Dow Theory Bearish, But Some Transports Are Thriving

Charles Dow wrote a series of essays in the early 20th century which inspired what is now known as classic Dow Theory. While I often use a more modern adaptation called Newer Dow Theory, I thought it might be helpful to break down this traditional macro technical discipline. Through a comparison of two different broad equity indexes, we can validate whether the markets are in a position of strength or weakness.

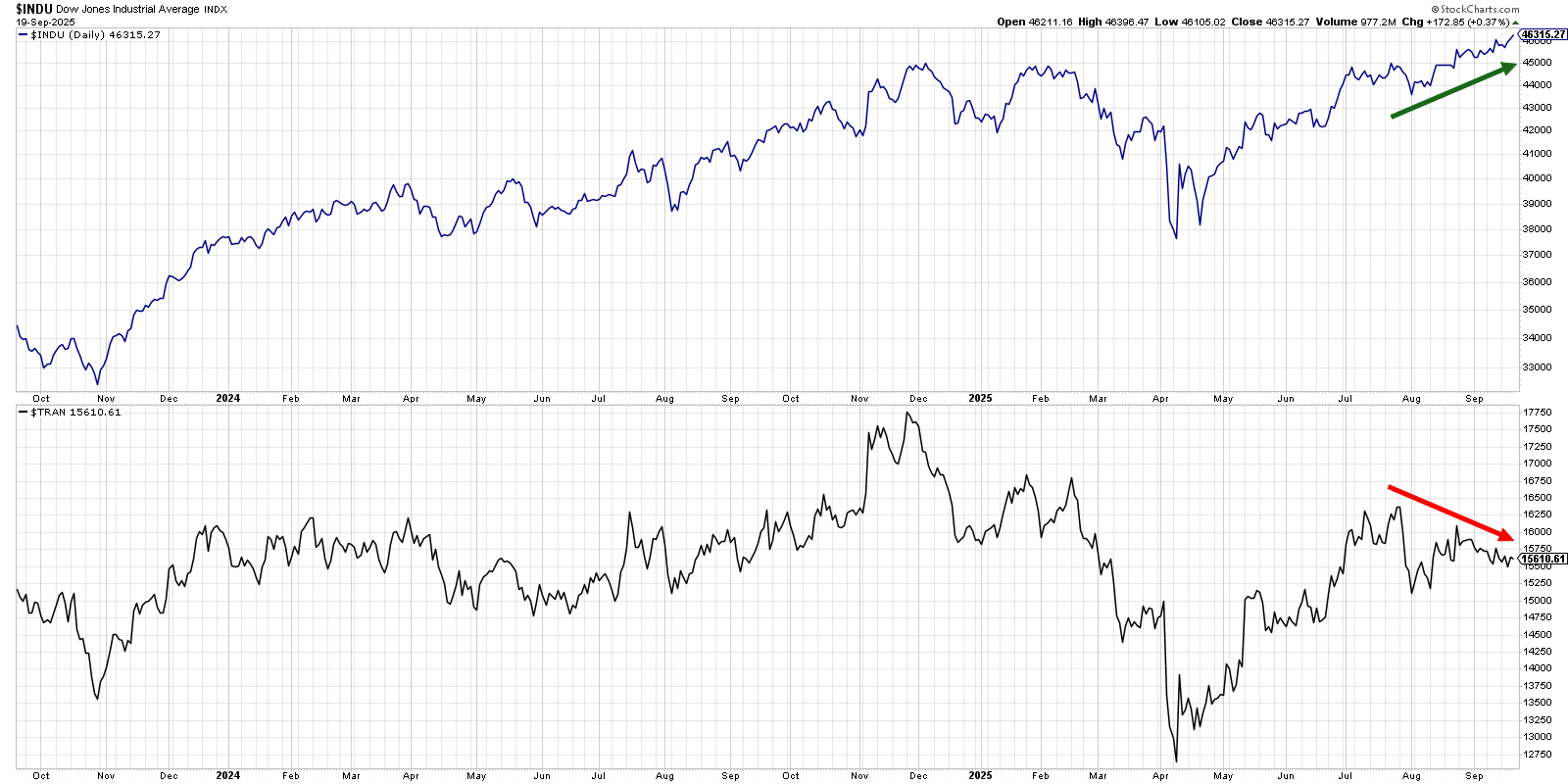

If both the Dow Industrials and Dow Transports achieve new highs, that’s known as a “confirmed bullish” pattern. However, if one index makes a new high and the other does not, then we have the dreaded “bearish non-confirmation” signal. Unfortunately, the weakness in transportation stocks over the last six weeks has resulted in this bearish pattern.

The Dow Jones Industrial Average and Dow Jones Transportation Average pulled back at the end of July. After both the indexes rallied in early August, the Dow Industrials continued the momentum from that initial push to achieve a new all-time high into September. The Dow Transports, instead of moving higher to confirm this new high from the industrials, reversed lower to confirm the lower high from late August.

So what’s really causing this weakness in transportation stocks, and should that be enough to question the Great Bull Market of 2025? While there is certainly weakness in areas like freight and trucking stocks, the most compelling charts are in the rideshare space.

Our next FREE webcast will teach you trend-following techniques from the ground up. Trend Following 101: Learn the Rules, Follow the Moves. Wednesday 9/24/25 1:00pm ET. Sign up for this FREE webcast HERE and I’ll see you on the 24th!

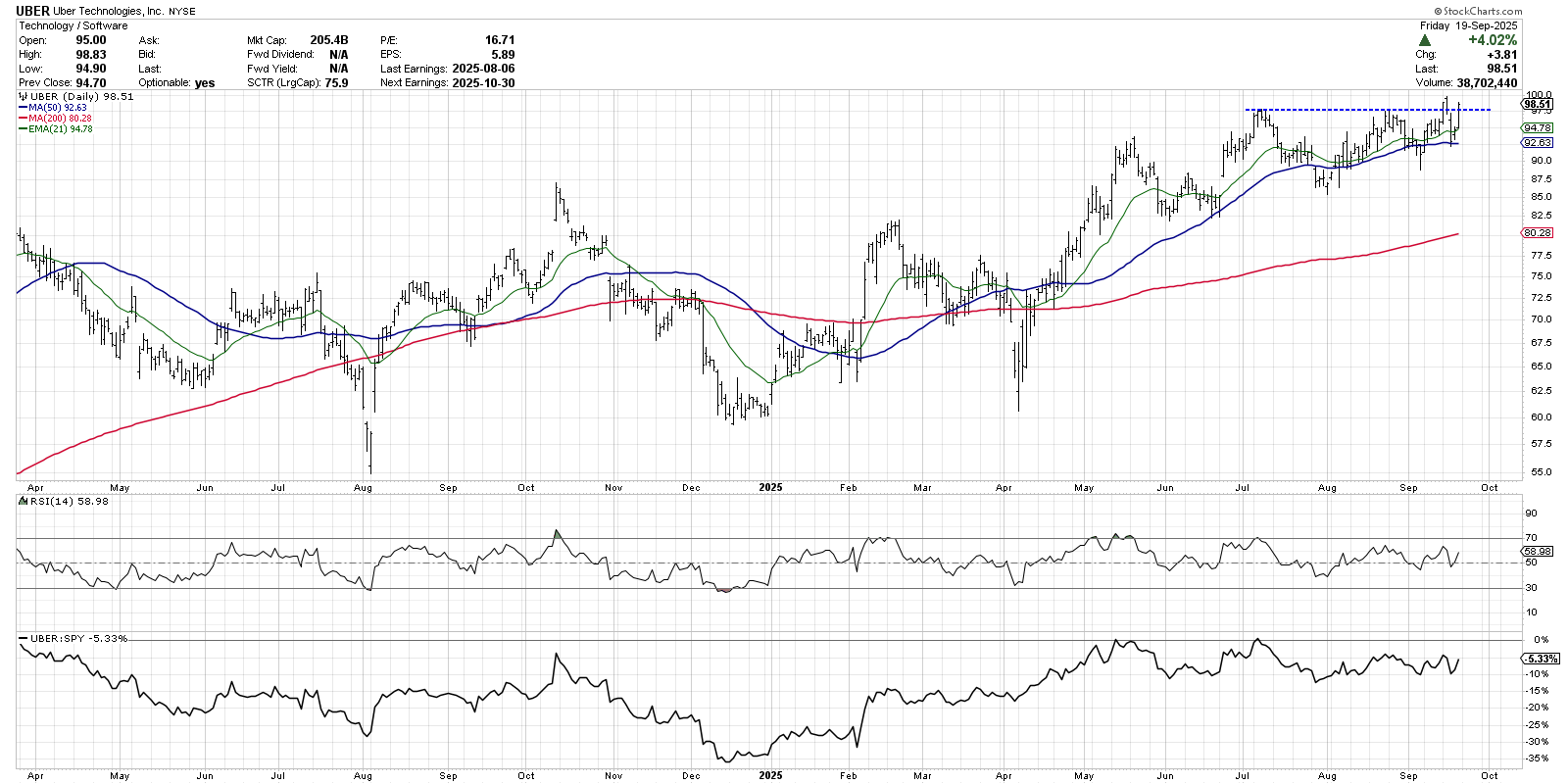

Since the initial rally off its April low, Uber Technologies (UBER) has made a series of higher lows all along the 50-day moving average. This week brought another retest of the 50-day moving average, but a rally into the weekend propelled UBER back up to its all-time high. We would want to see a confirmed break above this resistance, which would also mean UBER would trade above the $100 level for the first time ever.

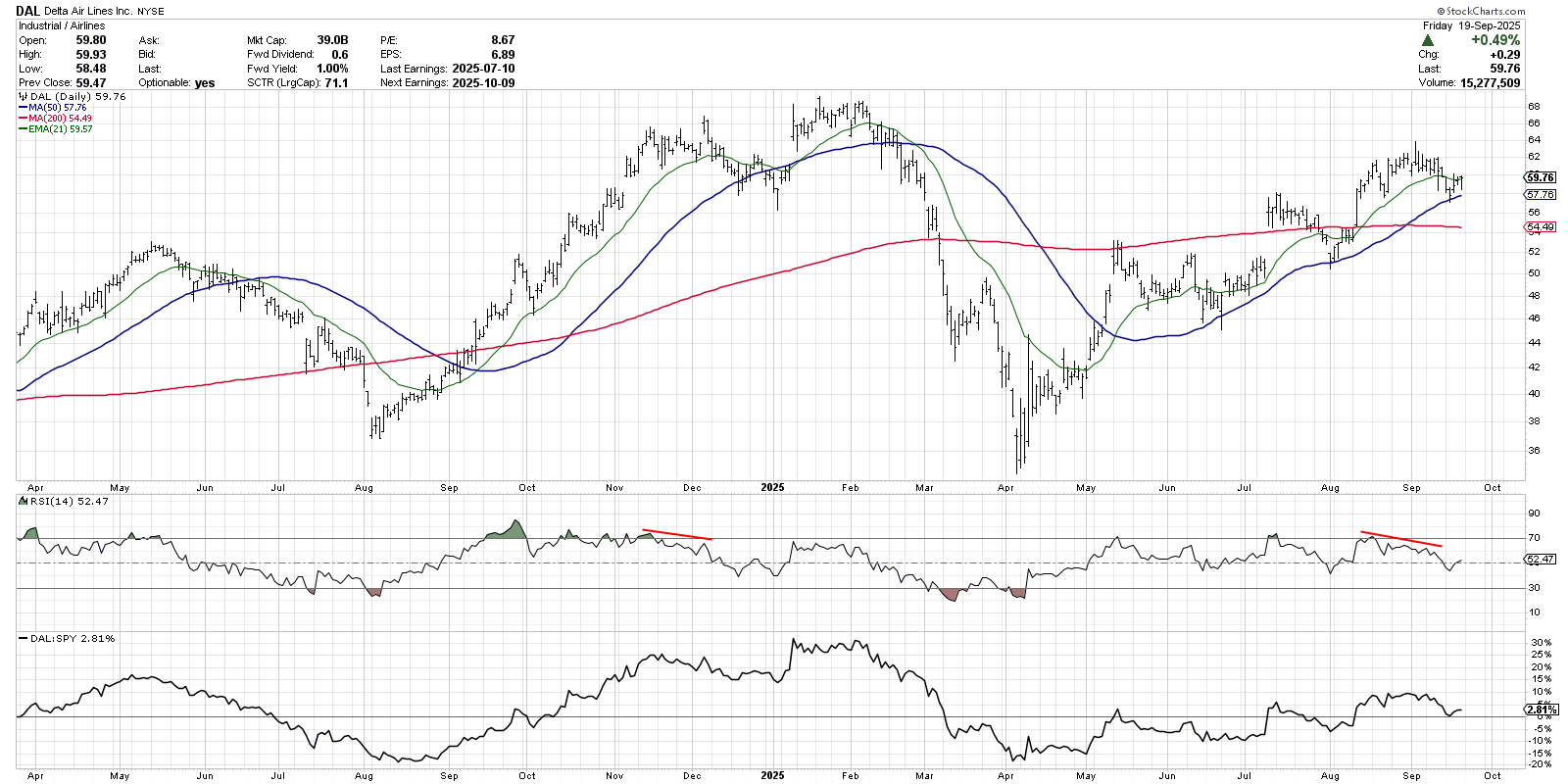

It’s not just the rideshare names that are showing strength, as a quick assessment of Delta Air Lines (DAL) will reveal. After rallying to the 200-day moving average in May, DAL has pounded out a series of higher lows as the price has moved up into the mid-60 range. If the 50-day moving average can once again hold, this could mean a tactical low before another move higher. We’re noting a bearish momentum divergence over the last six weeks, which could limit upside momentum.

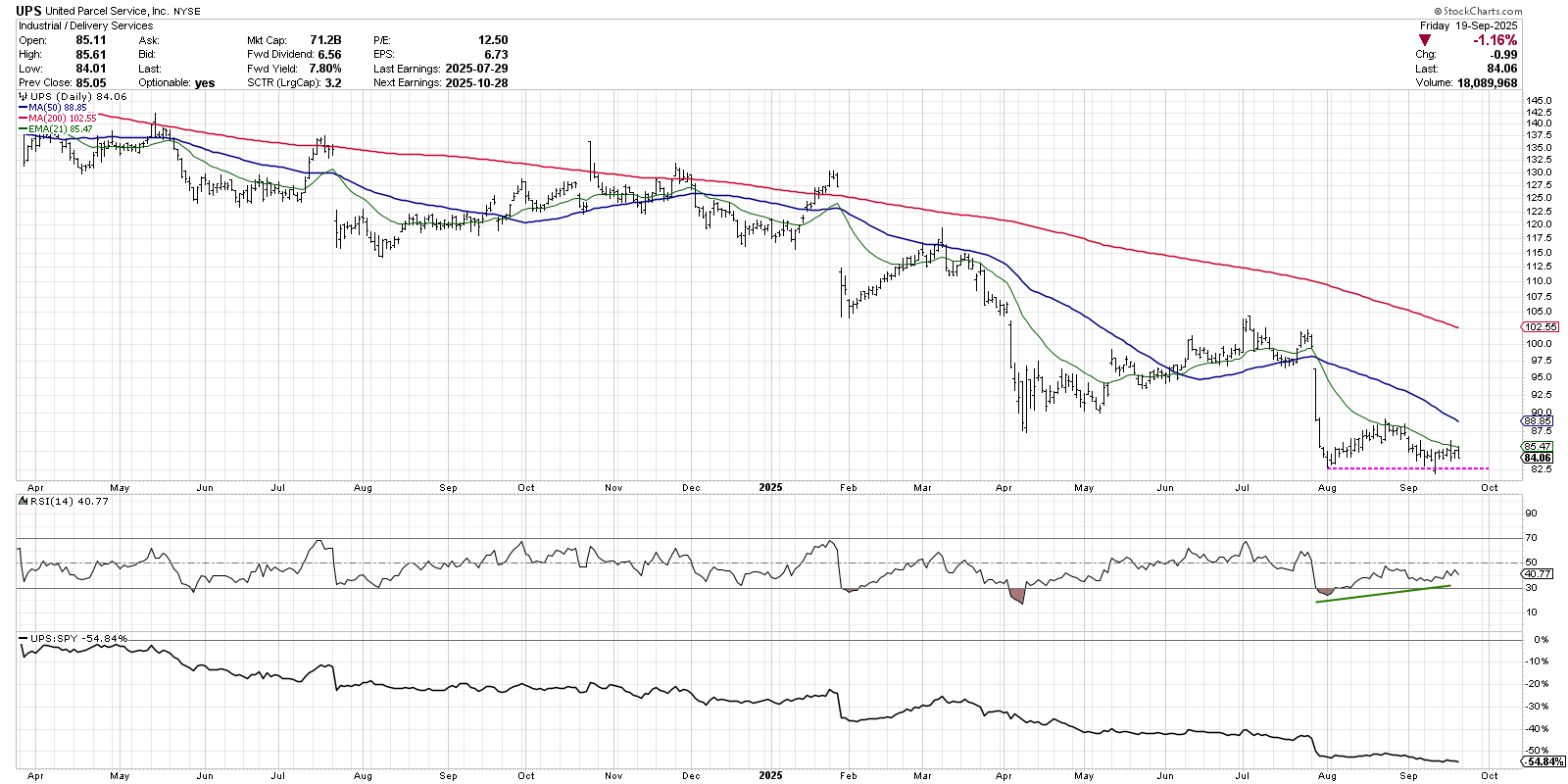

The real ugly charts are in two of the classic transportation industries, all related to the traditional role of transporting goods from producers to consumers. United Parcel Service (UPS) stands out, as it has spent over two straight years below its 200-day moving average, confirming a cyclical downtrend.

Given that the moving averages are in a bearish configuration, and that price remains below the 21-day exponential moving average, I’m inclined to consider this chart “guilty until proven innocent.” But a potential double bottom pattern, along with improving momentum on the recent lows, suggests a potential upside reversal.

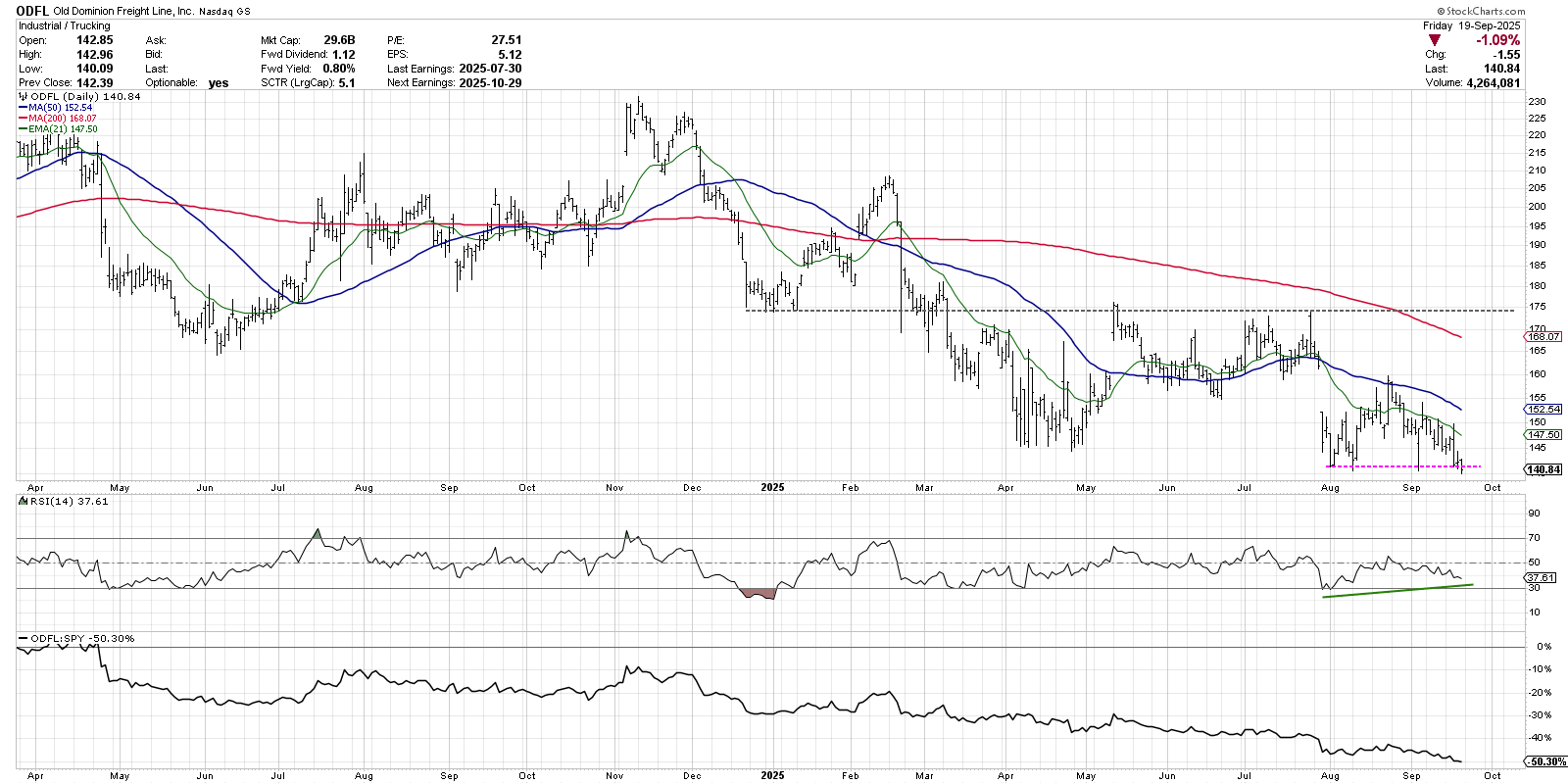

While some trucking companies are actually in decent uptrends, Old Dominion Freight Line (ODFL) is struggling to find its footing. ODFL rallied off the April low before gapping up to a pivot point around $175. After a series of failed tests to push higher, the stock gapped down before eventually making a new 52-week low in late July.

Old Dominion sold off this week to score another new 52-week low, which has not yet been confirmed with a breakdown in price momentum. I’d need to see some signs of accumulation before getting interested in a chart like this, and positive follow-through above the 50-day moving average could confirm a new bullish phase for this struggling freight carrier.

While we’ve identified some transportation names managing to achieve strong gains in 2025, challenged charts have kept the Dow Jones Transportation Average from confirming the recent new high in other equity indexes. And if companies that form the backbone of the modern economy are showing real signs of weakness, that should raise concerns for investors who are all bulled up!

RR#6,

Dave

P.S. Ready to upgrade your investment process? Check out my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Research

marketmisbehavior.com

https://www.youtube.com/c/MarketMisbehavior

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.