Three Good-Looking Sectors for the Ongoing Bull Market

- The Game Has Just Begun

- Three Interesting Sectors

- Watch the DB Agriculture Fund

The Game Has Just Begun

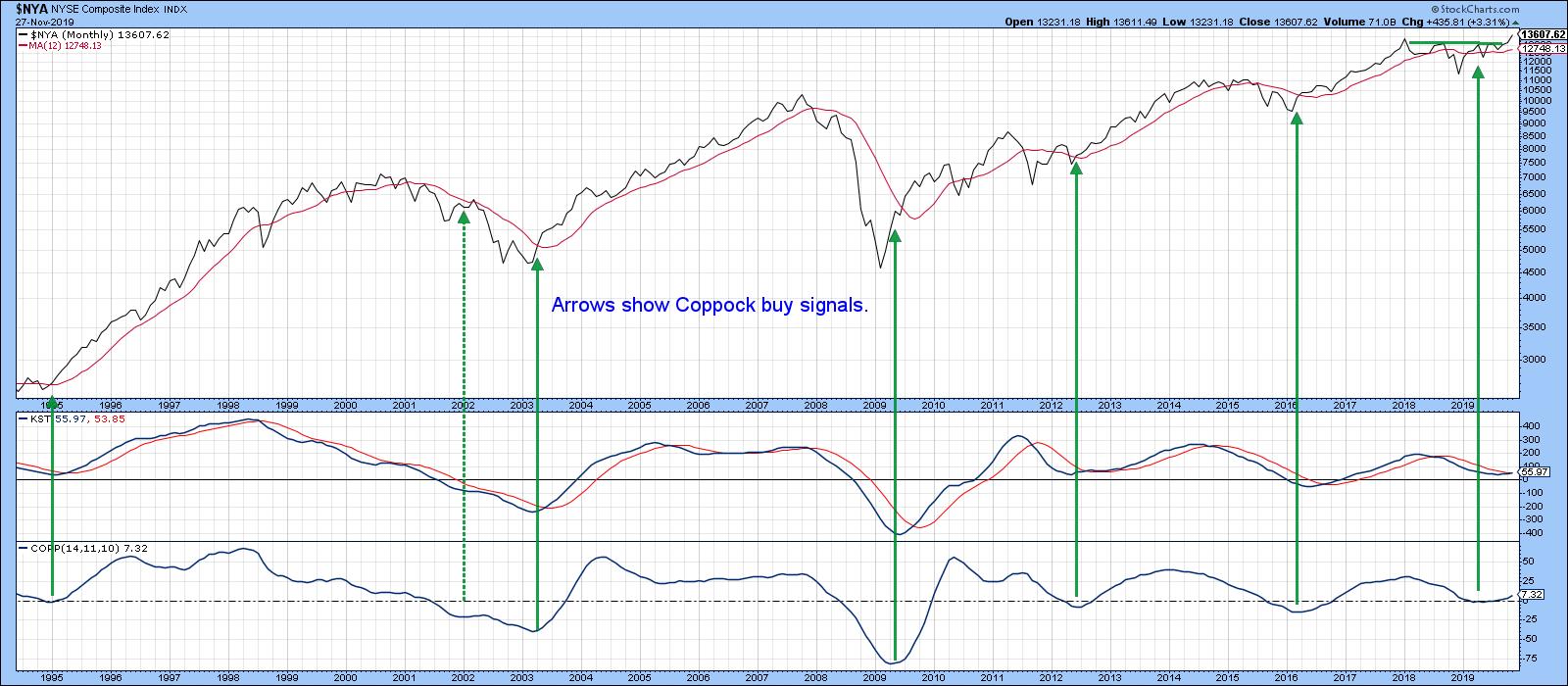

It is fairly evident by now that the equity market has broken to the upside big time. Chart 1 sets the scene by demonstrating that first the Coppock Indicator and later the long-term KST both went bullish. This confirms the price action, which has recently completed and broke out from a reverse head-and-shoulders pattern. Things may be a bit overdone for the near-term, but, with the seasonally bullish year-end period lying ahead, I wouldn't bet on it. Looking at the currently subdued reading in the two momentum indicators in Chart 1, I'd say the game has only just begun. When rallies have legs, it's usually better to focus on the long-term trend rather than worrying about corrections that may or may not come.

Chart 1

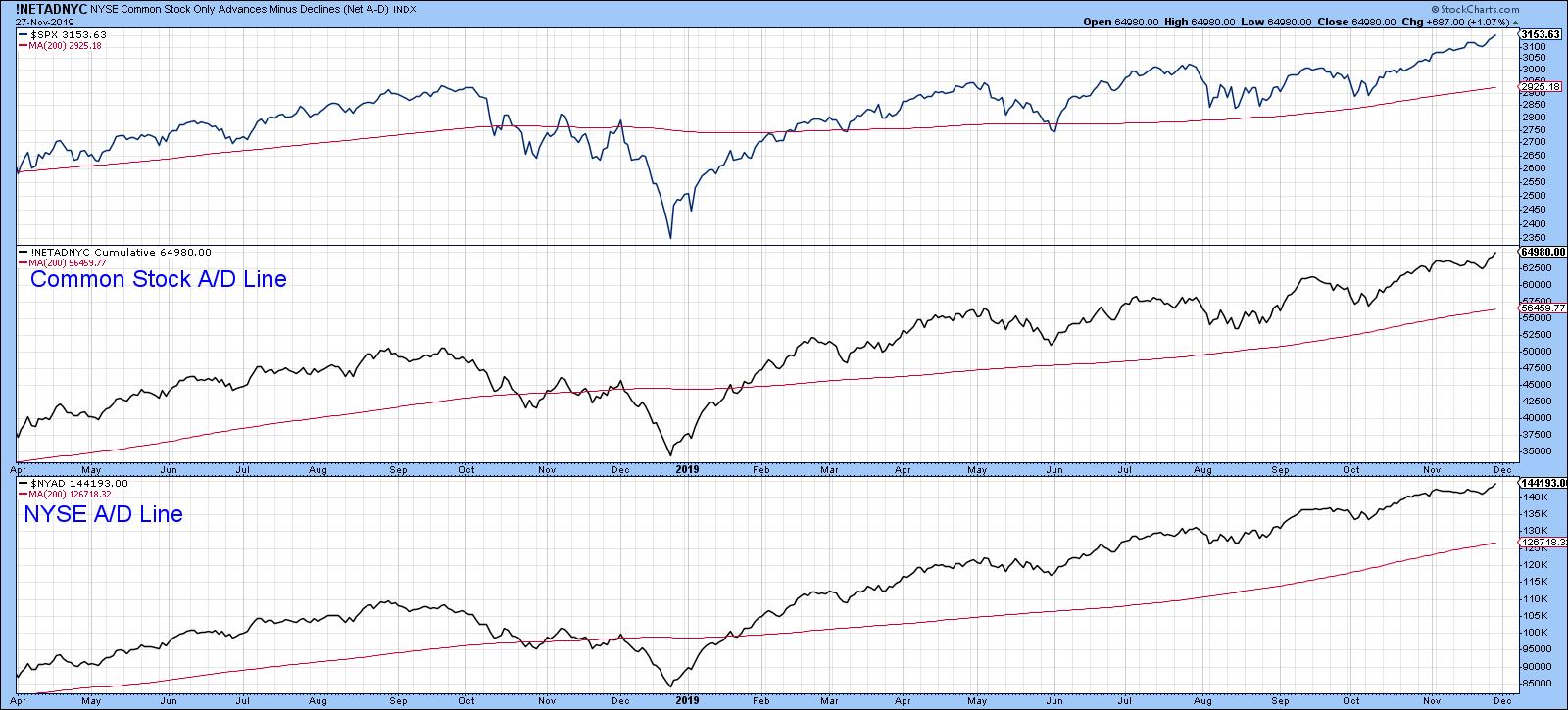

With Chart 2 showing that both the common stock and regular NYSE A/D lines at new all-time highs, what's not to like about this rally?

Chart 2

Three Interesting Sectors

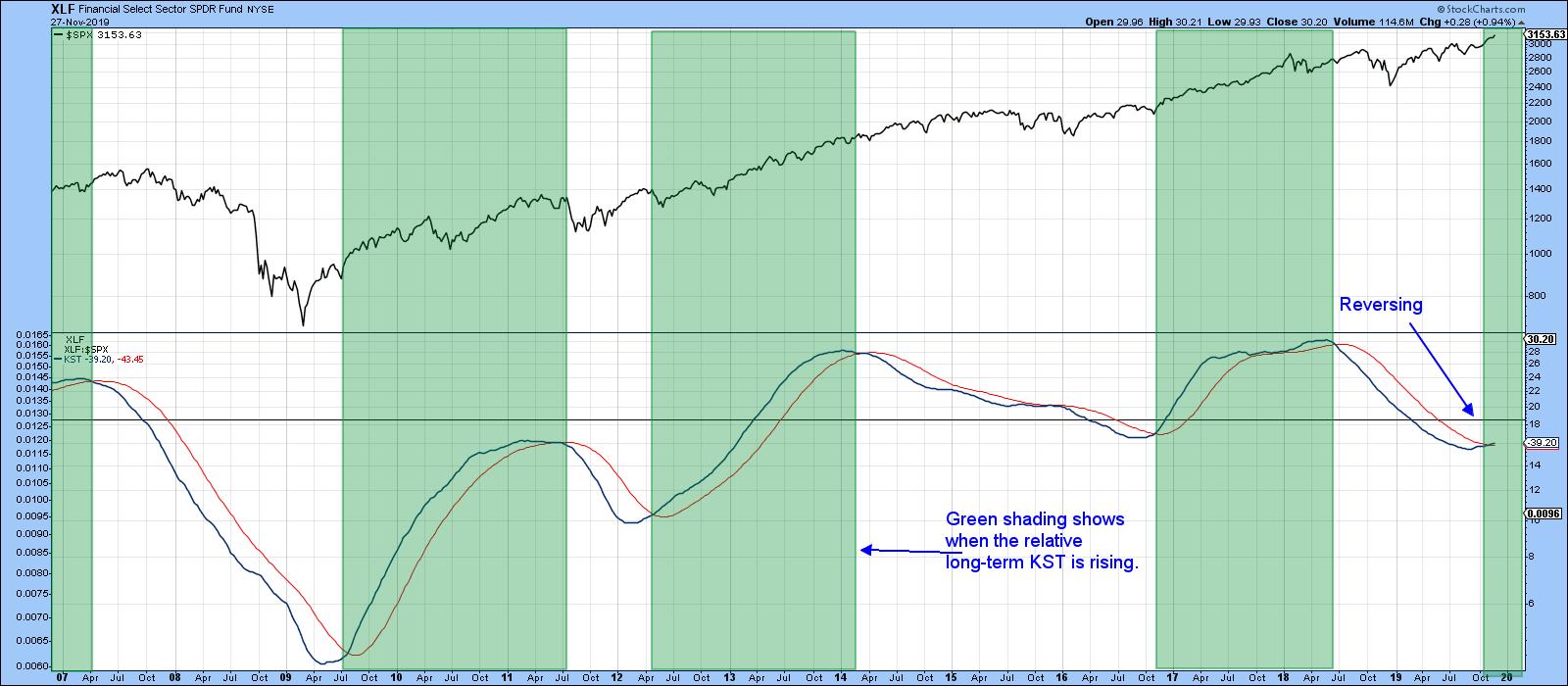

Chart 3 shows another long-term indicator that just went bullish for the market. It also points us in the direction of one of the sectors referred to in the title of this article, namely financials. The indicator in question is the long-term KST for the relative action of the SPDR Financials (XLF). The green-shaded areas begin when it crosses above its 26-week EMA and end when it moves back below it. If you look at the progress of the SPY in the upper window, you will see that it is typically in a bullish mode when in the "green." On the other hand, practically all of the declines developed in the unshaded areas, where financials were underperforming. Since the KST has just crossed above its EMA, it has just flashed another buy signal. That makes financials one of our choices as a potential market leader.

Chart 3

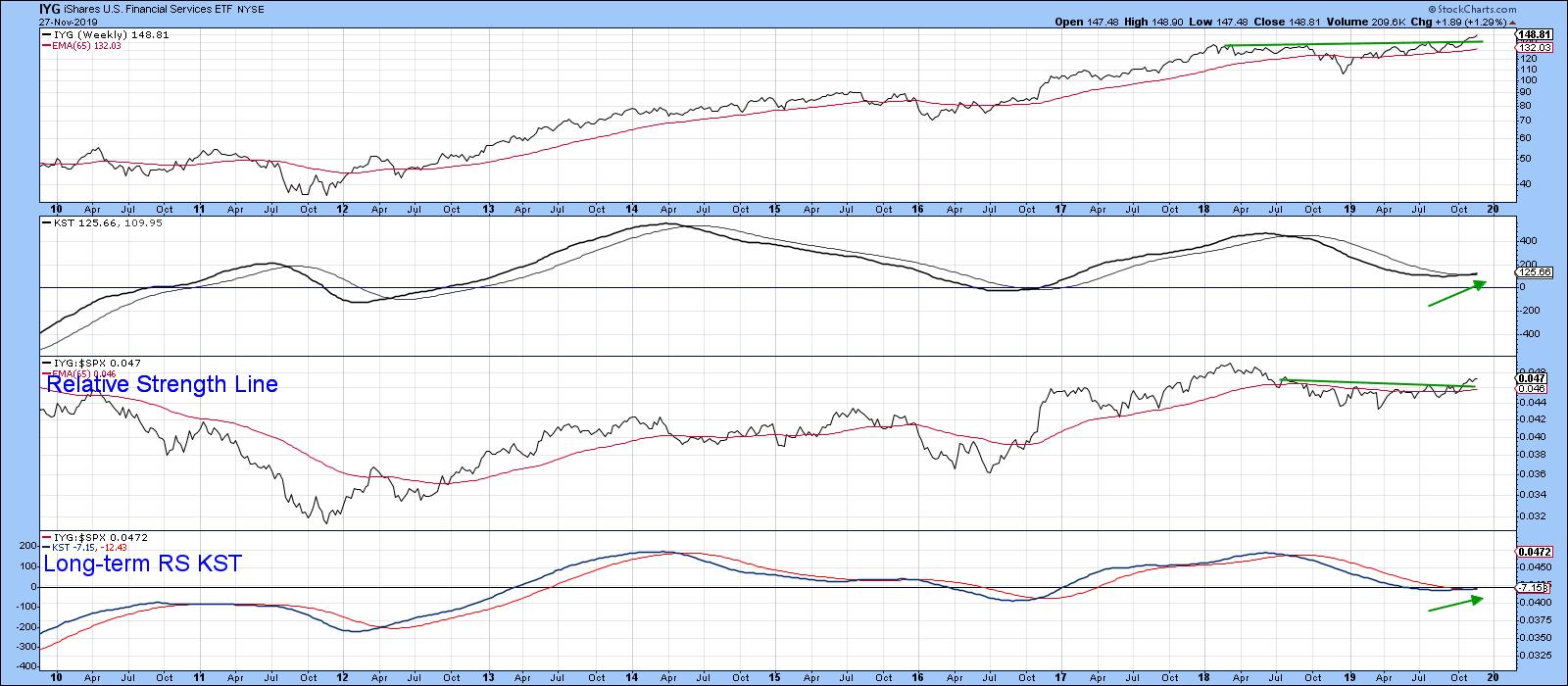

Chart 4 features the iShares Dow Jones Financial Services ETF (IYG). It, like the S&P itself, has emerged from a two-year consolidation, but we also see that the RS line has as well.

Chart 4

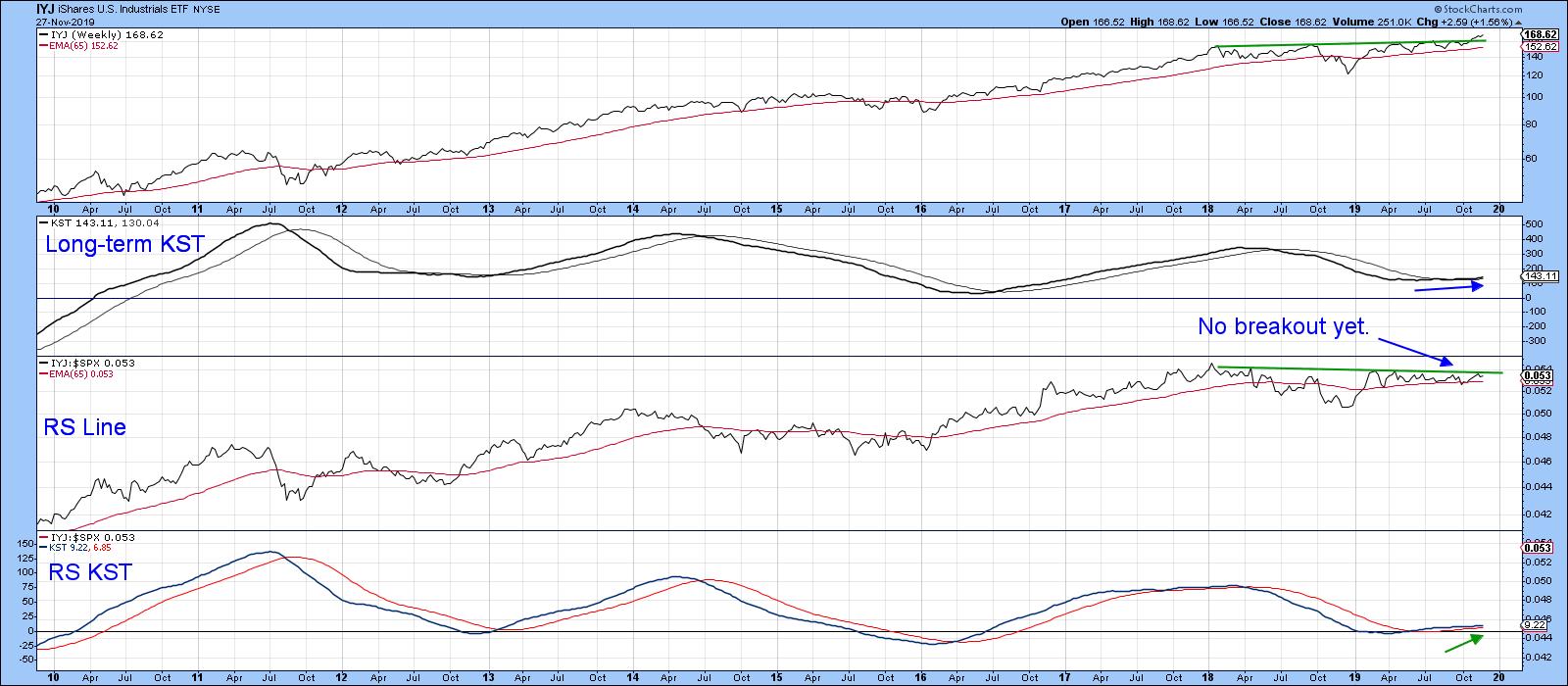

Industrials also look promising. Here, we have two principal contenders, the iShares Dow Jones Industrials (IYJ) and the SPDR Industrials (XLI). I prefer the IYJ, as it's a purer play on industrials. That compares to the XLI, which also includes transports, which tend to be early cycle leaders. Pure industrials are not.

Chart 5 shows that the IYJ has broken to the upside, while its RS line, though close, is contained in a trading range. However, the bullish KST for relative action suggests that it soon will.

Chart 5

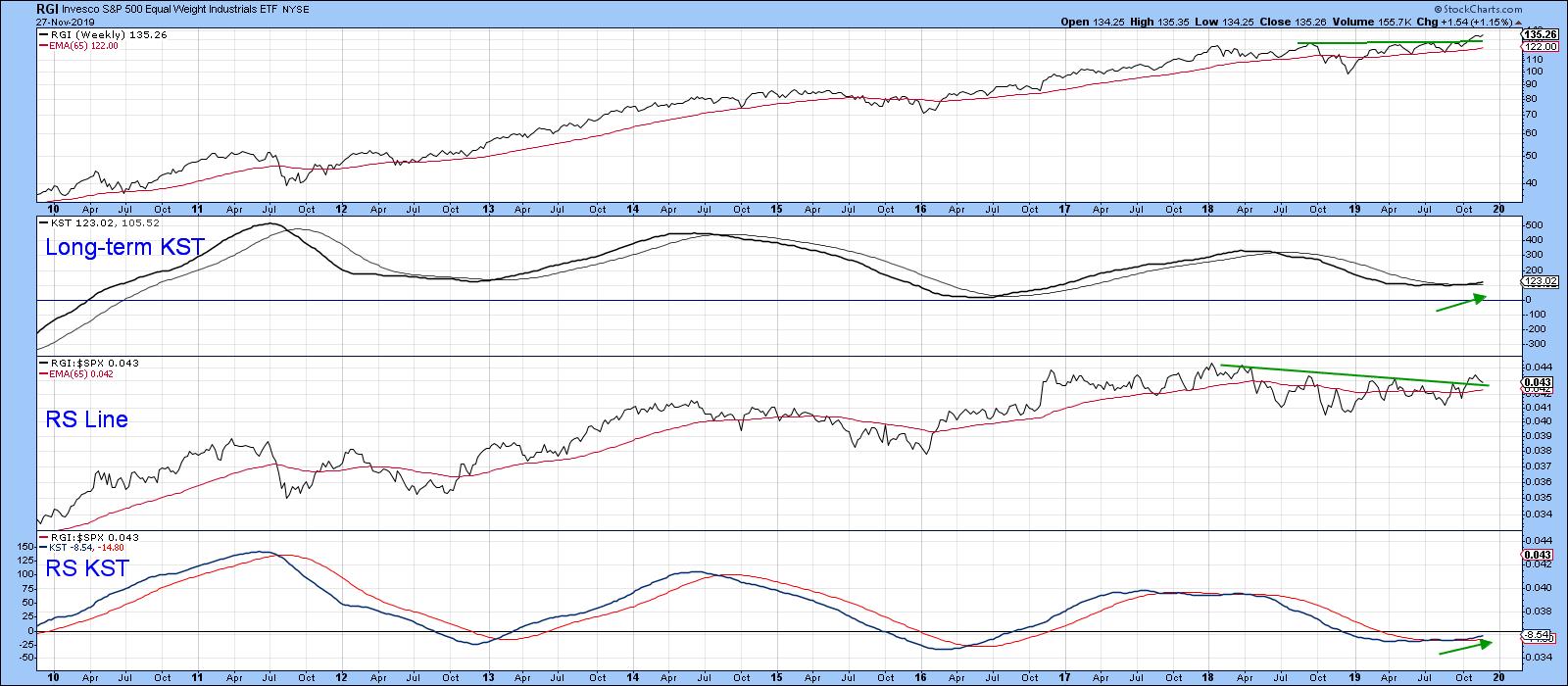

One industrial ETF that has broken out on both an absolute and relative basis is the Invesco Equal Weight Industrials (RGI). It looks to be the most promising of all, as shown in Chart 6.

Chart 6

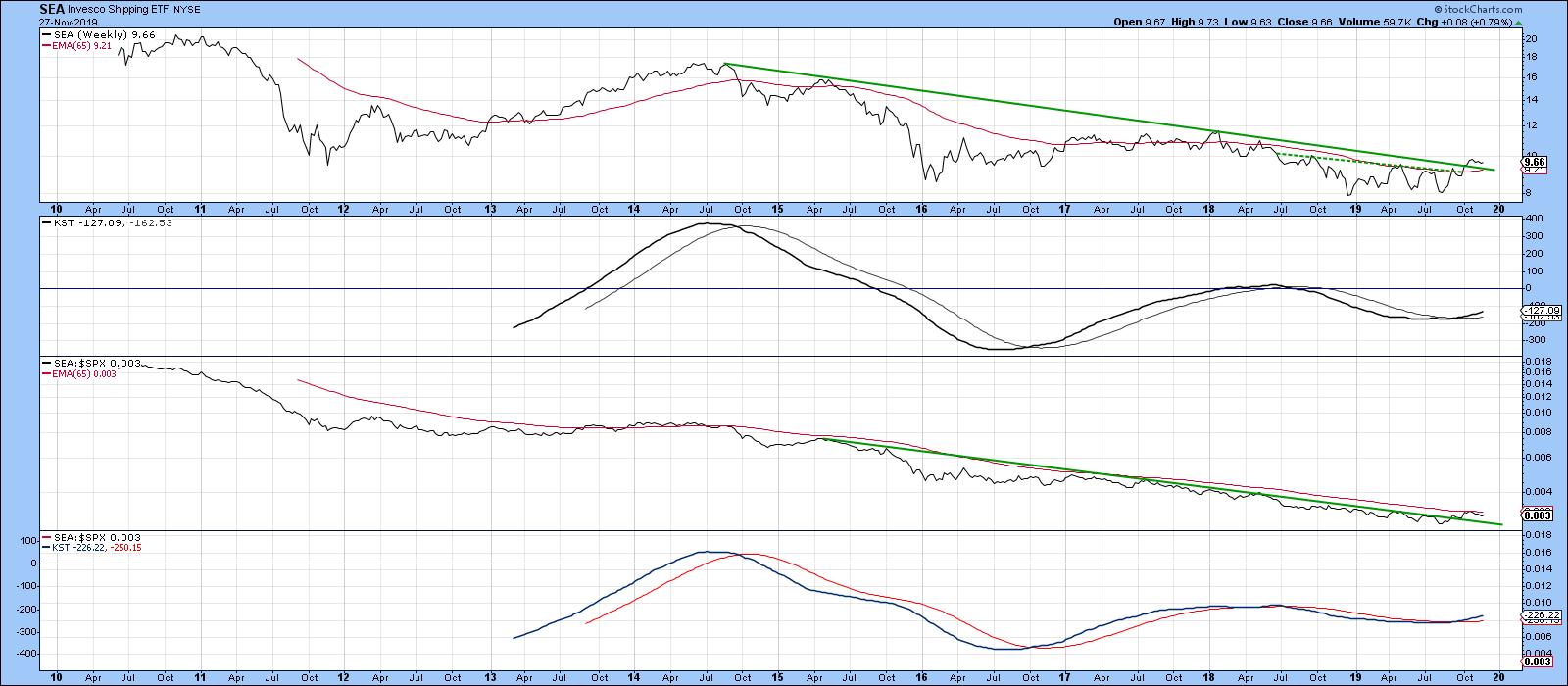

An industry (as opposed to sector) ETF that has recently got my attention is the Invesco Shipping ETF (SEA). Both the price and the RS line have been in a long-term downtrend, which may be coming to an end. That view is based on the fact that the price has broken out from a small base, i.e. above the dashed trendline, and its 2014-19 downtrend line. Relative action has already violated its equivalent trend line, but has not quite cleared its 65-week EMA. Since both long-term KSTs are positive, it seems a likely bet that it soon will.

Chart 7

Watch the DB Agriculture Fund

One area that's been under pressure for years is the agriculture sector, as reflected in the price of the DB Agriculture Fund the DBA. Chart 8 shows that the ongoing down trend is still intact, but both the price and Special K, which you can read about here, are very close to their multi-year bear market trend lines. Since these lines are so long, their penetration is likely to be followed by a very worthwhile move. At the moment, the short-term KST (in the lower window) is in a corrective mode, so any breakout may be delayed until early 2020. However, I think it's worth watching assolidnews about a good trade deal with China could be the triggering event.

Chart 8

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Groupof Walnut Creek or its affiliates.