Giant Outside Days Spook the Bears

Thursday's price action began bearishly with the probing of recent bear market lows. By the end of the session, the DJIA, along with several other markets, totally encompassed Tuesday's trading range and then some, in a one-day pattern known as an "outside day". To be sure, one day does not make a trend, but a valid outside day or bar is expected to have an influence from between 5-10 sessions. That's usually enough time to enable a nice reversal in some of the short-term indicators. In that respect, outside bars act as a kind of reverse domino.

I classify such patterns based on several principles, as outside bars are not created equal. First, they must have something to reverse, and we certainly have that in spades. Second, they should be wide, indicating a formidable battle between buyers and sellers. Thursday's action was extremely impressive in that regard. Third, the bar should end near its high, as that indicates the dominance of buyers at the closing bell. Check for that one as well. Fourth, it's nice when the bar totally encompasses the trading range of the previous session. However, that becomes an even stronger signal when it encompasses several sessions in one go, which was the case with Thursday's action.

Finally, if it is to represent a true victory for buyers over sellers, it's nice for volume to pick up on the day. Once again, Thursday's action is positive for the Dow, but not exceptional. None of these favorable characteristics guarantee a rally, but certainly increase the odds of one. So too does the tentative completion of a small RSI base and KST buy signal. That may not happen right away, as wide bars are often followed by a couple of quiet sessions, when market participants pause for breath. Also, it's important to note that the outside bar is certainly not a sign that the bear market is over. We need to see the longer-term indicators reverse for that. Nevertheless, the market is about to enter one of the most positive seasonal periods of the year, so it's likely that the year-end could bring some financial Christmas cheer. Let's hope so!

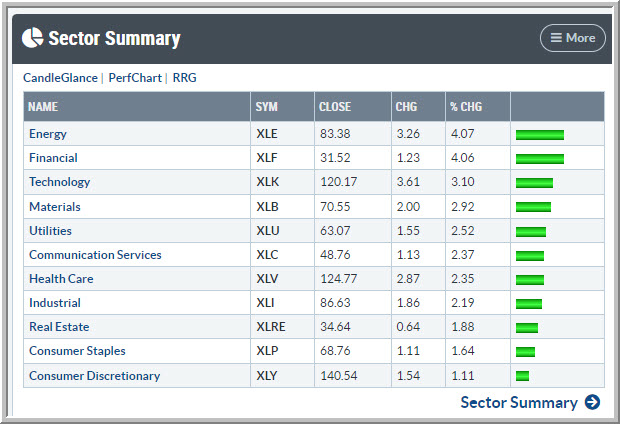

One characteristic that bothers me from a long-term perspective, should it continue, is the fact that upside leadership, which often changes when the primary trend reverses, has not done so. The attached table shows that the former leader, energy, continues to power ahead, while consumer discretionary, one of the superior performers on the downside, was up the least.

More Outside Bars

Chart 2 shows that Bitcoin also produced an outside bear. That suggests a bear market rally in the event that it can re-cross its 50-day MA and April/October down trend line.

Finally, we see a similar setup for the euro being supported by a KST buy signal. You can't see the 50-day MA because it is below the down trendline. The two reinforce each other as a resistance zone, so that level around par is an extremely important one.

The Canadian dollar has been suffering recently but has managed to trace out and outside bar which is also a hammer candlestick. Once again we see the KST being nicely poised to trigger some kind of rally.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Groupof Walnut Creek or its affiliates.