This Stock Market Will Likely Outperform the World Index, But Could Be Outshone by Something Completely Different

Since 2011, the US stock market, represented by the S&P Composite, has outperformed the world. In the last couple of weeks or so, it has managed to break out from a trading range in its relationship with the rest of the world and looks headed even higher on a relative basis.

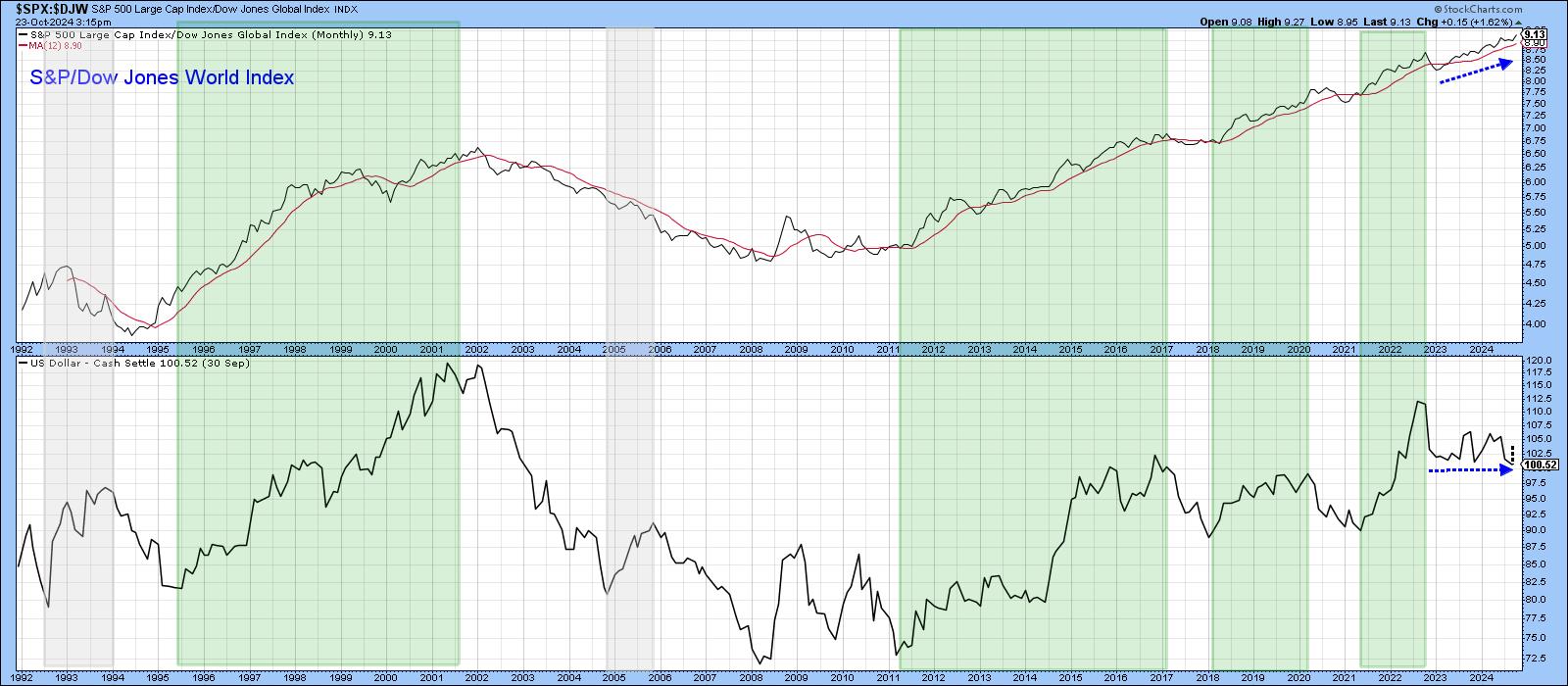

Chart 1 sets the scene with the ratio between the S&P and the Dow Jones World Index. Since 1995, there have been three major trends, one down and two up. The latest uptrend has now been in force for 23 years and is showing few signs of slowing down. Indeed, the long-term KST has just started to swing higher for the fourth time during this relatively secular bull market.

To a large degree, these trends have been driven by changes in the dollar. In that respect, the shaded areas in Chart 2 flag periods when the dollar has been in a rising trend. The green areas show that a rising dollar usually enhances relative stock market performance, but the two gray ones indicate a rising dollar is no guarantee of superior performance. Noteworthy is the fact that the RS line has continued to advance in the last 2 years despite the dollar being rangebound. StockCharts only plots the data up to September 30, so I have manually approximated the close for October 23 at with an annotation.

Chart 3 shows the performance if the S&P against the iShares MSCI Europe-Australia-Far East ETF (EFA), which is effectively the rest of the world. The recent breakout and move to significant new highs is self-evident. Some pullback seems likely, but, right now, all three momentum indicators are in a positive mode.

What is intriguing is the fact that previous strength has been largely driven by the high weighting of technology stocks in the S&P. However, the recent broadening nature of the US bull market has also spilled into the ratio between the Invesco Equal Weight S&P (RSP) and the EFA, as it has also just broken out. The solid base, formed over the course of the last two years, offers a sounder foundation for advancement that the $SPX/EFA relationship. Note the long-term KST has only just turned bullish, as has its intermediate counterpart.

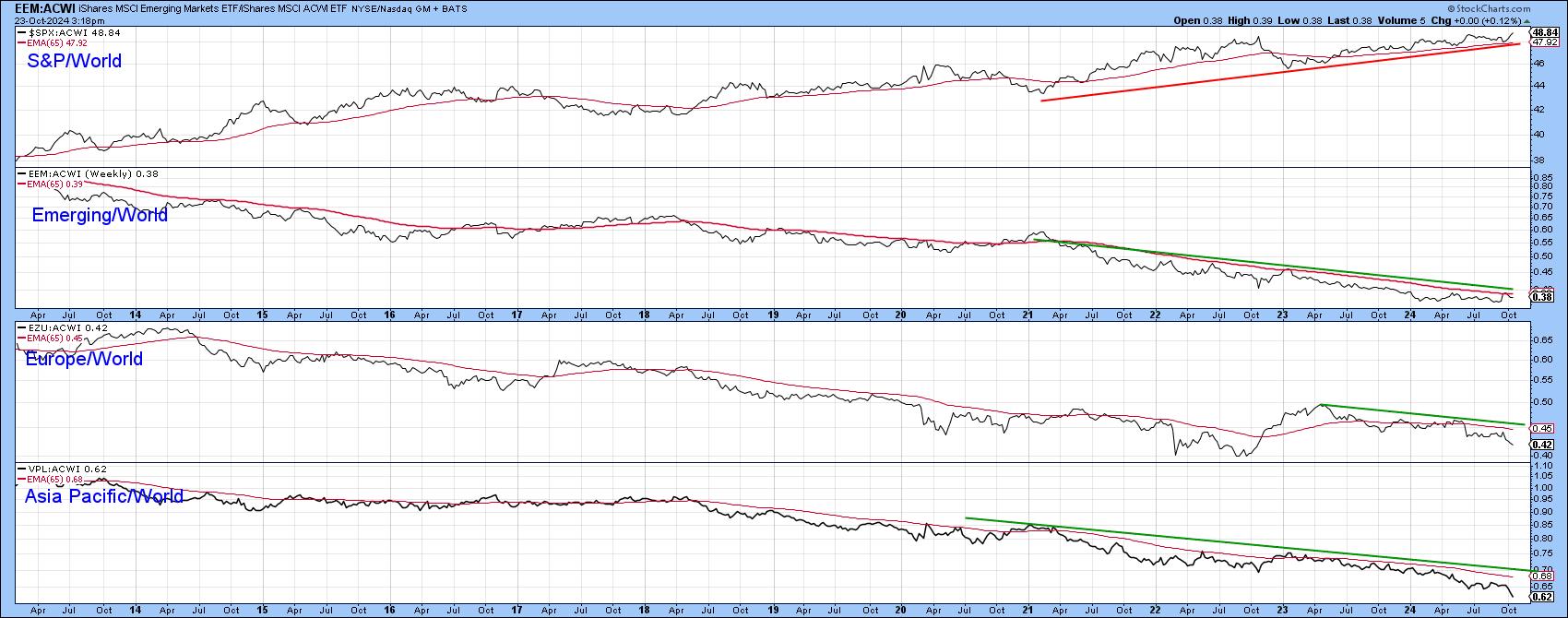

Chart 5 compares the performance of four regions of the world to the iShares MSCI World ETF (ACWI). The US, in the top window, is clearly in the lead, as it has broken to a new high this week. The worst performance can be attributed to the Asia Pacific (VPL/ACWI) ratio, which has just registered a new multi-year relative low. The iShares Emerging (EEM/ACWI) and the European Monetary Union (EZU/ACWI) are also below their 65-week EMAs. Even though they are not trading at new lows, the primary trend is still negative.

The S&P Isn't Rising Against Everything

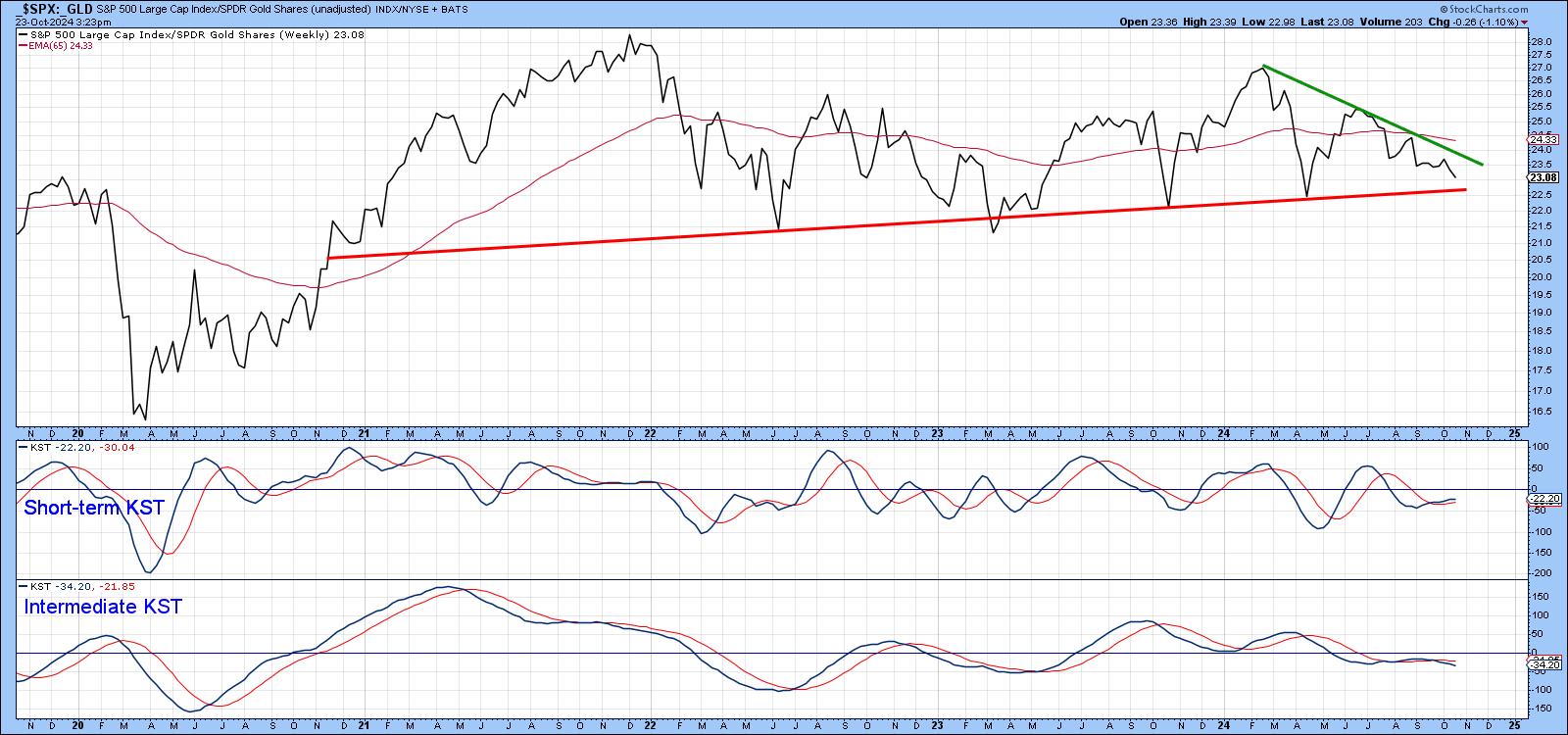

The US market may be well positioned to extend its superior performance against the rest of the world. However, it faces a real challenge in its relationship with gold.

The stock/gold ratio ($SPX/GLD), which is featured in Chart 6, has been in a holding pattern since 2021.The first sign of vulnerability from an equity point of view began at the end of 2022, with the violation of the (red dashed) secular up trendline. The ratio now it finds itself at the low end of the 2021-2024 trading range at a time when the long-term KST has started to roll over. The KST has been relatively flat this year, which tells us that a very fine balance is currently in force.

That fine balance also exists on the weekly chart, where it is evident the short- and intermediate-term KSTs are diverging in their trajectories. A decisive Friday close below the 22 level would take the ratio below its previous low and complete the top. On the other hand, a rally above the green down trendline and 65-week EMA and work in favor of stocks. Watch out for those numbers, as, while this relationship is too close to call at this moment, the next move is likely to be a big one.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Groupof Walnut Creek or its affiliates.