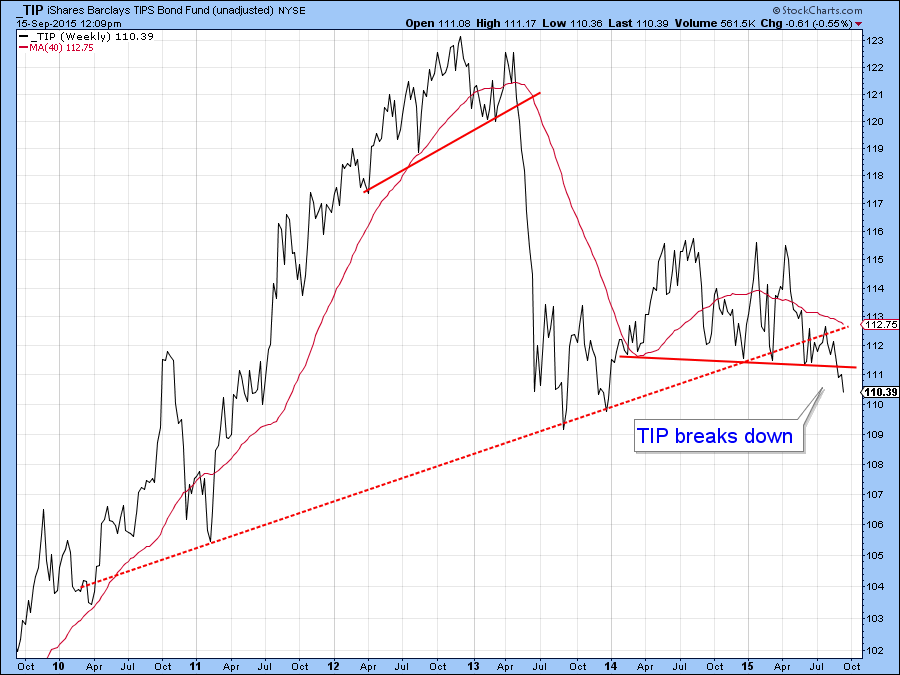

- TIPS break key support

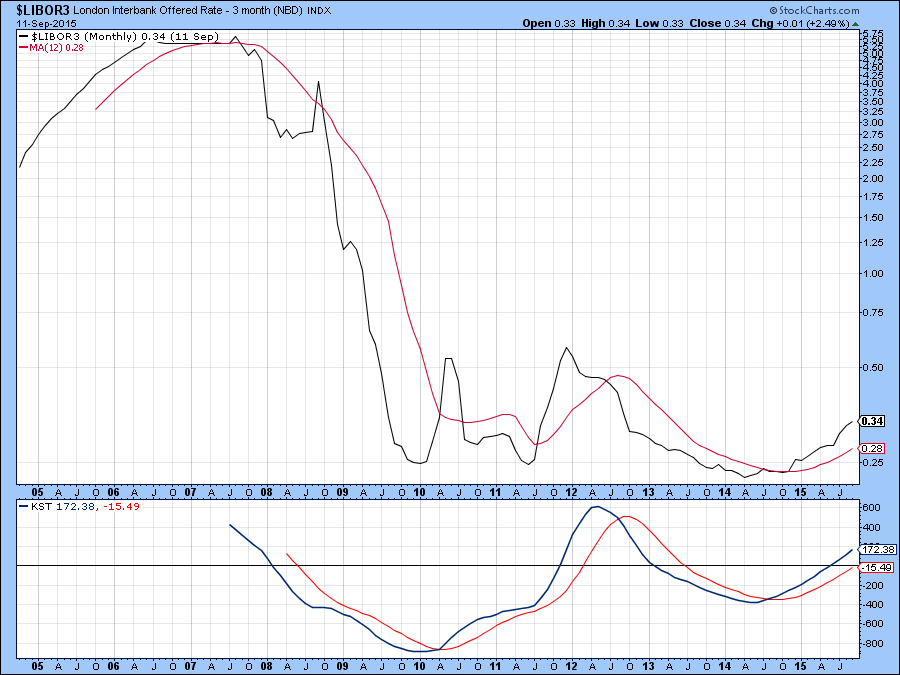

The biggest question in financial markets this week is "will she or won't she?". The ”she” in this case is Janet Yellen and the “will” or “won't” is whether the Fed will raise rates or not. I am not so sure whether it really matters because the market, as we can see in Chart 1 has already begun to raise short rates. I could have chosen any short-term maturity to make the point, but it’s fairly evident that the 3-month LIBOR ($LIBOR3) has been rising for well over a year and has already moved up 12 basis points from its low. That’s about half of what the Fed might be expected to do. Bottom line, the market is saying a rate hike is a toss-up.

Chart 1

Usually the Fed raises rates to combat inflation but at the moment there is no inflation. Commodity and gold prices are down and some forward looking economic indicators have started to point in a southerly direction. That’s not a forecast of a recession but merely a recognition of the fact that not all leading indicators are moving higher. For example, the latest data from the University of Michigan shows a distinct weakening in sentiment, not dissimilar to the two previous bear markets and their associated recessions. We have to be a bit careful on this one because the chart plots the end of the month final number, whereas that shown for September i.e. the latest sharp drop, is only last week’s preliminary number. Nevertheless the overall trend appears to be a declining one. For example, the KST is a smoothed momentum calculation, where one month either up or down is not going to make much of a difference to its overall trajectory. This indicator has now given a sell signal for the true path of consumer attitudes. Indeed, William Dudley a Fed board member, said last month in Jackson Hole that he would pay close attention to this very survey in coming to a decision on interest rates. Since the number was reported below expectations it’s clearly a negative factor for a rate hike.

Chart 2

Dudley also said he was paying close attention to Chinese developments. In this respect Chart 3 shows the Wisdom Tree Yuan fund (CYB), unadjusted for dividends. It’s important to bear in mind the fact that prices prior to the listing of this ETF were much lower. That means that the red trendline violation marks the breakdown from a multi-year top. In other words, if the pattern works, and there are no technical grounds for suspecting otherwise, the yuan is headed significantly lower in the coming months. Raising US rates would exacerbate that trend, raising the question of additional competitive devaluations throughout the emerging market community. Indeed the IMF and World Bank, citing EM concerns have both advised the Fed against a rate hike. I am not normally one to absorb the pablum of establishment thinking, but the data suggest that they are probably right on this one.

Chart 3

Chart 4 compares the CRB Composite ($CRB) to the yield on 3-month commercial paper. The green arrows show that the Fed usually raises rates after commodity prices have established a cyclical uptrend. Right now the CRB Composite is in a declining trend and its long-term KST continues to fall. This is hardly the stuff of an overheating economy that would justify a rate hike.

Chart 4

Charts 5 and 6 show that the bond market agrees. Chart 5 features the inflation adjusted Barclays TIP ETF. A rising trend indicates that investors are concerned about inflation as they rush to inflation adjusted bonds. On the other hand a drop in price tells us they are more concerned about deflation. Recently the TIP price, unadjusted for interest rate payments and other distributions, dropped below a major support trendline thereby indicating that bond investors are not concerned about inflation at the present time. If they are not why should the Fed?

Chart 5

Chart 6 looks at things from the point of view of quality spreads. The top window features a ratio between junk and high quality treasuries (HYG:TLT). A rising relationship means investors are confident because they are more inclined to go for a high risk yield than the relative safety of treasuries. By the same token a declining ratio indicates fear amongst bond investors as they favor treasuries. As you can see, the ratio has been moving irregularly lower since its peak in 2007. It has also violated its 2009-2015 up trendline and is now finding resistance in the area of the extended line. The KST looks like it is flattening but at this moment of time the ratio is below its 12-month MA and the overall trend is declining. That status may change but as a factor in the rate hike debate this credit spread is a no vote.

Chart 6

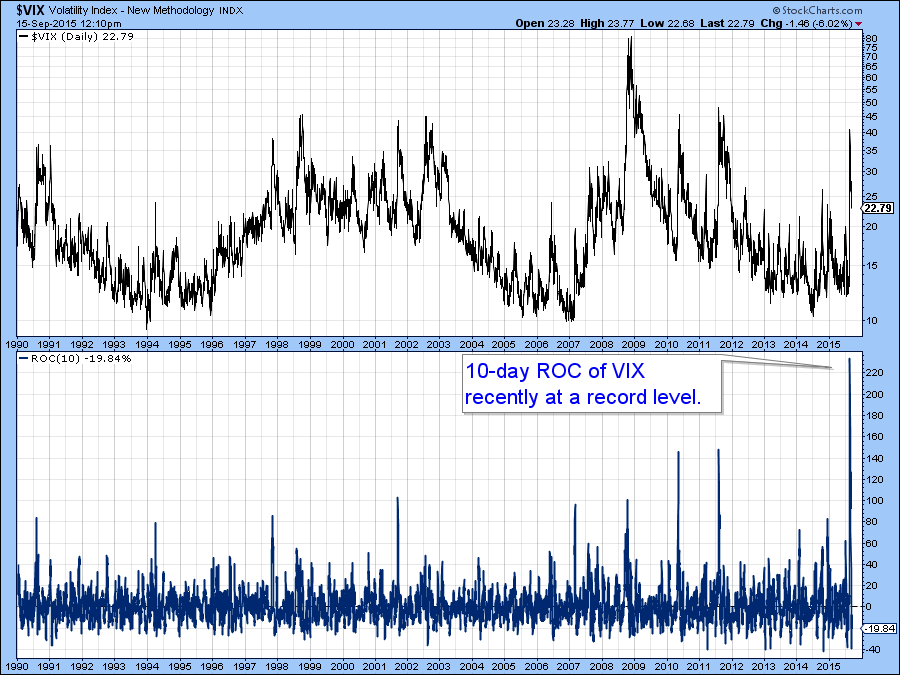

Finally recent stock market volatility around the world is arguing for caution. In that regard you can see from Chart 7 that the 10-day ROC for the $VIX reached a record level in August.

Chart 7

If there are few economic reasons for raising rates, why would the Fed do so? The only rationale I can think of is so that they can lower them in the future. That might sound irrational but consider the fact that interest rate changes have historically been a key tool used in monetary policy both for tightening and stimulating the economy. If rates are at zero when the economy turns sour again the Fed’s tool box is virtually empty. In my book that’s not a good reason for raising borrowing costs, and in the process could cause the very recession they are hoping to avoid! Could it be that the markets and the economy have put the Fed in a box from which it cannot escape? Just a thought.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group or its affiliates.